Starwood 2008 Annual Report Download - page 146

Download and view the complete annual report

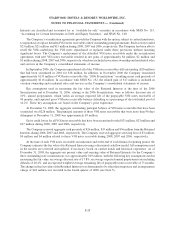

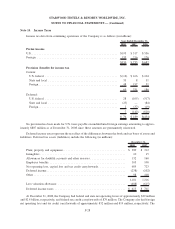

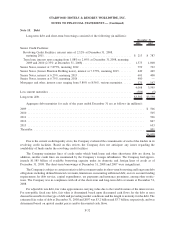

Please find page 146 of the 2008 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.During 2007, the Company completed an evaluation of its ability to claim U.S. foreign tax credits generated in

prior years on its federal tax return. As a result of this analysis, the Company determined that it can realize the

credits for the 1999 and 2000 tax years. The Company had not previously accrued this benefit since the realization

of the benefit was determined to be unlikely. Therefore, during 2007, a $28 million tax benefit, net of incremental

taxes and interest, was recorded for these foreign tax credits. In addition, during 2006, the Company determined that

it could claim the credits for the 2005 and 2006 tax years. The Company had not previously accrued this benefit

since the realization of the benefit was determined to be unlikely. Therefore, during 2006, a $15 million and

$19 million tax benefit was recorded for 2006 and 2005, respectively for these foreign tax credits.

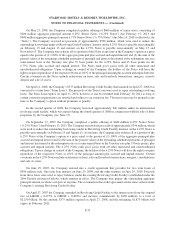

Pursuant to FIN 48, the Company is required to accrue tax and associated interest and penalty on uncertain tax

positions. During 2007, the Company recorded a $13 million charge, primarily associated with interest due on

existing uncertain tax positions.

During 2006, the IRS completed its audits of the Company’s 2001, 2002 and 2003 tax returns and issued its

final audit adjustments to the Company. In addition, state income tax audits for various jurisdictions and tax years

were completed during 2006. As a result of the completion of these audits, the Company recorded a $50 million tax

benefit. The Company also recognized a $9 million tax benefit during 2006 related to the reversal of previously

accrued income taxes after an evaluation of the applicable exposures and the expiration of the related statutes of

limitations.

As discussed in Note 5, the Company completed the Host Transaction during the second quarter of 2006 which

included the sale of 33 hotel properties. As the Company sold these hotels subject to long-term management

contracts, the gain of approximately $962 million has been deferred and is being recognized over the life of those

contracts. Accordingly, the Company has established a deferred tax asset and recognized the related tax benefit of

approximately $359 million for the book-tax difference on the deferred gain. Additional tax benefits of $1.017 bil-

lion resulted from the Host Transaction, consisting primarily of the tax benefit of $832 million on the $2.4 billion

federal capital loss, net of carrybacks and 2006 utilization. The remaining benefit consisted of an adjustment to

deferred income taxes for the increased tax basis of certain retained assets, partially offset by current tax liabilities

generated as a result of the transaction. During 2007, the Company completed its 2006 tax return which included the

Host Transaction. As a result, the Company recognized a net $97 million tax charge during 2007 as an adjustment to

the original tax benefit accrued in 2006. The net charge was comprised of a $114 million charge related to a

reduction to the amount of capital loss generated in the transaction offset by a $17 million tax benefit related to other

aspects of the transaction. As a valuation allowance fully offsets the capital loss carryforward, the Company also

recorded a $114 million tax benefit for the reversal of the capital loss valuation allowance.

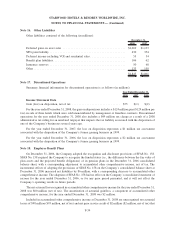

During 2008, the Company sold the Westin Turnberry subject to a long-term management contract. As a result,

the pretax gain has been deferred and is being recognized over the life of the contract. Accordingly, the Company

has established a deferred tax asset and recognized the related tax benefit of approximately $10 million for the

book-tax difference on the deferred gain.

During 2008 and 2007, the Company completed certain transactions that generated capital gains for U.S. tax

purposes. These gains were completely offset by the capital loss generated in the Host Transaction. As discussed

above, the Company had not previously accrued a benefit for the capital loss since the realization was determined to

be unlikely. Therefore, during 2008 and 2007, the Company recorded tax benefits of $31 million and $35 million,

respectively, to reverse the capital loss valuation allowance.

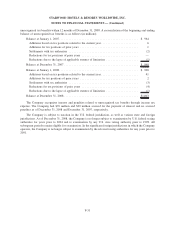

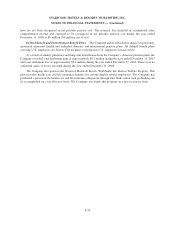

As a result of the implementation of FIN 48 in 2007, the Company recognized a $35 million cumulative effect

adjustment to the beginning balance of retained earnings in the period. As of December 31, 2008, the Company had

approximately $1.0 billion of total unrecognized tax benefits, of which $150 million would affect its effective tax

rate if recognized. As discussed above, the Company expects to resolve the tax litigation related to the ITT World

Directories transaction during 2009 and expects to reduce that amount of unrecognized tax benefits by approx-

imately $499 million. The Company does not expect other significant increases or decreases to the amount of

F-30

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)