Starwood 2003 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2003 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

distribution through its own internet site and catalogue as well as through third party retail stores. The

purchase price for the acquired interest was $23.8 million, and was funded from available cash.

The Company intends to Ñnance the acquisition of additional hotel properties (including equity

investments), hotel renovations, VOI construction, capital improvements, technology spend and other core

business acquisitions and investments and provide for general corporate purposes through its credit facilities

described below, through the net proceeds from dispositions, through the assumption of debt and through the

issuance of additional equity or debt securities.

The Company periodically reviews its business with a view to identifying properties or other assets that

the Company believe either are non-core, no longer complement the business, are in markets which may not

beneÑt the Company as much as other markets during an economic recovery or could be sold at signiÑcant

premiums. The Company is focused on restructuring and enhancing real estate returns and monetizing

investments. During 2003, the Company realized $1.1 billion of cash proceeds from the sale of the Principe,

the Sardinia Assets, and 16 non-core domestic hotels.

There can be no assurance, however, that the Company will be able to complete future dispositions on

commercially reasonable terms or at all.

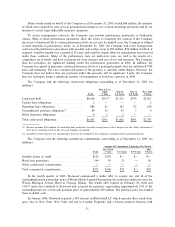

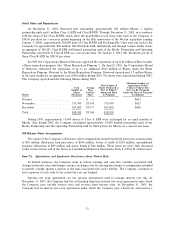

Cash Used for Financing Activities

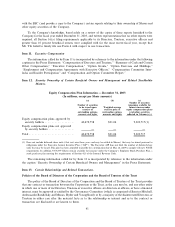

Following is a summary of the Company's debt portfolio (including capital leases) as of December 31,

2003:

Amount Interest Rate at

Outstanding at December 31, Average

December 31, 2003(a) Interest Terms 2003 Maturity

(Dollars in millions)

Floating Rate Debt

Senior Credit Facility:

Term Loan ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 300 LIBOR(c)°162.5 2.75% 2.0 years

Revolving Credit Facility ÏÏÏÏÏÏ 15 CBA(d)°162.5 4.34% 2.8 years

Mortgages and Other ÏÏÏÏÏÏÏÏÏÏÏ 251 Various 5.08% 1.8 years

Interest Rate Swaps ÏÏÏÏÏÏÏÏÏÏÏÏ 1,050 5.07% Ì

Total/Average ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 1,616 4.63% 1.9 years

Fixed Rate Debt

Sheraton Holding Public DebtÏÏÏÏ $ 1,067(e) 6.47% 9.0 years

Senior Notes ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,532(e) 7.04% 6.0 years

Convertible Senior Notes Ì

Series B ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 326 3.25% 2.8 years(b)

Convertible Debt ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 360 3.50% 2.4 years

Mortgages and Other ÏÏÏÏÏÏÏÏÏÏÏ 775 7.15% 8.2 years

Interest Rate Swaps ÏÏÏÏÏÏÏÏÏÏÏÏ (1,050) 7.11% Ì

Total/Average ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 3,010 5.90% 6.6 years

Total Debt

Total Debt and Average Terms ÏÏÏ $ 4,626 5.46% 6.0 years

(a) Excludes approximately $410 million of the Company's share of unconsolidated joint venture debt, all of which was non-recourse,

except as noted earlier.

(b) Average maturity reÖects the maturity date of the revolving credit facility which would be used to reÑnance the amount put to the

Company.

(c) At December 31, 2003, LIBOR was 1.12%

32