Sunoco 2004 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2004 Sunoco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

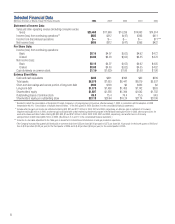

Results of Operations

Earnings Profile of Sunoco Businesses (after tax)

(Millions of Dollars) 2004 2003 2002

Refining and Supply $541 $261 $(31)

Retail Marketing 68 91 20

Chemicals 94 53 28

Logistics 31 26 33

Coke 40 43 42

Corporate and Other:

Corporate expenses (67) (40) (26)

Net financing expenses and other (78) (99) (91)

Income tax settlement 18 ——

Midwest marketing divestment program —9—

Asset write-downs and other matters (8) (32) (22)

Debt restructuring (34) ——

Consolidated net income (loss) $605 $312 $(47)

Analysis of Earnings Profile of Sunoco Businesses

In 2004, Sunoco earned $605 million, or $8.08 per share of common stock on a diluted

basis, compared to net income of $312 million, or $4.03 per share, in 2003 and a net loss of

$47 million, or $.62 per share, in 2002.

The $293 million increase in net income in 2004 was primarily due to an increase in mar-

gins in Sunoco’s Refining and Supply business ($234 million) and the income contribution

from the Eagle Point refinery acquired on January 13, 2004 ($135 million). Also con-

tributing to the improvement were higher production of refined products ($15 million),

higher margins from Sunoco’s Chemicals business ($35 million), income attributable to

the Mobil®retail gasoline outlets acquired from ConocoPhillips in April 2004 ($15

million), increased income from the Speedway®sites acquired from Marathon in June

2003 ($6 million), increased earnings related to the March 2003 propylene supply agree-

ment with Equistar ($12 million), lower net financing expenses ($21 million), a gain on an

income tax settlement ($18 million) and lower provisions for asset write-downs and other

matters ($24 million). Partially offsetting these positive factors were higher expenses across

the Company ($104 million), primarily fuel, depreciation and employee-related charges,

including pension and performance-related incentive compensation; lower non-gasoline

income ($9 million); lower margins for retail gasoline ($27 million); an accrual for the

estimated liability attributable to retrospective premiums related to certain insurance poli-

cies ($10 million); the absence of gains from a retail marketing divestment program in the

Midwest ($9 million); a loss on early extinguishment of debt in connection with a debt

restructuring ($34 million); and a higher effective income tax rate ($23 million).

In 2003, the $359 million increase in net income was primarily due to significantly higher

margins in Sunoco’s Refining and Supply ($339 million), Retail Marketing ($78 million)

and Chemicals ($50 million) businesses. Also contributing to the improvement in earnings

were higher production of refined products ($13 million), $7 million of after-tax income

from the retail gasoline sites acquired from Marathon and $14 million of after-tax income

related to the propylene supply agreement with Equistar. Partially offsetting these positive

factors were higher expenses across the Company ($109 million), primarily refinery fuel

and utility costs and employee-related expenses, including pension and performance-

related incentive compensation; lower chemical sales volumes ($15 million); higher net

financing expenses ($8 million), primarily due to higher expenses attributable to the

preferential return of third-party investors in Sunoco’s cokemaking operations; and a

higher effective income tax rate ($7 million).

12