Sunoco 2004 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2004 Sunoco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

To Our Shareholders

2004 was an outstanding

year for Sunoco. We generated

record earnings and our share

price rose to record levels. We

had our best-ever overall

operating and Health,

Environment and Safety

performance. We grew and

upgraded our asset base while

returning significant cash to our

shareholders. We improved our balance sheet and grew

our financial capacity.

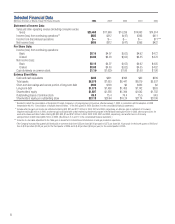

Financially, it was our best year as an independent

refiner and marketer. Income before special items*

was $629 million ($8.40 per share), almost double

the relatively strong 2003 performance. Return on

Capital Employed** — a key strategic and financial

metric for the Company — was a sector-leading 21.7

percent. Share price, the ultimate scorecard for our

owners, increased 60 percent for the year — on the

heels of a 54 percent increase in 2003.

The strengthening global economy in 2004

increased demand for our key products. The resulting

high refining margins allowed us to demonstrate the

earnings power of Sunoco’s refining assets at a time

when we also saw significant income contributions

from the balance of our diversified asset portfolio. I’d

like to share with you what we accomplished in 2004

and our ongoing strategy to create shareholder value.

• The Refining and Supply business led the way

with pacesetter performance combined with

record high margins. We took advantage of the

strong refining margin environment by running

our refineries at record operating rates. We set

production records, particularly for high-valued

products, and improved both the utilization and

energy efficiency of our facilities. We have made

significant reliability improvements through our

long-term program of investing in refining infra-

structure and by driving operational excellence.

These gains have been steadily accumulating

over the past several years. Since 2000, refinery

production increased by 18 million barrels,

excluding the Eagle Point refinery acquired in

2004. Over this period, we have been able to add

a 50,000 barrels-per-day “refinery within our

refineries" at little or no capital cost.

Refining and Supply results were substantially

enhanced by cost-advantaged marine time charters,

programs that expanded our crude oil mix, particularly

the use of heavily discounted high-acid crude oils,

and sales strategies that maximized product values.

All of these actions have improved the earnings

power and competitiveness of our refining system

and contributed significantly to our record 2004

refining results. We will continue to do more. We

still have unrealized potential.

• While Refining and Supply led the way in 2004,

our other businesses also generated $233 million

of earnings in 2004. We expect this contribution

to grow in the years ahead.

Chemicals earned $94 million, including $70

million over the second half of the year. Despite

persistently rising feedstock costs, Chemicals

results have improved year-on-year for seven

consecutive quarters. Market fundamentals are

healthy, and a continued cyclical recovery should

lead to growth in earnings going forward.

Retail Marketing earned $68 million in 2004, an

outstanding result given the challenging retail

marketing conditions during most of the year. We

are aggressively expanding our geography and

upgrading our retail portfolio through targeted

acquisitions and divestitures. We have generated

significant proceeds from our Retail Portfolio

Management (RPM) program, divesting of selected