Sonic 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Sonic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2012 Annual Report

Table of contents

-

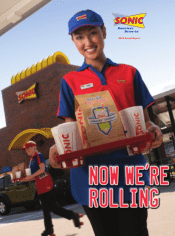

Page 1

2012 Annual Report -

Page 2

.... Customers also may enjoy patio dining or drive-thru service at many Sonic locations. Sonic Drive-Ins feature signature menu items, offering made-when-youorder footlong quarter pound coneys, six-inch premium beef hot dogs, hamburgers, popcorn chicken, chicken strips and chicken sandwiches. Likewise... -

Page 3

... company and franchise drive-in information, is a non-GAAP measure. We believe system-wide information is useful in analyzing the growth of the Sonic brand as well as our revenues, since franchisees pay royalties based on a percentage of sales. 3 Change in same-store sales based on drive-ins open... -

Page 4

...increasing royalty revenue and new drive-in development, to achieve double-digit earnings per share growth. We were very pleased that positive same-store sales in fiscal 2012 fueled other layers in our multi-layered growth strategy, including greater operating leverage, increased franchising revenue... -

Page 5

...regeneration of new drive-in development will contribute to the scale of our marketing efforts and the profitability of all franchisees and our company! The combination of these initiatives and the strong cash flow we generate each year supported our fiscal year 2012, stock repurchase program, which... -

Page 6

... of a true footlong quarter pound coney. Last year, we expanded on that with a new line of premium beef hot dogs in several craveable versions, including the famous New York, Chicago and All-American Dogs. And there's more. This year, we continued to expand our new product news with the introduction... -

Page 7

Mt. Juliet, TENNESSEE 6 ounces of pure bliss So good, you have to eat slow, very slow! You'll want to savor every bite. We reintroduced our Jumbo Popcorn Chicken across our system in March 2012, and cheers went out all across Sonicland. 5 -

Page 8

... Slush, Seaweed Slush, Hulk Slush and...the Pink Flamingo. 32 Frozen Favs What do the best shakes, sundaes, cones, floats, splits, Sonic Blasts®, and CreamSlush® Treats have in common? They all start with Real Ice Cream. Sonic's got it. Others don't. I'm Diving In! Each year Sonic sells enough... -

Page 9

...of eating at the seashore when I was a " "I remember the first time I stopped at My carhop's name was Becky." kid. Sonic. "Real ice cream milk shakes on Friday afternoon after school have become a " family tradition. "Awesome" Fresh Thinking Sonic's Premium Grilled Chicken Sandwich is new and... -

Page 10

... develop larger markets that are well established or where land availability is limited. Either way, the new small Sonic Drive-In means added flexibility in our business model, lower up-front capital and reduced operational risk. For almost 60 years, Sonic has been a franchise-driven business... -

Page 11

... % size, this drive-in is booming, with no sacrifice in brand perception. In fact, the franchisee has found that with its re-engineered kitchen, food orders are prepared and delivered as fast or faster than at a traditional Sonic Drive-In, using less labor for greater operational efficiency. 9 -

Page 12

... Sonic Games team medal winners below. These company drive-ins have embraced and benefitted from our sales- and profit-driving initiatives, such as an added emphasis on customer service and skating, a reduction in management layers between drive-in operations and the corporate office, and a new... -

Page 13

... Hill (right) NO. The Troy Smith Award 1 The Mann Hill Hill & Twiggs franchise group in Houston, which operates 31 Sonic Drive-Ins, won Sonic's most prestigious award for franchisees, The Troy Smith Award, for 2012. Named for the company's founder, this annual award recognizes a high-performing... -

Page 14

... margins and increased profitability with improved customer service. Sonic's Technology Advisory Council, composed of franchisees from across the system, selected Barbara Stammer The Merritt Group Las Cruces, NM a new POS platform that enhances drive-in level profitability, reduces operational... -

Page 15

...'s the way you Sonic! At Sonic, we are always thinking about how to move our business forward, and technology improvements are a big part of this effort. Remember PAYS (Pay At Your Stall), when we introduced a streamlined credit/debit card payment system years back, and the sales and profit bump it... -

Page 16

Sonic at a Glance Net Income Per Diluted Share As Reported Adjusted System-wide Drive-Ins 3,556 3,561 3,572 System-wide Average Sales Per Drive-In (in thousands) Business Mix Franchise Drive-Ins Company Drive-Ins 12% 88% $0.481 $0.532 $0.34 $0.60 $0.31 $0.60 $1,023 $1,037 11 6 10 11 12... -

Page 17

...Data: Company Drive-In sales Franchise Drive-Ins: Franchise royalties Franchise fees Lease revenue Other Total revenues Cost of Company Drive-In sales Selling, general and administrative Depreciation and amortization Provision for impairment of long-lived assets Total expenses Other operating income... -

Page 18

... fiscal quarter of 2012, mostly offset by an increase in same-store sales. Restaurant margins at Company Drive-Ins improved by 80 basis points during fiscal year 2012, reflecting the leverage of positive same-store sales as well as moderating commodity cost inflation. Net income and diluted earnings... -

Page 19

... the change in net income and diluted earnings per share for the periods below provides useful information to investors and management regarding the underlying business trends and the performance of our ongoing operations and is helpful for period-to-period and company-to-company comparisons... -

Page 20

... Franchise Drive-Ins: Franchise royalties Franchise fees Lease revenue Other Total revenues $ The following table reflects the changes in sales and same-store sales at Company Drive-Ins. It also presents information about average unit volumes and the number of Company Drive-Ins, which is useful... -

Page 21

... royalties, franchise fees and lease revenues. See Revenue Recognition Related to Franchise Fees and Royalties in the Critical Accounting Policies and Estimates section of "Management's Discussion and Analysis of Financial Condition and Results of Operations." Drive-ins that are temporarily closed... -

Page 22

... direct operating costs such as marketing, telephone and utilities, repair and maintenance, rent, property tax and other controllable expenses. Company Drive-In Margins Year Ended August 31, 2012 2011 Costs and expenses(1): Company Drive-Ins: Food and packaging Payroll and other employee benefits... -

Page 23

... quarter of fiscal year 2012 relating to a point-of-sale system that is used by a majority of the Sonic system. The decrease in depreciation and amortization expense for fiscal year 2011 was primarily attributable to the provision for impairment of long-lived assets recorded in the fourth quarter... -

Page 24

...property related to a point-of-sale system that is used by a majority of the Sonic system. These cash outflows were partially offset by $9.9 million in proceeds primarily related to the sale of operations and a portion of the real estate for 34 Company Drive-Ins. The balance of the change relates to... -

Page 25

... of a new point-of-sale system at Company Drive-Ins, and the implementation of a new supply chain management tool for use by the entire Sonic system. We expect to fund these capital expenditures through cash flow from operations as well as cash on hand. On October 13, 2011, our Board of Directors... -

Page 26

... significant accounting policies and estimates involve a high degree of risk, judgment and/or complexity. Impairment of Long-Lived Assets. We review Company Drive-In assets for impairment when events or circumstances indicate they might be impaired. We test for impairment using historical cash flows... -

Page 27

... two approaches: an income approach, using the discounted cash flow method, and a market approach, using the guideline public company method. The discounted estimates of future cash flows include significant management assumptions such as revenue growth rates, operating margins, capital expenditures... -

Page 28

... option periods when appropriate. The lease term commences on the date when we have the right to control the use of lease property, which can occur before rent payments are due under the terms of the lease. Contingent rent is generally based on sales levels and is accrued at the point in time... -

Page 29

..., net Property, equipment and capital leases, net Goodwill Debt origination costs, net Other assets, net Total assets Liabilities and stockholders' equity Current liabilities: Accounts payable Deposits from franchisees Accrued liabilities Income taxes payable Current maturities of long-term debt... -

Page 30

...(In thousands, except per share data) 2012 Revenues: Company Drive-In sales Franchise Drive-Ins: Franchise royalties Franchise fees Lease revenue Other Costs and expenses: Company Drive-Ins: Food and packaging Payroll and other employee benefits Other operating expenses, exclusive of depreciation... -

Page 31

...Common Stock Shares Amount Paid-in Capital Retained Earnings Balance at August 31, 2009 Comprehensive Income: Net income Net change in deferred hedging losses, net of tax of $462 Total comprehensive income, net of income taxes Purchases of noncontrolling interests in Company Drive-Ins Changes to... -

Page 32

... and equipment Proceeds from sale of assets Other Net cash used in investing activities Cash flows from financing activities Payments on and purchases of debt Proceeds from borrowings Restricted cash for securitization obligations Proceeds from exercise of stock options Purchases of noncontrolling... -

Page 33

... Operations Sonic Corp. (the "company") operates and franchises a chain of quick-service restaurants in the United States. It derives its revenues primarily from Company Drive-In sales and royalty fees from franchisees. The company also leases signs and real estate, and receives equity earnings... -

Page 34

... two approaches: an income approach, using the discounted cash flow method, and a market approach, using the guideline public company method. The discounted estimates of future cash flows include significant management assumptions such as revenue growth rates, operating margins, capital expenditures... -

Page 35

... option periods when appropriate. The lease term commences on the date when the company has the right to control the use of the leased property, which can occur before rent payments are due under the terms of the lease. Contingent rent is generally based on sales levels and is accrued at the point... -

Page 36

... fair value of the company's fixed-rate loans approximated their carrying value. • Long-term debt - The company prepares a discounted cash flow analysis for its fixed rate borrowings to estimate fair value each quarter. This analysis uses Level 2 inputs from market information available for public... -

Page 37

... years 2012 and 2011 and have been included in "payroll and other employee benefits" on the Consolidated Statements of Income and in "other noncurrent liabilities" on the Consolidated Balance Sheets. New Accounting Pronouncements In September 2011, the Financial Accounting Standards Board ("FASB... -

Page 38

...regular quarterly reviews of long-lived assets. The recoverability of Company Drive-Ins is assessed by estimating the undiscounted net cash flows expected to be generated over the remaining life of the Company Drive-Ins. This involves estimating same-store sales and margins for the cash flows period... -

Page 39

..., buildings and signs for a period of 15 years and are classified as operating leases. There are four renewal options at the end of the primary term for periods of five years for property that is owned by the company. For property owned by third parties, the lease term runs concurrent with the term... -

Page 40

... Consolidated Financial Statements August 31, 2012, 2011 and 2010 (In thousands, except per share data) Future minimum rental payments receivable as of August 31, 2012 are as follows: Operating Direct Financing Years ending August 31: 2013 2014 2015 2016 2017 Thereafter Less unearned income $ $ 12... -

Page 41

...Wages and employee benefit costs Property taxes, sales and use taxes and employment taxes Unredeemed gift cards and gift certificates Other $ The company sells gift cards that do not have expiration dates. Gift card balances are recorded as a liability on the company's Consolidated Balance Sheets... -

Page 42

... closing, and has the ability to draw additional amounts under the facility from time to time as needed. In June 2011, the company repaid the outstanding balance under its 2011 Variable Funding Notes. Sonic used the $535 million of net proceeds from the issuance of the 2011 Fixed Rate Notes and 2011... -

Page 43

...The company categorizes its assets and liabilities recorded at fair value based upon the following fair value hierarchy established by FASB: • Level 1 valuations use quoted prices in active markets for identical assets or liabilities that are accessible at the measurement date. An active market is... -

Page 44

... 2012, 2011 and 2010 (In thousands, except per share data) The table below sets forth our fair value hierarchy for financial assets measured at fair value on a recurring basis as of August 31, 2012 and 2011: Quoted Prices in Active Markets for Identical Assets (Level 1) August 31, 2012 Assets: Cash... -

Page 45

..., depreciation and direct financing leases State net operating losses Property, equipment and capital leases Deferred income from affiliated franchise fees Intangibles and other assets Deferred income from franchisees Stock compensation Debt extinguishment Allowance for doubtful accounts and notes... -

Page 46

... Balance Sheets. 12. Stockholders' Equity Employee Stock Purchase Plan The company has an employee stock purchase plan ("ESPP") that permits full-time regular employees to purchase the company's common stock at a 15% discount from the stock's fair market value. Employees are eligible to purchase... -

Page 47

... future events or the value ultimately realized by the employees who receive equity awards. The fair value of RSUs granted is equal to the company's closing stock price on the date of the grant. The per share weighted average fair value of stock options granted during 2012, 2011 and 2010 was $2.88... -

Page 48

... consists of the drive-in operations in which the company owns a controlling ownership interest and derives its revenues from operating drive-in restaurants. The Franchise Operations segment consists of franchising activities and derives its revenues from royalties, initial franchise fees and lease... -

Page 49

... of approximately $77 million which primarily related to its estimated share of system-wide commitments for food products. 16. Selected Quarterly Financial Data (Unaudited) First Quarter Second Quarter Third Quarter Fourth Quarter 2012 2011 2012 2011 2012 2011 2012 2011 $ 128,279 $129,146 $115,084... -

Page 50

... balance sheets of Sonic Corp. as of August 31, 2012 and 2011, and the related consolidated statements of income, stockholders' equity (deficit), and cash flows for each of the three years in the period ended August 31, 2012. These financial statements are the responsibility of the company... -

Page 51

... 31, 2012, the company's internal control over financial reporting is effective based on those criteria. The company's independent registered public accounting firm that audited the financial statements included in this annual report has issued an attestation report on the company's internal control... -

Page 52

... Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Sonic Corp. as of August 31, 2012 and 2011, and the related consolidated statements of income, stockholders' equity (deficit), and cash flows for each of the three years in the period ended August 31, 2012... -

Page 53

... Sonic Industries Services Inc. (SISI) (the company's franchising subsidiary) Omar R. Janjua President of Sonic Restaurants, Inc. (the company's restaurant-operating subsidiary) and Executive Vice President of Operations of SISI Stephen C. Vaughan Executive Vice President and Chief Financial Officer... -

Page 54

...com Independent Registered Public Accounting Firm Ernst & Young LLP Oklahoma City, Oklahoma Annual Meeting Our 2013 Annual Meeting of Shareholders will be held at 1:30 p.m. Central Standard Time on January 17, 2013, at our Corporate Offices, 4th Floor, 300 Johnny Bench Drive, Oklahoma City, Oklahoma... -

Page 55

-

Page 56

... to visit a special website, LimeadesforLearning.com, and vote for a teacher's project they wanted Sonic to fund. More than four million votes were cast by Sonic's customers and fans in the 2012 Limeades for Learning® Campaign to fund 1,495 public school classroom projects in 30 states! Since 2009...