Starwood 2008 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2008 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

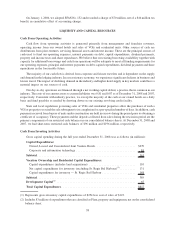

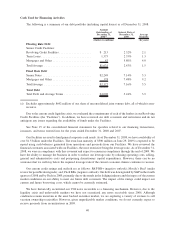

Cash Used for Financing Activities

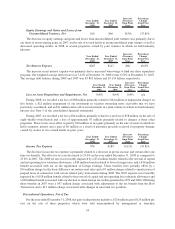

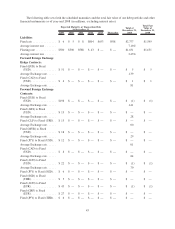

The following is a summary of our debt portfolio (including capital leases) as of December 31, 2008:

Amount

Outstanding at

December 31,

2008

(a)

Interest Rate at

December 31,

2008

Average

Maturity

(Dollars in millions) (In years)

Floating Rate Debt

Senior Credit Facilities:

Revolving Credit Facilities .................... $ 213 2.32% 2.1

Term Loans ............................... 1,375 2.35% 1.3

Mortgages and Other . . . ..................... 43 5.80% 4.0

Total/Average ............................. $1,631 2.43% 1.5

Fixed Rate Debt

Senior Notes .............................. $2,249 7.14% 5.3

Mortgages and Other . . . ..................... 128 7.48% 9.2

Total/Average ............................. $2,377 7.16% 5.5

Total Debt

Total Debt and Average Terms ................. $4,008 5.24% 3.9

(a) Excludes approximately $642 million of our share of unconsolidated joint venture debt, all of which is non-

recourse.

Due to the current credit liquidity crisis, we evaluated the commitments of each of the lenders in our Revolving

Credit Facilities (the “Facilities”). In addition, we have reviewed our debt covenants and restrictions and do not

anticipate any issues regarding the availability of funds under the Facilities.

See Note 15 of the consolidated financial statements for specifics related to our financing transactions,

issuances, and terms entered into for the years ended December 31, 2008 and 2007.

Our Facilities are used to fund general corporate cash needs. As of December 31, 2008, we have availability of

over $1.5 billion under the Facilities. The term loan maturity of $500 million on June 29, 2009 is expected to be

repaid using cash balances generated from operations and proceeds from our Facilities. We have reviewed the

financial covenants associated with our Facilities, the most restrictive being the leverage ratio. As of December 31,

2008, we were in compliance with this covenant and expect to remain in compliance through the end of 2009. We

have the ability to manage the business in order to reduce our leverage ratio by reducing operating costs, selling,

general and administrative costs and postponing discretionary capital expenditures. However, there can be no

assurance that we will stay below the required leverage ratio if the current economic climate continues to worsen.

Our current credit ratings and outlook are as follows: S&P BB+ (negative outlook); Moody’s Baa3 (under

review for possible downgrade); and; Fitch BB+ (negative outlook). Our debt was downgraded by S&P in the fourth

quarter of 2008 and by Fitch in 2009, primarily due to the trends in the lodging industry and the impact of the current

market conditions on our ability to meet our future debt covenants. The impact of the ratings could impact our

current and future borrowing costs, which cannot be currently estimated.

We have historically securitized our VOI notes receivable as a financing mechanism. However, due to the

liquidity crisis and unfavorable markets we have not securitized any notes receivable since 2006. Although

conditions remain uncertain in the asset backed securities market, we are exploring a variety of avenues to sell

vacation ownership receivables. However, given unpredictable market conditions, we do not currently expect to

receive proceeds from securitizations in 2009.

40