Southwest Airlines 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 Southwest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Southwest Airlines Co. is the nation’s low-fare, high Customer Satisfaction airline. We primarily serve shorthaul city pairs, providing

single-class air transportation which targets the business commuter as well as leisure travelers. The Company, incorporated in Texas,

commenced Customer Service on June 18, 1971, with three Boeing 737 aircraft serving three Texas cities – Dallas, Houston, and San

Antonio. At yearend 2002, Southwest operated 375 Boeing 737 aircraft and provided service to 59 airports in 30 states throughout the

United States. Southwest has one of the lowest operating cost structures in the domestic airline industry and consistently offers the

lowest and simplest fares. Southwest also has one of the best overall Customer Service records. LUV is our stock exchange symbol,

selected to represent our home at Dallas Love Field, as well as the theme of our Employee and Customer relationships.

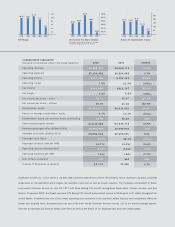

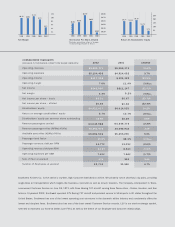

1998 1999 2000 2001 2002

Net Margin

12%

10%

8%

6%

4%

2%

10.4% 10.0%

11.1%

9.2%

4.4%

$5,104,433 $4,924,052

$417,338 $631,122

7.6% 11.4%

$240,969 $511,147

4.4% 9.2%

$0.31 $0.67

$0.30 $0.63

$4,421,617 $4,014,053

5.7% 13.7%

$5.69 $5.24

63,045,988 64,446,773

45,391,903 44,493,916

68,886,546 65,295,290

65.9% 68.1%

11.77¢ 12.09¢

8.0 2 ¢ 8.51¢

7.41¢ 7.54¢

375 355

3.7%

(33.9)%

(3.8)

pts.

(52.9)%

(4.8)

pts.

(53.7)%

(52.4)%

10.2%

(8.0)

pts.

8.6%

(2.2)%

2.0%

5.5%

(2.2)

pts.

(2.6)%

(5.8)%

(1.7)%

5.6%

Operating expenses

Operating income

Operating margin

Net income

Net margin

Net income per share – basic

Net income per share – diluted

Stockholders’ equity

Revenue passengers carried

Revenue passenger miles {RPMs} (000s)

Available seat miles {ASMs} (000s)

Passenger load factor

Passenger revenue yield per RPM

Operating revenue yield per ASM

Operating expenses per ASM

Size of fleet at yearend

33,705 31,580 6.7%

Number of Employees at yearend

Stockholders’ equity per common share outstanding

Return on average stockholders’ equity

CONSOLIDATED HIGHLIGHTS

Operating revenues

2001

$5,521,771 $5,555,174

2002

(0.6)%

CHANGE

(DOLLARS IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

1998 1999 2000 2001 2002

Net Income Per Share, Diluted

$0.80

$0.70

$0.60

$0.50

$0.40

$0.30

$0.55 $0.59

$0.79*

$0.63

$0.30

Excludes cumulative effect of change

in accounting principle of $0.03.

*

1998 1999 2000 2001 2002

Return On Stockholders’ Equity

25%

20%

15%

10%

5%

19.7% 18.1% 19.9%

13.7%

5.7%

Table of contents

-

Page 1

... Southwest Airlines Co. is the nation's low-fare, high Customer Satisfaction airline. We primarily serve shorthaul city pairs, providing single-class air transportation which targets the business commuter as well as leisure travelers. The Company, incorporated in Texas, commenced Customer Service... -

Page 2

... SEPTEMBER 11, 2001, SOUTHWEST AIRLINES MADE A BOLD PROMISE TO OUR PEOPLE, OUR SHAREHOLDERS, AND OUR CUSTOMERS: NOTHING WILL KEEP US FROM MOVING AHEAD. IN WHAT WAS THE WORST YEAR EVER FOR THE AIRLINE INDUSTRY, SOUTHWEST KEPT ITS PROMISE. IN 2002, WE POSTED OUR 30TH CONSECUTIVE ANNUAL PROFIT. WE WERE... -

Page 3

... U.S. economy. Probably a technology stock. Or maybe a big name in pharmaceuticals. "WHAT WE WERE NOT EXPECTING WAS AN AIRLINE - SOUTHWEST AIRLINES, TO BE PRECISE. SINCE AUGUST 1972, SOUTHWEST HAS PRODUCED ANNUALIZED RETURNS OF 25.99%, WHICH MEANS THAT HAD YOU INVESTED $10,000 IN SOUTHWEST 30 YEARS... -

Page 4

...service: new nonstop flights from Baltimore/Washington to San Jose and from Phoenix to Detroit; and additional flights from Baltimore/Washington to Orlando, Long Island/Islip, Manchester, Hartford, Austin, Phoenix, San Antonio, and West Palm Beach; Chicago Midway to Cleveland, Las Vegas, and Houston... -

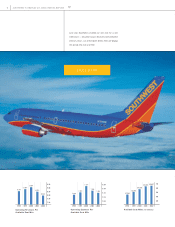

Page 5

4 Southwest airlines co. 2002 annual report Last year, Southwest unveiled our new look for a new millennium - beautiful Canyon Blue jets with all-leather interiors. Soon, our entire Spirit Series fleet will display this proud new look and feel. FREEDOM 9.43¢ 8.96¢ 8.76¢ 8.51¢ 8.02¢ 9.5¢ ... -

Page 6

.... Sluggish economy. Radical changes in airport security. High energy prices. International tension. Corporate scandals. Nasty bear market. Add all that up and it spelled financial disaster for the major airlines. All major airlines incurred significant losses in 2002, except one - Southwest Airlines... -

Page 7

6 Southwest airlines co. 2002 annual report SPIRIT Our Southwest Spirit has never been stronger, thanks to our remarkably resourceful People, who always go the extra mile to deliver Legendary Customer Service. -

Page 8

..., in Business Traveler's Annual Best in Business Travel Reader Survey, and Best Low Cost Airline in the 2002 Official Airline Guide. In addition, Southwest ranked first among airlines for Customer Service satisfaction, according to a survey by the American Customer Satisfaction Index, as reported in... -

Page 9

8 Southwest airlines co. 2002 annual report CONVENIENCE Our new RAPID CHECK-IN Kiosks and automated boarding passes signal our ongoing commitment to keeping our Southwest boarding procedure quick and simple for our Customers. -

Page 10

... Southwest Airlines Rapid Rewards Visa card. Cautious Growth Steady, manageable growth has enabled Southwest to keep its debt under control and profits intact while still allowing the doubling of our aircraft fleet in less than nine years. For the five years ended 2001, the average annual capacity... -

Page 11

... Southwest Airlines Co. is the nation's low-fare, high Customer Satisfaction airline. We primarily serve shorthaul city pairs, providing single-class air transportation which targets the business commuter as well as leisure travelers. The Company, incorporated in Texas, commenced Customer Service... -

Page 12

... as well. All-Jet Fleet Southwest operates an all-coach, all-Boeing 737 fleet of 375 aircraft, as of the end of 2002. All 413 orders, options, and purchase rights with The Boeing Company for 2003 through 2012 are B737-700s. The average age of this young fleet is 9.2 years. As the -700 model is our... -

Page 13

Southwest airlines co. 2002 annual report 11 This past year, Southwest Airlines retired our signature plastic boarding pass, a symbol of simplicity for 31 years. Simplicity has served us and our Customers well. In an increasingly complex world, please join us in a fond farewell to an old friend. ... -

Page 14

...Nashville Raleigh-Durham (Southern Virginia) Tulsa Amarillo Oklahoma City Lubbock Little Rock Los Angeles (LAX) Orange County San Diego Phoenix Tucson El Paso Birmingham Midland/ Odessa Dallas (Love Field) Jackson Jacksonville New Orleans Houston (Hobby & Intercontinental) Austin San Antonio... -

Page 15

...PRICE RANGES AND DIVIDENDS Southwest's common stock is listed on the New York Stock Exchange and is traded under the symbol LUV. The high and low sales prices of the common stock on the Composite Tape and the quarterly dividends per share, as adjusted for the February 2001 three-for-two stock split... -

Page 16

... in 1999 through 1995 related to the sale of flight segment credits from Other to Passenger due to the accounting change implemented in 2000 (3) Certain figures include special items related to the September 11, 2001, terrorist attacks (4) Includes leased aircraft (5) Includes certain estimates for... -

Page 17

Southwest airlines co. 2002 annual report 15 1998 1997 1996 1995 1994 1993 $ 4, 010, 029 98, 500 55, 451 4, 163, 980 3, 480,369 683, 611 (21, 501) 705,112 271, 681 $ ... -

Page 18

... of Shareholders of Southwest Airlines Co. will be held at 10:00 a.m. on May 14, 2003, at the Southwest Airlines Corporate Headquarters, 2702 Love Field Drive, Dallas, Texas. FINANCIAL INFORMATION A copy of the Company's Annual Report on Form 10-K as filed with the U.S. Securities and Exchange... -

Page 19

... not to build lasting equity. And increasingly they are haunted by Southwest, haunted because they can never match it." -The New York Times, February 25, 2002 "Q: Is there any product you would endorse? A: Southwest Airlines. Superb airline. The lowest fares, the highest profits , the best service... -

Page 20

...For the Fiscal Year Ended December 31, 2002 or [X] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from _____ to _____ Commission File No. 1-7259 Southwest Airlines Co. (Exact name of registrant as specified in its charter) TEXAS 74... -

Page 21

... domestic airline that provides predominantly shorthaul, high-frequency, point-to-point, low-fare service. Southwest was incorporated in Texas and commenced Customer Service on June 18, 1971, with three Boeing 737 aircraft serving three Texas cities - Dallas, Houston, and San Antonio. At yearend... -

Page 22

... promulgated thereunder. Operations at John Wayne Airport, Orange County, California, are governed by the Airport's Phase 2 Commercial Airline Access Plan and Regulation (the "Plan"). Pursuant to the Plan, each airline is allocated total annual seat capacity to be operated at the airport, subject to... -

Page 23

... Company's Customers fly nonstop. In addition, Southwest serves many conveniently located satellite or downtown airports such as Dallas Love Field, Houston Hobby, Chicago Midway, Baltimore-Washington International, Burbank, Manchester, Oakland, San Jose, Providence, Ft. Lauderdale/Hollywood and Long... -

Page 24

... surface transportation, price is a competitive factor, but frequency and convenience of scheduling, facilities, transportation safety and security procedures, and Customer Service may be of equal or greater importance to many passengers. Insurance The Company carries insurance of types customary in... -

Page 25

... bank credits indefinitely; and Award Tickets and Companion Passes are valid for one year with an automatic expiration date. Blackout dates apply during peak holiday periods. The Company also sells flight segment credits to business partners including credit card companies, phone companies, hotels... -

Page 26

... sold to business partners. The liability for free travel awards earned but not used at December 31, 2002 and 2001, was not material. Employees At December 31, 2002, Southwest had 33,705 active employees, consisting of 10,920 flight, 1,900 maintenance, 16,405 ground customer and fleet service, and... -

Page 27

... passenger service facilities at each of the airports it serves, to which it has added various leasehold improvements. The Company leases land on a long-term basis for its maintenance centers located at Dallas Love Field, Houston Hobby, Phoenix Sky Harbor, and Chicago Midway; its training center... -

Page 28

... effect on the Company's financial condition, results of operations, or cash flows. Item 4. Submission of Matters to a Vote of Security Holders None to be reported. EXECUTIVE OFFICERS OF THE REGISTRANT The executive officers of Southwest, their positions, and their respective ages (as of January... -

Page 29

... purchase Southwest Common Stock as follows: Number of Shares Purchased 415,528 437,032 Southwest's common stock is listed on the New York Stock Exchange and is traded under the symbol LUV. The high and low sales prices of the common stock on the Composite Tape and the quarterly dividends per share... -

Page 30

... to an outstanding option, shall be proportionately adjusted in the event of a subdivision or consolidation of shares or the payment of a stock dividend on Common Stock, and the purchase price per share of outstanding options shall b e proportionately revised. SOUTHWEST AIRLINES CO. 2002 10-K | 11 -

Page 31

... income per share, diluted ...Cash dividends per common share ...Total assets at period-end...Long-term obligations at period-end ...Stockholders' equity at period-end...Operating Data: Revenue passengers carried ...Revenue passenger miles ( RPMs) (000s) ...Available seat miles (ASMs) (000s) ...Load... -

Page 32

... was the worst year, ever, in the history of commercial aviation. It was a year that included dramatic increases in aviation insurance costs, increased passenger security costs resulting from continually evolving security laws and directives, airline industry downsizing, rising energy prices, and... -

Page 33

... by available seat miles or ASMs) attributable to the post-September 11, 2001, reduction in demand for air travel, and from lower passenger yields (passenger revenue divided by RPMs) caused by a decline in full-fare traffic. The Company's load factor for 2002 was 14 | SOUTHWEST AIRLINES CO. 2002... -

Page 34

... in operating expenses per ASM primarily due to higher fuel costs and salaries, wages, and benefits. To a large extent, changes in operating expenses for airlines are driven by changes i n capacity, or ASMs. The following presents Southwest's operating expenses per ASM for 2002 and 2001 followed... -

Page 35

...part to additional security requirements at airports. The remaining portion of the increase in salaries and wages per ASM was primarily due to increases in average wage rates. The increase in benefits expense per ASM was primarily due to higher healthcare costs. Employee retirement plans expense per... -

Page 36

... and repairs scheduled. The majority of the Company's engine maintenance work is outsourced. Agency commissions per ASM decreased 50.0 percent, primarily due to a change in the Company's commission rate policy. Effective October 15, 2001, the Company reduced the commission paid to travel agents from... -

Page 37

...to the prior year, due to higher debt levels. In fourth quarter 2001, the Company issued $614.3 million in long-term debt in the form of Pass-Through Certificates. In first quarter 2002, the Company issued $385 million i n unsecured notes. See Note 7 to the Consolidated Financial Statements for more... -

Page 38

... of 1.9 percent in passenger yield. Passenger yield decreased as a result of fare discounting by the Company and the airline industry in general as the United States economy weakened throughout 2001. The Company's load factor (RPMs divided by ASMs) over this time period was 71.2 percent, compared... -

Page 39

... increased compared to 2000. 20 | SOUTHWEST AIRLINES CO. 2002 10-K Agency commissions per ASM decreased 40.7 percent, primarily due to a change in the Company's commission rate policy. Effective January 1, 2001, the Company reduced the commission rate paid to travel agents from ten percent to eight... -

Page 40

... generated in 2002 and in 2001 was primarily used to finance aircraft-related capital expenditures and provide working capital. The Company has various options available to meet its capital and operating commitments, including cash on hand at December 31, 2002, SOUTHWEST AIRLINES CO. 2002 10-K | 21 -

Page 41

... years prior to the contractual delivery date, to substitute 737-600s or 737-800s for the 737-700s. The following table aggregates the Company's expected contractual obligations and commitments subsequent to December 31, 2002: Payments due by period (in thousands) Contractual obligations (1) Long... -

Page 42

...of the amount of future refunds, exchanges, and forfeitures for all unused tickets once the flight date has passed. These estimates are based on historical experience over many years. The Company and members of the airline industry have consistently applied this accounting method to estimate revenue... -

Page 43

... 2001 patterns. Accounting for Long-lived Assets program, changes in utilization of the aircraft (actual flight hours during a given period of time), governmental regulations on aging aircraft, and changing market prices of new and used aircraft of the same or similar types. The Company evaluates... -

Page 44

... that could cause these differences include, but are not limited to: • Items directly linked to the September 11, 2001, terrorist attacks, such as the adverse impact of new airline and airport security directives on the Company's costs and Customer demand for travel, changes in the Transportation... -

Page 45

...freight deliveries among different types of carriers. • Factors that could affect the Company's ability to control its costs, such as the results of Employee labor contract negotiations, Employee hiring and retention rates, costs for health care, the largely unpredictable prices of jet fuel, crude... -

Page 46

...'s financial instruments. A change i n market interest rates could, however, have a corresponding effect on the Company's earnings and cash flows associated with its Aircraft Secured Notes, French Credit Agreements, and invested cash because of the floating-rate nature SOUTHWEST AIRLINES CO. 2002 10... -

Page 47

...change in market rates would not impact the Company's earnings or cash flow associated with the Company's publicly traded fixed-rate debt or its Certificates. The Company is also subject to various types of liquidity and financing risk included in agreements with financial institutions that process... -

Page 48

...obligations Short-term borrowings Current maturities of long-term debt Total current liabilities Long-term debt less current maturities Deferred income taxes Deferred gains from sale and leaseback of aircraft Other deferred liabilities Commitments and contingencies Stockholders' equity: Common stock... -

Page 49

SOUTHWEST AIRLINES CO. CONSOLIDATED STATEMENT OF INCOME YEARS ENDED DECEMBER 31, (In thousands, except per share amounts) OPERATING REVENUES: Passenger Freight Other Total operating revenues OPERATING EXPENSES: Salaries, wages, and benefits Fuel and oil Maintenance materials and repairs Agency ... -

Page 50

... stock split Issuance of common and treasury stock pursuant to Employee stock plans Tax benefit of options exercised Cash dividends, $.018 per share Comprehensive income (loss) Net income Unrealized loss on derivative instruments Other Total comprehensive income Balance at December 31, 2001 Issuance... -

Page 51

... net income to net cash provided by ope rating activities: Depreciation Deferred income taxes Amortization of deferred gains on sale and leaseback of aircraft Amortization of scheduled airframe inspections and repairs Income tax benefit from Employee stock option exercises Changes in certain assets... -

Page 52

...by changes to the Company's maintenance program, changes in utilization of the aircraft (actual flight hours or cycles during a given period of time), governmental regulations o n aging aircraft, changing market prices of new and used aircraft of the same or similar types, etc. The Company evaluates... -

Page 53

... refunds and exchanges of tickets sold for past travel dates. The majority of the Company's tickets sold are 34 | SOUTHWEST AIRLINES CO. 2002 10-K nonrefundable. Tickets that are sold but not flown on the travel date can be reused for another flight, up to a year from the date of sale, or refunded... -

Page 54

... cost of providing free travel for awards earned under its Rapid Rewards frequent flyer program. The Company also sells frequent flyer credits and related services to companies participating i n its Rapid Rewards frequent flyer program. Funds received from the sale of flight segment credits... -

Page 55

... and disclosure provisions of SFAS No. 123. The Company is currently evaluating SFAS No. 148 to determine if it will adopt SFAS No. 123 to account for Employee stock options using the fair value method and, if so, when to begin transition to that method. 36 | SOUTHWEST AIRLINES CO. 2002 10-K -

Page 56

... call options, collar structures, and fixed price swap agreements. Prior to 2001, the net cost paid for option premiums and gains and losses on all financial derivative instruments, including those terminated or settled early, were deferred and charged or credited to "Fuel and oil" expense in the... -

Page 57

... recognizes Passenger revenue when free travel awards resulting from the flight segment credits sold are flown or credits expire unused. Due to this change, the Company recorded a cumulative effect charge in first quarter 2000 of $22.1 million (net of income taxes of $14.0 million) or $.03 per share... -

Page 58

... air space, Southwest temporarily suspended its normal refund policy in order to provide the highest Service to the Company's Customers, including refunding nonrefundable tickets upon Customer request. As a result, the Company's refunds during September 2001 and through December 2001 were far above... -

Page 59

... the Trust and accepted delivery of all 19 aircraft, thereby terminating the Trust. The receipt of the aircraft from the Trust was reflected in the Consolidated Statement of Cash Flows as "Payments of trust arrangement." The cost of financing these aircraft obligations, approximately $5 million, was... -

Page 60

...Notes due 2003 Aircraft Secured Notes due 2004 8% Notes due 2005 Pass Through Certificates 7 7/8% Notes due 2007 French Credit Agreements 6 1/2% Notes due 2012 7 3/8% Debentures due 2027 Capital leases (Note 8) Less current maturities Less debt discount and issue costs On March 1, 2002, the Company... -

Page 61

In July 2001, the Company redeemed $100 million of senior unsecured 9.4% Notes originally issued in 1991. In fourth quarter 1999, the Company issued $200 million of floating rate Aircraft Secured Notes (the Notes), due 2004. The Notes are funded by a bank through a commercial paper conduit program ... -

Page 62

... 100,563 9,657 $ 90,906 Operating Leases $ 281,042 263,343 233,028 189,498 175,905 1,459,961 $ 2,602,777 options at or near the end of the lease term at fair market value, generally limited to a stated percentage of the lessor's defined cost of the aircraft. SOUTHWEST AIRLINES CO. 2002 10-K | 43 -

Page 63

...to meet their obligations. The credit exposure related to these financial instruments is represented by the fair value of contracts with a positive fair value at the reporting date. To manage credit risk, the Company selects and periodically reviews counterparties based on credit ratings, limits its... -

Page 64

... due 2003 Aircraft Secured Notes due 2004 8% Notes due 2005 Pass Through Certificates 7 7/8% Notes due 2007 French Credit Agreements 6 1/2% Notes due 2012 7 3/8% Debentures due 2027 The estimated fair values of the Company's long-term debt were based on quoted market prices. The carrying values... -

Page 65

.... The Agreement is not applicable to a fully financed or cash tender offer for all of the Company's shares of 46 | SOUTHWEST AIRLINES CO. 2002 10-K common stock, which remains open for at least 60 calendar days, is at a price equal to the higher of (a) 65 percent over the average closing price of... -

Page 66

... stock on the date of grant, have ten-year terms, and vest and become fully exercisable over three, five, or ten years of continued employment, depending upon the grant type. All of these other Employee plans have been approved by shareholders except the plan covering non-management, non-contract... -

Page 67

Aggregated information regarding the Company's fixed stock option plans, as adjusted for stock splits, is summarized below: COLLECTIVE BARGAINING PLANS OTHER EMPLOYEE PLANS Average exercise price $ 4.61 13.86 3.47 8.67 8.66 18.75 4.77 10.87 10.20 16.90 5.75 12.48 $ 11.47 $ 11.33 (In thousands, ... -

Page 68

... pricing model with the following weighted-average assumptions used for grants under the fixed option plans: 2002 3.4% 5.0 34.0% 0.13% 2001 4.5% 5.9 34.8% 0.07% 2000 5.0% 6.0 34.9% 0.10% Wtd-average risk-free interest rate Expected life of option (years) Expected stock volatility Expected dividend... -

Page 69

...1,011,743 DEFERRED TAX LIABILITIES: Accelerated depreciation Scheduled airframe maintenance Other Total deferred tax liabilities DEFERRED TAX ASSETS: Deferred gains from sale and leaseback of aircraft Capital and operating leases Accrued employee benefits State taxes Other Total deferred tax assets... -

Page 70

... tax rates Nondeductible items State income taxes, net of federal benefit Other, net Total income tax provision At December 31, 2002, Southwest Airlines Co. had an estimated tax net operating loss of $145 million for federal income tax purposes. The Company estimates that a federal tax refund of... -

Page 71

...) $ .81 The Company has excluded 11.0 million, 5.7 million, and 11.7 million shares from its calculations of net income per share, diluted, in 2002, 2001, and 2000, respectively, as they represent antidilutive stock options for the respective periods presented. 52 | SOUTHWEST AIRLINES CO. 2002 10... -

Page 72

...to the financial statements, in 2001 the Company changed its method of accounting for derivative financial instruments and in 2000 the Company changed its method of accounting for the sale of flight segment credits. /s/ ERNST & YOUNG LLP Dallas, Texas January 21, 2003 SOUTHWEST AIRLINES CO. 2002 10... -

Page 73

...,399 .05 .05 2001 Operating revenues Operating income Income before income taxes Net income Net income per share, basic Net income per share, diluted $1,428,617 ...Item 9. Changes In and Disagreements With Accountants on Accounting and Financial Disclosure None. 54 | SOUTHWEST AIRLINES CO. 2002 10-K -

Page 74

... See "Compensation of Executive Officers," incorporated herein by reference from the definitive Proxy Statement for Southwest's Annual Meeting of Shareholders to be held May 14, 2003. Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters See "Voting... -

Page 75

...Annual Report on Form 10-K for the year ended December 31, 1994 [File No. 1-7259]). Amended and Restated Rights Agreement dated July 18, 1996, between Southwest and Continental Stock Transfer & Trust Company, as Rights Agent (incorporated by reference to Exhibit 1, Southwest's Registration Statement... -

Page 76

... be furnished to the Securities and Exchange Commission upon request. 4.5 10.1 Purchase Agreement No. 1810, dated January 19, 1994, between The Boeing Company and Southwest (incorporated by reference to Exhibit 10.4 to Southwest's Annual Report on Form 10-K for the year ended December 31, 1993... -

Page 77

... 10.12 to Southwest's Annual Report on Form 10-K for the year ended December 31, 2001 ([File No. 1-7259]); Amendment No. 1 to Southwest Airlines Co. 401(k) Plan; Amendment No. 2 to Southwest Airlines Co. 401(k) Plan. Southwest Airlines Co. 1995 SWAPA Non-Qualified Stock Option Plan (incorporated by... -

Page 78

...-100862]). 2002 Ramp, Operations, Provisioning, and Freight Non-Qualified Stock Option Plan. 2002 Customer Service/Reservations Non-Qualified Stock Option Plan. Subsidiaries of Southwest (incorporated by reference to Exhibit 22 to Southwest's Annual Report on Form 10-K for the year ended December 31... -

Page 79

...by the undersigned, there unto duly authorized. SOUTHWEST AIRLINES CO. January 30, 2003 By /s/ Gary C. Kelly Gary C. Kelly Executive Vice President, Chief Financial Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons... -

Page 80

...affect internal controls subsequent to the date of our most recent evaluation, including any corrective actions with regard to significant deficiencies and material weaknesses. Date: February 5, 2003 /s/ Gary C. Kelly Gary C. Kelly Executive Vice President Chief Financial Officer SOUTHWEST AIRLINES... -

Page 81

... affect internal controls subsequent to the date of our most recent evaluation, including any corrective actions with regard to significant deficiencies and material weaknesses. Date: February 5, 2003 /s/ James F. Parker James F. Parker Chief Executive Officer 62 | SOUTHWEST AIRLINES CO... -

Page 82

...Annual Report on Form 10-K for the year ended December 31, 1994 [File No. 1-7259]). Amended and Restated Rights Agreement dated July 18, 1996, between Southwest and Continental Stock Transfer & Trust Company, as Rights Agent (incorporated by reference to Exhibit 1, Southwest's Registration Statement... -

Page 83

...will be furnished to the Securities and Exchange Commission upon request. 10.1 Purchase Agreement No. 1810, dated January 19, 1994, between The Boeing Company and Southwest (incorporated by reference to Exhibit 10.4 to Southwest's Annual Report on Form 10-K for the year ended December 31, 1993 [File... -

Page 84

... 10.12 to Southwest's Annual Report on Form 10-K for the year ended December 31, 2001 [File No. 1-7259]); Amendment No. 1 to Southwest Airlines Co. 401(k) Plan; Amendment No. 2 to Southwest Airlines Co. 401(k) Plan. Southwest Airlines Co. 1995 SWAPA Non-Qualified Stock Option Plan (incorporated by... -

Page 85

...-100862]). 2002 Ramp, Operations, Provisioning, and Freight Non-Qualified Stock Option Plan. 2002 Customer Service/Reservations Non-Qualified Stock Option Plan. Subsidiaries of Southwest (incorporated by reference to Exhibit 22 to Southwest's Annual Report on Form 10-K for the year ended December 31...