Sunoco 2004 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2004 Sunoco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

Sunoco sites but retaining the sales volumes

through long-term dealer or distributor contracts.

These strategic initiatives have resulted in a bigger,

stronger retail portfolio with little change in our

net investment.

Coke and Logistics, our most ratable businesses,

earned $40 million and $31 million, respectively,

and continue to offer significant value and growth

potential for the Company. In 2004, Sunoco

Logistics Partners L.P. (NYSE: SXL) unit value

increased 17 percent, and annual cash distributions

increased by $0.40 per unit (20 percent).

Acquisitions and expansion capital totaled $65

million, and a successful equity offering was

completed in April 2004. In Coke, we are on

schedule to begin production at a new 550,000

tons-per-year cokemaking plant in Haverhill, Ohio

in March 2005 and construction is underway for a

joint-venture plant in Vitória, Brazil that is expected

to be operational in 2006.

We view the diversity of our business portfolio as

a key strength of the Company, with each business

offering good returns and growth prospects. In

addition to realizing all we can from Refining and

Supply, a key element of our strategy is to maximize

income from the non-refining businesses to

moderate volatility in the Company’s earnings. We

expect to continue to grow the earnings power of

these non-refining businesses.

• Our acquisition activity over the past two years has

been crucial to our success in 2004. The Eagle

Point refinery, the Speedway and ConocoPhillips

retail sites, and the Equistar Chemicals transaction

contributed $190 million, or 30 percent, to our

2004 income before special items. These

acquisitions, which totaled only $800 million,

have added significant earnings power to the

Company in 2004 and will have an impact going

forward. We will continue to be opportunistic and

disciplined as we pursue additional growth

across our business portfolio.

Sunoco 2004 Highlights

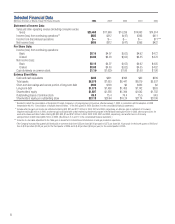

• Income before special items* a record $629 million, or

$8.40 per diluted share

• Sector-leading Return on Capital Employed of 21.7

percent (based on income before special items)**

• Share price increase of 60 percent, reaching new

record highs

• Best overall operating and Health, Environment and

Safety performance

• From 2000 to 2004, refinery production up 18 million

barrels, excluding Eagle Point refinery acquisition

• Acquisitions in 2003 and 2004 contributed $190

million to 2004 income before special items

*Net income for 2004 amounted to $605 million, which includes net charges for special

items of $24 million.

**ROCE for 2004 (based on net income) was 21.0 percent.

• New 550,000 tons-per-year cokemaking facility in

Haverhill, OH scheduled to begin production in March

2005; signed contract and began construction for joint-

venture plant in Brazil

• Approximately $425 million of proceeds generated

through portfolio management and divestment activities

• Increased annual dividend from $1.20 to $1.60 per

share in 2005 after an increase from $1.10 to $1.20

per share in 2004

• Repurchased 8.0 million shares of common stock,

reducing outstanding shares by 8 percent

• Restructured outstanding debt lowering pretax interest

costs by $20 million in 2005