Starwood 2003 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2003 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

AND STARWOOD HOTELS & RESORTS

NOTES TO FINANCIAL STATEMENTS Ì (Continued)

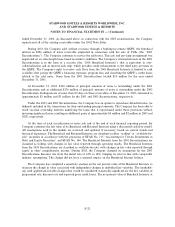

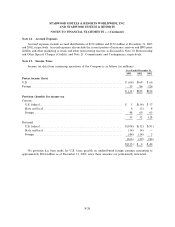

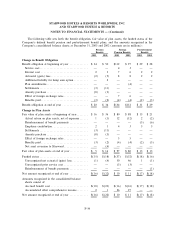

2003 Restructuring and Other Special Charges (Credits). During the year ended December 31, 2003,

the Company received $12 million in a favorable settlement of a litigation matter. This special credit was

oÅset by an increase of $13 million in a reserve for legal defense costs associated with a separate litigation

matter. Additionally, the Company reversed through restructuring credits a $9 million liability that was

originally established in 1997 for the ITT Excess Pension Plan through restructuring charges and is no longer

required as the Company Ñnalized the settlement of its remaining obligations associated with the plan.

2002 Restructuring and Other Special Credits. During the year ended December 31, 2002, the

Company recorded reversals of restructuring charges of $1 million and reversals of other special charges of

$6 million. The reversal of the restructuring charge relates to an adjustment to the severance liability

established in connection with the cost containment eÅorts following the September 11 Attacks based on

actual costs incurred. The reversal of the other special charges primarily related to sales of investments in

certain e-business ventures previously deemed impaired and the collections of receivables which were

previously deemed uncollectible.

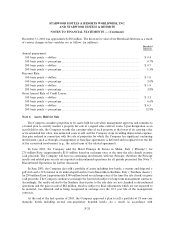

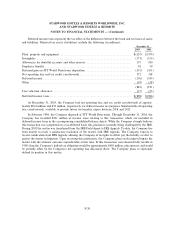

2001 Restructuring and Other Special Charges (Credits). Due to the September 11 Attacks and the

weakening of the U.S. economy, in the third and fourth quarter of 2001, the Company implemented a cost

reduction plan and conducted a comprehensive review of the carrying value of certain assets for potential

impairment, resulting in 2001 restructuring charges of $15 million and noncash other special charges

aggregating approximately $36 million. The restructuring charges were primarily for severance costs incurred

as part of the cost reduction plan. The other special charges consisted primarily of employee retention costs

associated with the accelerated vesting of 50% of restricted stock awards granted in February 2001

(approximately $11 million); bad debt expense associated with receivables no longer deemed collectible

(approximately $17 million); impairments of certain investments and other assets (approximately $5 million);

and abandoned pursuit projects (approximately $3 million).

In addition, in early 2001, the Company wrote down its investments in various e-business ventures by

approximately $19 million based on the market conditions for the technology sector at the time and

management's assessment that impairment of these investments was other-than-temporary. This special

charge was oÅset by the reversal of a $20 million bad debt restructuring charge taken in 1998 relating to a note

receivable, which is now fully performing.

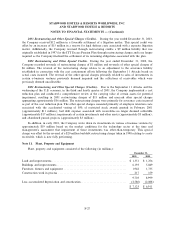

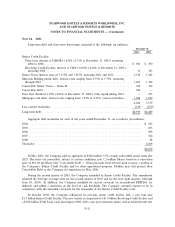

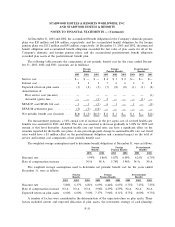

Note 11. Plant, Property and Equipment

Plant, property and equipment consisted of the following (in millions):

December 31,

2003 2002

Land and improvements ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 1,351 $ 1,256

Buildings and improvementsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 6,193 5,849

Furniture, Ñxtures and equipment ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,942 1,735

Construction work in process ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 217 159

9,703 8,999

Less accumulated depreciation and amortization ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (2,580) (2,088)

$ 7,123 $ 6,911

F-27