SanDisk 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 SanDisk annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

-

119

-

120

-

121

-

122

-

123

-

124

-

125

-

126

-

127

-

128

-

129

-

130

-

131

-

132

-

133

-

134

-

135

-

136

-

137

-

138

-

139

-

140

-

141

-

142

-

143

-

144

-

145

-

146

-

147

-

148

-

149

-

150

-

151

-

152

-

153

-

154

-

155

-

156

-

157

-

158

-

159

-

160

-

161

-

162

-

163

-

164

-

165

-

166

-

167

-

168

-

169

-

170

-

171

-

172

-

173

-

174

-

175

-

176

-

177

-

178

-

179

-

180

-

181

-

182

-

183

-

184

-

185

-

186

-

187

-

188

-

189

-

190

-

191

-

192

-

193

-

194

-

195

-

196

-

197

-

198

-

199

-

200

-

201

-

202

-

203

-

204

-

205

-

206

-

207

-

208

-

209

-

210

-

211

-

212

-

213

-

214

-

215

-

216

-

217

-

218

-

219

-

220

-

221

-

222

-

223

-

224

-

225

-

226

-

227

-

228

-

229

-

230

-

231

-

232

Table of contents

-

Page 1

-

Page 2

-

Page 3

Stockholders Letter Proxy Statement

Annual Report

-

Page 4

... Flow

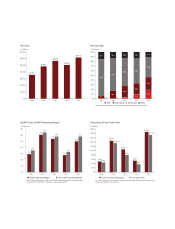

Non-GAAP operating margin excludes share-based compensation expense, acquisition-related amortization and impairments, and purchase accounting adjustments.

Free Cash Flow equals Cash Flow from Operations less Acquisition of Property and Equipment and Net Investing Activity in Flash Ventures...

-

Page 5

... of mobile phones and tablets to the next level.

Removable

Our removable products are sold in both commercial and retail channels. Our offerings in the retail channel remain a key differentiator for the company, with 2013 marking a year of record retail revenue. The strength of the SanDisk brand is...

-

Page 6

...speed of business in both data centers and client devices, allowing companies to manage dramatically increasing data loads and accelerate employee productivity while lowering total cost of ownership. Our innovative embedded and removable solutions for smartphones and tablets help our customers build...

-

Page 7

... Employee Stock Purchase Plans. To ratify the appointment of Ernst & Young LLP as the Company's independent registered public accounting firm for the fiscal year ending December 28, 2014.

2. 3. 4. 5.

Proxy Statement

To pass an advisory resolution to approve the compensation of the Company's Named...

-

Page 8

...Stock Ownership Guidelines ...Insider Trading Policy ...Section 162(m) Policy ...Accounting for Share-based Compensation ...COMPENSATION COMMITTEE REPORT ...EXECUTIVE COMPENSATION ...Summary Compensation Table-Fiscal Years 2011-2013 ...Grants of Plan-Based Awards in Fiscal Year 2013 ...Outstanding...

-

Page 9

... of record at the close of business on April 21, 2014 (the ''Record Date'') will be entitled to vote at the Annual Meeting. The Annual Meeting will be held at 8:00 a.m., local time, on June 19, 2014, at the Company's headquarters, 951 SanDisk Drive, Milpitas, CA 95035. These materials will...

-

Page 10

... the term of the 2005 Employee Stock Purchase Plans, the ratification of the appointment of Ernst & Young LLP as the Company's independent registered public accounting firm and the advisory resolution to approve the compensation of the Company's Named Executive Officers (who are identified below in...

-

Page 11

... Relations, c/o SanDisk Corporation, 951 SanDisk Drive, Milpitas, CA 95035, or call the Company's Investor Relations department at (408) 801-1000, and the Company will promptly comply with such request. Stockholders may contact the Company's Investor Relations representative at the phone number...

-

Page 12

... as of the Record Date are entitled to attend the Annual Meeting. Such individuals should be prepared to present government-issued photo identification, such as a valid driver's license or passport, and verification of ownership of Common Stock or proxy status as of the Record Date for admittance...

-

Page 13

... Services Agreements with the Company in October 2013 and January 2014. There are no family relationships between any executive officer, as defined in Rule 3b-7 of the Securities Exchange Act of 1934, as amended (an ''executive officer''), and any Director nominee. Directors elected to the Board...

-

Page 14

... serving as the chief executive officer and chief financial officer of a large, complex, publicly-held technology company, his venture capital experience, which is important to the Board's understanding of business development, financing, strategic alternatives and industry trends, and his extensive...

-

Page 15

...regard to the operation of the Board and its role in overseeing the Company. The Board also values Mr. Hartenstein's previous experience, including as the chief executive officer, of large, complex, publicly-held companies. Dr. Hu has served as a Director of the Company since August 2009. Employment...

-

Page 16

... of other public companies are valuable to the Board's operations. The Board values Ms. Lego's significant experience, expertise and background in financial and accounting matters, including in the technology industry. Ms. Lego's venture capital experience aids the Board's understanding of business...

-

Page 17

...Semiconductor Industry Association, the Engineering Advisory Board at the University of California, Berkeley, and the Stanford Graduate School of Business Advisory Council. Director Qualifications: Mr. Mehrotra, as the co-founder, President and Chief Executive Officer of the Company, offers a unique...

-

Page 18

... to: Board of Directors, c/o Investor Relations, SanDisk Corporation, 951 SanDisk Drive, Milpitas, CA 95035. Communications that are intended specifically for non-management Directors should be sent to the attention of the Chair of the Nominating and Governance Committee. The Company will deliver...

-

Page 19

...setting the compensation of the Company's executive officers, as defined by NASDAQ listing standards and Rule 16a-1(f) of the Exchange Act (the ''Section 16 Officers''), evaluating the performance of the Company's Section 16 Officers, administering the Company's incentive and employee stock purchase...

-

Page 20

... year 2014 compensation, evaluating the competitiveness of the Company's executive compensation programs relative to the Company's fiscal year 2013 peer companies and to provide information on compensation-related trends and developments in the Company's industry and fiscal year 2013 peer companies...

-

Page 21

...long-term performance. These grants are generally made annually, so executives and other key employees always have unvested awards that could decrease significantly in value if the Company's business is not managed for the long term. Internal Processes Further Restrict Risk. The Company has in place...

-

Page 22

... as a Director since July 2010. The Board believes that it is in the Company's best interests to maintain a separation of the Chairman of the Board and the Chief Executive Officer roles because it allows the Chief Executive Officer of the Company to focus on the Company's day-to-day business, while...

-

Page 23

... Nominating and Governance Committee, c/o SanDisk Corporation, 951 SanDisk Drive, Milpitas, CA 95035. The recommendation must include the following written materials: (1) all information relating to the Recommended Candidate that is required to be disclosed pursuant to applicable Exchange Act rules...

-

Page 24

... incumbent Director's performance during his or her term, including the number of meetings attended, level of participation and overall contribution to the Company; the number of other company boards on which the individual serves; the composition of the Board at that time; any changed circumstances...

-

Page 25

... SEC on February 21, 2014. Under general accounting principles, compensation expense with respect to stock awards and option awards granted to the Directors is generally recognized over the vesting periods applicable to the awards. In June 2013, the Company granted each of the Non-Employee Directors...

-

Page 26

.... Mercer for his Board service and Audit Committee service, respectively, in the third quarter of fiscal year 2013.

(7)

(8)

Elements of Director Compensation Compensation for Non-Employee Directors during fiscal year 2013 generally consisted of annual retainers and annual share-based awards. The...

-

Page 27

... 12, 2013, a Non-Employee Director who first takes office and who has not been employed by the Company in the preceding twelve (12) months received, at the time of his or her election or appointment to the Board, (i) an initial option grant to purchase 25,000 shares of Common Stock (the ''Original...

-

Page 28

... Company's 2013 Incentive Plan (the ''2013 Plan'' and together with the 2005 Plan, the ''Incentive Plans''). Initial and Annual Stock Option Grants. The Initial and Annual Option Grants are granted with a per share exercise price equal to the fair market value of a share of Common Stock on the grant...

-

Page 29

...first anniversary of the grant date or (ii) the day immediately preceding the next Annual Meeting of Stockholders following the grant date. Pursuant to the terms of the Incentive Plans, RSUs granted to the Company's Non-Employee Directors will vest on an accelerated basis in connection with a change...

-

Page 30

...sec.gov. You may also obtain, free of charge, a copy of the 2005 Purchase Plans by writing to: Investor Relations, c/o SanDisk Corporation, 951 SanDisk Drive, Milpitas, CA 95035. Administration The 2005 Purchase Plans are administered by the Compensation Committee of the Company's Board of Directors...

-

Page 31

..., stock split, exchange or combination of shares spin off or other change in corporate structure effected without the Company's receipt of consideration), appropriate adjustments will be made to (i) the maximum number and class of securities issuable in the aggregate under the 2005 Purchase Plans...

-

Page 32

...of the offering period or (ii) the fair market value on the last day of the offering period. The fair market value per share of Common Stock on any particular date under the 2005 Purchase Plans will be deemed to be equal to the closing selling price per share on such date on NASDAQ. On March 3, 2014...

-

Page 33

...an ''employee stock purchase plan'' within the meaning of Section 423 of the Internal Revenue Code. Under a plan which so qualifies, no taxable income will be recognized by a participant, and no deductions will be allowable to the Company, upon either the grant or the exercise of the purchase rights...

-

Page 34

...the accounting principles currently applicable to employee stock purchase plans such as the 2005 Purchase Plans, the fair value of each purchase right granted under the 2005 Purchase Plans will be charged as a direct compensation expense to the Company's reported earnings over the offering period to...

-

Page 35

Recommendation of the Board of Directors The Board believes that it is in the Company's best interests to continue to provide its employees with the opportunity to acquire an ownership interest in the Company through their participation in the 2005 Purchase Plans and thereby encourage them to remain...

-

Page 36

... of a different independent registered public accounting firm at any time if the Audit Committee determines that such a change would be in the best interests of the Company and its stockholders. Ernst & Young LLP has audited the Company's financial statements annually since 1991. The Company expects...

-

Page 37

...person or represented by proxy at the Annual Meeting and entitled to vote on Proposal No. 3 is required to ratify the appointment of Ernst & Young LLP as the Company's independent registered public accounting firm for the fiscal year ending December 28, 2014. Recommendation of the Board of Directors...

-

Page 38

... 10-K The Company filed its Annual Report on Form 10-K with the SEC on February 21, 2014. Stockholders may obtain a copy of the Annual Report on Form 10-K, without charge, by writing to: Investor Relations, c/o SanDisk Corporation, 951 SanDisk Drive, Milpitas, CA 95035. The Annual Report on Form 10...

-

Page 39

... with that policy and pursuant to Section 14A of the Exchange Act, the Company is asking stockholders to pass an advisory resolution commonly known as a ''say-on-pay'' proposal to approve the Company's compensation of its Named Executive Officers for fiscal year 2013 (who are identified below in the...

-

Page 40

... to manage the Company's business as owners and subjecting a significant portion of the executive officer's total compensation to fluctuations in the market price of Common Stock. During fiscal year 2013, a significant percentage of each Named Executive Officer's total compensation (as reported in...

-

Page 41

...customers, and the Company now supplies client SSDs to all leading PC OEMs. • In its Retail channel, achieved record annual revenue with share gains in cards and USB drives. • Completed the strategic acquisition of SMART Storage Systems (''SMART Storage''), strengthening the Company's technology...

-

Page 42

... executive officers from short-selling the Company's Common Stock, trading in derivative securities related to the Company's securities, including the Company's Common Stock, or otherwise engaging in activities designed to hedge against the Company's Common Stock. • Perquisites and other personal...

-

Page 43

...'s broader employee population, which the Company believes also aligns the interests of the executive officers with the Company as a whole. The table below lists each material element of the Company's executive compensation program and the compensation objective or objectives that it is designed to...

-

Page 44

... officers at companies determined to be peer companies of the Company. The Compensation Committee reviewed and approved the following selected peer companies for fiscal year 2013:

Adobe Systems Incorporated Advanced Micro Devices, Inc. Analog Devices, Inc. Broadcom Corporation CA, Inc. Electronic...

-

Page 45

... year 2013 peer companies and to provide information on compensation-related trends and developments in the Company's industry and fiscal year 2013 peer companies, including equity award practices. Compensia did not provide any other services to the Company. The Company's Chief Executive Officer...

-

Page 46

...salaries of the executive officers, including the Named Executive Officers, in the first quarter of each year. To assist with that review, Compensia provided the Compensation Committee with a summary of the base salary levels in effect for comparable executive officers based upon industry surveys as...

-

Page 47

... (2) system technology/product platform competitiveness as demonstrated through achievement of product development, (3) customer ratings compared to competitors from top strategic OEM Customers, (4) product launches with respect to certain SSD products, (5) customer acceptance and revenue objectives...

-

Page 48

... and managing the Company's worldwide memory technology teams. • Mr. Whitaker-The Compensation Committee considered Mr. Whitaker's leadership in the Company's intellectual property licensing program and litigation strategy, as well as his contributions to the completed acquisition of SMART Storage...

-

Page 49

... hire has joined the Company or, in the case of a promoted employee, after the promotion has been approved. For a newly hired or promoted executive officer, the associated stock award is granted at the next meeting of the Compensation Committee. For a newly hired or promoted employee who is not an...

-

Page 50

... and responsibilities as Executive Vice President and Chief Strategy Officer and individual performance related to the Company's overall strategy and mergers and acquisitions, as well as corporate management of the Company, the Company's financial performance in fiscal year 2012, his expected future...

-

Page 51

... Agreement Upon Termination of Employment. In connection with his promotion to Chief Executive Officer in January 2011, Mr. Mehrotra and the Company entered into a separate severance agreement not related to a change in control of the Company, pursuant to which Mr. Mehrotra is entitled to severance...

-

Page 52

... bonus payout amount in connection with the Company's fiscal year 2014 annual cash incentive program for the executive officers including the Named Executive Officers. The performance targets under the fiscal year 2014 annual cash incentive program relate to a non-GAAP EPS goal and certain strategic...

-

Page 53

... the Exchange Act), with a minimum stock ownership requirement, if any, as determined by the Board from time to time. During fiscal year 2013, each Director and executive officer was required to beneficially own 1,000 shares of Common Stock upon his or her one-year anniversary of service, increasing...

-

Page 54

Accounting for Share-based Compensation The Compensation Committee takes accounting considerations into account in designing compensation plans and arrangements for the Company's executive officers, other employees, and Directors. Chief among these is ASC 718, the standard which governs the ...

-

Page 55

... any future filings with the SEC, or subject to the liabilities of Section 18 of the Exchange Act, except to the extent that the Company specifically incorporates it by reference into a document filed under the Securities Act or the Exchange Act. The Compensation Committee has reviewed and discussed...

-

Page 56

EXECUTIVE COMPENSATION Summary Compensation Table-Fiscal Years 2011-2013 The following table presents information regarding compensation of the Named Executive Officers for services rendered during fiscal years 2013, 2012 and 2011.

Non-Equity Incentive Plan All Other Compensation Compensation (2) ...

-

Page 57

...of Named Executive Officers The Summary Compensation Table above quantifies the value of the different forms of compensation earned by or awarded to the Named Executive Officers in fiscal years 2013, 2012 and 2011. The primary elements of each Named Executive Officer's total compensation reported in...

-

Page 58

...Number of Number of Exercise or Fair Value of Non-Equity Incentive Plan Shares of Securities Base Price of Stock and Awards Stock or Underlying Option Option Threshold Target Maximum Units Options Awards Awards ($)(1) ($)(1) ($)(1 Sh) ($)(2)

Name

Grant Date

Sanjay Mehrotra ...2/15/2013 2/15/2013...

-

Page 59

...21, 2014. Under GAAP, compensation expense with respect to stock awards and option awards granted to the Company's employees is generally recognized over the vesting periods applicable to the awards. Dr. Sivaram was not an executive officer at the time the Compensation Committee established the 2013...

-

Page 60

... Each RSU reported in the table above and granted to the Named Executive Officers in fiscal year 2013 represents a contractual right to receive one share of the Company's Common Stock if the vesting requirements described below are satisfied. RSUs are credited to a bookkeeping account established by...

-

Page 61

... by the Company for ''misconduct'' (as determined under the plan), outstanding stock options (whether vested or unvested) will immediately terminate. The stock options granted to the Named Executive Officers during fiscal year 2013 do not include any dividend or dividend equivalent rights.

Proxy...

-

Page 62

... date. Additional information regarding these awards is presented in the footnotes below and in the table below under ''Option Exercises and Stock Vested in Fiscal Year 2013.''

Option Awards(1) Stock Awards(2) Number of Number of Number of Market Value Securities Securities Shares or of Shares or...

-

Page 63

... of the Named Executive Officer's employment. The market value of stock awards reported is computed by multiplying the number of shares or units of stock reported by $70.24, the closing market price of our Common Stock on December 27, 2013, the last trading day in fiscal year 2013. The unvested...

-

Page 64

...price per share of Common Stock is equal to $70.24, the closing price per share on December 27, 2013 (the last trading day in fiscal year 2013). In addition to the change in control and termination benefits described below, outstanding sharebased awards held by the Company's Named Executive Officers...

-

Page 65

... of Control of the Company, the Named Executive Officer will be entitled to severance pay that includes: (i) a lump sum cash payment equal to one and one-half times (two times for Mr. Mehrotra) the sum of (A) the Named Executive Officer's annual base salary as of the Change of Control or termination...

-

Page 66

...multiplied by the closing price of the Common Stock on December 27, 2013 of $70.24 per share.

Severance Benefits-Termination of Employment Not in Connection with Change in Control. In connection with his promotion to Chief Executive Officer in January 2011, Mr. Mehrotra and the Company entered into...

-

Page 67

... shares subject to outstanding options granted to the Directors or executive officers that were exercisable on or within 60 days after March 3, 2014. Some of the shares subject to those options granted to the Directors are currently unvested and would be subject to a repurchase right of the Company...

-

Page 68

...SECURITIES EXCHANGE ACT OF 1934 Section 16(a) of the Exchange Act, requires the Company's Directors, executive officers and persons who own more than 10% of a registered class of the Company's equity securities, to file initial reports of ownership and reports of changes in ownership of Common Stock...

-

Page 69

... to 1,500 shares of Common Stock at the end of each six (6) month offering period (the last U.S. business day on or preceding February 14th and August 14th of each calendar year) at a purchase price per share equal to 85% of the lower of (i) the closing selling price per share of Common Stock on the...

-

Page 70

... 2% of that company's total annual revenue; • compensation to executive officers determined by the Compensation Committee; • compensation to Directors determined by the Board; • transactions in which all security holders receive proportional benefits; and • banking-related services involving...

-

Page 71

... Company with advanced memory technology consulting services through April 13, 2014 and earned $114,000 in consulting fees in 2014. The 2014 Consulting Agreement will be filed as an exhibit to the Company's Form 10-Q for the fiscal quarter ended March 30, 2014. In accordance with the related-person...

-

Page 72

OTHER BUSINESS The Board knows of no other business that will be presented for consideration at the Annual Meeting. If other matters are properly brought before the Annual Meeting; however, it is the intention of the persons named in the accompanying proxy to vote the shares represented thereby on ...

-

Page 73

... per share, provides important supplemental information to management and investors about financial and business trends relating to our operating results. We believe that the use of these non-GAAP financial measures also provides consistency and comparability with our past financial reports. We...

-

Page 74

...; setting and determining variable compensation levels; calculating return on investment for development programs and growth initiatives; comparing performance with internal forecasts and targeted business models; strategic planning; and benchmarking performance externally against our competitors...

-

Page 75

... under the International Plan B. Should any change be made to the Common Stock by reason of any stock split, stock dividend, recapitalization, combination of shares, exchange of shares, spinoff or other change affecting the outstanding Common Stock as a class without the Corporation's receipt of...

-

Page 76

IV.

OFFERING PERIODS A. Shares of Common Stock shall be offered for purchase under the Plan through a series of successive offering periods until such time as (i) the maximum number of shares of Common Stock available for issuance under the Plan shall have been purchased or (ii) the Plan shall have...

-

Page 77

.... Under no circumstances shall purchase rights be granted under the Plan to any Eligible Employee if such individual would, immediately after the grant, own (within the meaning of Code Section 424(d)) or hold outstanding options or other rights to purchase, stock possessing five percent (5%) or...

-

Page 78

... event of certain changes in the Corporation's capitalization. However, the Plan Administrator shall have the discretionary authority, exercisable prior to the start of any offering period under the Plan, to increase or decrease the limitation to be in effect for the number of shares purchasable per...

-

Page 79

...accordingly re-enroll in the Plan (by making a timely filing of the prescribed enrollment forms) on or before the start date of any subsequent offering period in which he or she wishes to participate. I. Change in Control. Each outstanding purchase right shall automatically be exercised, immediately...

-

Page 80

..., when aggregated with (i) rights to purchase Common Stock accrued under any other purchase right granted under this Plan and (ii) similar rights accrued under other employee stock purchase plans (within the meaning of Code Section 423)) of the Corporation or any Corporate Affiliate, would otherwise...

-

Page 81

... increase the number of shares of Common Stock issuable in the aggregate under the Plan and the International Plan, except for permissible adjustments in the event of certain changes in the Corporation's capitalization, (ii) alter the purchase price formula so as to reduce the purchase price payable...

-

Page 82

... incurred by such individual in the sale or other disposition of any shares purchased under the Plan. B. Nothing in the Plan shall confer upon the Participant any right to continue in the employ of the Corporation or any Corporate Affiliate for any period of specific duration or interfere with or...

-

Page 83

Schedule A Corporations Participating in Employee Stock Purchase Plan SanDisk Corporation.

Proxy Statement

B-9

-

Page 84

... of the Corporation's outstanding securities pursuant to a tender or exchange offer made directly to the Corporation's stockholders. D. Code shall mean the Internal Revenue Code of 1986, as amended. E. Common Stock shall mean the Corporation's common stock.

F. Corporate Affiliate shall mean any...

-

Page 85

..., then the Fair Market Value shall be the closing selling price on the last preceding date for which such quotation exists. J. Plan. K. L. International Plan shall mean the Corporation's 2005 International Employee Stock Purchase

Proxy Statement

1933 Act shall mean the Securities Act of 1933, as...

-

Page 86

...and (iii) the number and class of securities and the price per share in effect under each outstanding purchase right in order to prevent the dilution or enlargement of benefits thereunder. IV. OFFERING PERIODS A. Shares of Common Stock shall be offered for purchase under the Plan through a series of...

-

Page 87

... day or following business day of August each year to the fourteenth day or previous business day of February in the following year. The first Purchase Interval in effect under the Plan shall begin on February 15, 2012 and end on August 14, 2012, unless the Plan Administrator designates different...

-

Page 88

.... Under no circumstances shall purchase rights be granted under the Plan to any Eligible Employee if such individual would, immediately after the grant, own (within the meaning of Code Section 424(d)) or hold outstanding options or other rights to purchase, stock possessing five percent (5%) or...

-

Page 89

... event of certain changes in the Corporation's capitalization. However, the Plan Administrator shall have the discretionary authority, exercisable prior to the start of any offering period under the Plan, to increase or decrease the limitation to be in effect for the number of shares purchasable per...

-

Page 90

...Plan (by making a timely filing of the prescribed enrollment forms) on or before the start date of that offering period. H. Termination of Purchase Right. The following provisions shall govern the termination of outstanding purchase rights: Should the Participant cease to remain an Eligible Employee...

-

Page 91

... Article VII.(C) for the offering period in which the Participant is enrolled at the time of such Change in Control. However, the applicable limitation on the number of shares of Common Stock purchasable per Participant shall continue to apply to any such purchase. The Corporation shall use its best...

-

Page 92

...or any Corporate Affiliate (determined on the basis of the Fair Market Value per share on the date or dates such rights are granted) for each calendar year such rights are at any time outstanding. B. For purposes of applying such accrual limitations to the purchase rights granted under the Plan, the...

-

Page 93

... of the shares of Common Stock issuable under the Plan on a Form S-8 registration statement filed with the Securities and Exchange Commission), all applicable listing requirements of any stock exchange (or the Nasdaq National Market, if applicable) on which the Common Stock is listed for trading and...

-

Page 94

... Limited SanDisk India Device Design Centre Private Limited SanDisk Hong Kong Limited, Singapore Representative Office SanDisk IL Ltd. SanDisk Israel (Tefen) Ltd. SanDisk Information Technology (Shanghai) Co., Ltd. SanDisk Semi Shanghai Ltd SanDisk (Branch) Shenzhen SanDisk Storage Malaysia SanDisk...

-

Page 95

... of the Corporation's outstanding securities pursuant to a tender or exchange offer made directly to the Corporation's stockholders. D. Code shall mean the Internal Revenue Code of 1986, as amended. E. Common Stock shall mean the Corporation's common stock.

Proxy Statement

F. Corporate Affiliate...

-

Page 96

... in the Plan are listed in attached Schedule A. N. Plan shall mean the Corporation's International Employee Stock Purchase Plan, as set forth in this document. O. Plan Administrator shall mean the Compensation Committee of the Board. P. Purchase Date shall mean the last business day of each Purchase...

-

Page 97

R. Stock Exchange shall mean either the New York Stock Exchange or the American Stock Exchange. S. U.S. Plan shall mean the Corporation's 2005 Employee Stock Purchase Plan.

Proxy Statement

B-23

-

Page 98

(This page has been left blank intentionally.)

-

Page 99

... SanDisk Drive Milpitas, California

(Address of principal executive offices)

95035

(Zip Code)

(408) 801-1000

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock...

-

Page 100

... Market Risk ...Financial Statements and Supplementary Data ...Changes in and Disagreements with Accountants on Accounting and Financial Disclosure ...Controls and Procedures ...Other Information ...PART III Directors, Executive Officers and Corporate Governance ...Executive Compensation ...Security...

-

Page 101

... design, develop and manufacture data storage solutions in a variety of form factors using flash memory, controller, firmware and software technologies. Our solutions include SSDs, embedded products, removable cards, universal serial bus, or USB, drives, wireless media drives, digital media players...

-

Page 102

... our vertical integration and invest in additional manufacturing capacity in order to produce leading-edge, high-quality, low-cost products that our customers can count on to store and reliably access their data. • Drive profitable growth across diversified markets, customers and channels. We...

-

Page 103

... lines of USB flash drives are marketed to the corporate user and are specifically designed to support secure, authorized access to corporate information. • Digital Media Players and Wireless Drives. Sansa↧ is our branded line of flash-based digital media players and SanDisk Connect↧ is...

-

Page 104

..., notebooks, gaming devices, enterprise storage solutions, servers and other computing devices. We also sell our data storage solutions to customers in our Commercial channel that offer our products under their own brand name in retail channels. We generate license and royalty revenue related to...

-

Page 105

...density NAND flash process, module integration, device design and reliability; • securing data on a flash device; • controller design; • firmware and software development; • system-level integration; • multi-die stacking and packaging technology; and • low-cost system testing. To achieve...

-

Page 106

... Electronics Corporation, Samsung, Sony Corporation, or Sony, and Toshiba. In the three years ended December 29, 2013, we have generated $1.13 billion in revenue from license and royalty agreements. Trade secrets and other confidential information are also important to our business. We protect...

-

Page 107

... strong retail and commercial distribution; • that we have global retail distribution for our products and worldwide leading market share in removable flash cards and USB flash drives; • that we have a well-recognized and trusted brand; and • our strong financial position. Our competitors...

-

Page 108

... Media Players and Drives. In the standalone digital audio/video player market, we face strong competition from Apple. We also face competition from Coby Electronics Corporation, GPX, a brand of Digital Products International, Inc., Koninklijke Philips Electronics N.V., Mach Speed Technologies, LLC...

-

Page 109

... SEC's Public Reference Room may be obtained by calling the SEC at (202) 551-8090. Our website address is www.sandisk.com. Information on our website is not incorporated by reference nor otherwise included in this report. Our principal executive offices are located at 951 SanDisk Drive, Milpitas, CA...

-

Page 110

...our board of directors in July 2010. Mr. Mehrotra previously served as our Chief Operating Officer, Executive Vice President, Vice President of Engineering, Vice President of Product Development, and Director of Memory Design and Product Engineering. Mr. Mehrotra has more than 30 years of experience...

-

Page 111

... held sales and marketing positions at Destinator Ltd. and also co-founded and served as Chief Executive Officer of MindEcho, Inc. Mr. Nir has a B.A. in Law and Accounting and an M.B.A. from Tel Aviv University. Dr. Siva Sivaram has been our Senior Vice President, Memory Technology since June 2013...

-

Page 112

...or changing demand for our products; • failure to manage the risks associated with our ventures and strategic partnerships with Toshiba; • the rate of growth of our captive flash memory supply fails to keep pace with that of our competitors for an extended period of time, resulting in lost sales...

-

Page 113

... supply of the right product mix and quality in the time frame necessary to meet demand, or inability to realize an adequate margin on non-captive purchases; • insufficient assembly and test or retail packaging and shipping capacity from our Shanghai, China facility or our contract manufacturers...

-

Page 114

... needs from non-captive supply sources and may not be able to obtain the right mix of non-captive product that meets our requirements within an adequate lead time or at a cost that allows us to generate an adequate gross margin. Furthermore, if our memory supply is limited, we may make strategic...

-

Page 115

... in these markets. Historically, removable flash memory imaging cards and USB drives, both sold primarily through the retail channel, provided the majority of our revenue. As growth in these retail products slowed, we increased sales of embedded NAND flash memory and cards for devices such as...

-

Page 116

... our OEM customers. Our primary OEM products include cards for mobile devices, embedded memory products, and SSDs for the notebook, storage and server markets. Our OEM revenue is primarily dependent upon our products meeting OEM specifications and the achievement of design wins in an OEM's products...

-

Page 117

...of a relatively limited number of customers, with long design, qualification and test cycles prior to sales. OEM customers in the enterprise SSD market typically also require us to customize our products, which could further lengthen the product design, qualification, manufacturing and sales process...

-

Page 118

...vertical or stacked NAND, phase-change and charge-trap flash technologies and other technologies. Samsung has announced the launch of its 3D NAND flash technology, known as 3D VNAND, with volume production beginning in 2014, and other companies have indicated they are working on 3D NAND technologies...

-

Page 119

...products or specific quantities of our products and if we limit the growth of our production, we may not be able to meet customer volume supply requirements or other competitors with greater market share may become more preferred suppliers based upon either the breadth of product offerings or volume...

-

Page 120

... or quality issues relating to the controllers or firmware in our products, could harm our revenue and gross margin, as well as business relationships with our customers. Any material delay in a development or qualification schedule could delay deliveries and harm our operating results...

-

Page 121

... certain business activities, including funding technology development and capacity expansion. Furthermore, as we diversify the products that we sell, changes in our product mix could result in volatility in our product gross margin, since we have significant variation in our product gross margin...

-

Page 122

... commercial terms such as the right to return unsold inventory and protection against price declines. As a result, we do not recognize revenue until after the product has been sold through to the end user, in the case of sales to retailers, or to our distributors' customers, in the case of sales...

-

Page 123

... branded market share and reduce our sales and profits. We also sell flash memory in the form of private label cards, wafers or components to certain OEMs who sell flash products that may ultimately compete with our branded products in the retail or commercial channels. The sales volumes and pricing...

-

Page 124

... but are not limited to: • difficulty in integrating the technology, products, operations or workforce of the acquired business into our business; • difficulty in entering into new markets in which we have limited or no experience, such as software solutions, and where competitors have stronger...

-

Page 125

...of SMART Storage's products or technologies to perform as expected or to meet customer qualification requirements; • failure of the enterprise SSD space to grow as expected; • delays in the timing and successful integration of SMART Storage, including the transition of the SMART Storage business...

-

Page 126

... our assembly and test requirements, to produce products with leading-edge technologies such as multi-stack die packages and to provide order fulfillment. In addition, our Shanghai, China facility is responsible for packaging and shipping our retail products within the U.S., Asia, Europe, Canada and...

-

Page 127

... would harm our gross margin, operating results, and the cost of future Flash Venture funding, and increase the risk of asset impairment. We also have foreign currency exposures related to certain non-U.S. dollar-denominated revenue and operating expenses in Europe and Asia. Additionally, we have...

-

Page 128

...sub-contractors run their operations and manage their risks, and as a result, we may not be adequately insured. If our security measures or security measures of our suppliers, vendors and partners are breached and unauthorized access to our or their information technology systems is obtained, we may...

-

Page 129

...to protect our rights and potential commercial advantage; or • any of our products or technologies do not infringe on the patents of other companies. In addition, our competitors may be able to design their products around our patents and other proprietary rights. We also have patent cross-license...

-

Page 130

...suppliers or increase the cost of the materials used in our products, we could experience a shortage in supply and an increase in production costs, which would harm our operating results. We and certain of our officers are at times involved in litigation, including litigation regarding our IP rights...

-

Page 131

... significant working capital investments in receivables and inventory, including the need to build inventory levels in advance of our projected high volume selling seasons. The Flash Ventures' master equipment lease obligations contain covenants, which if breached, would harm our business, operating...

-

Page 132

... or results of litigation or changes in earnings estimates by analysts. In addition, in recent years the stock market has experienced significant price and volume fluctuations and the market prices of the securities of high-technology and semiconductor companies have been especially volatile...

-

Page 133

... in, or ship finished product from, our Shanghai, China facility or our Asia-based contract manufacturers. As a result, our business and operating results may be harmed. We rely on information systems to run our business and any prolonged down time could harm our business operations and/or financial...

-

Page 134

... income in the U.S. We may be subject to risks associated with laws, regulations and customer initiatives relating to the environment or other social responsibility issues. Production and marketing of products in certain states and countries may subject us to environmental and other regulations...

-

Page 135

... a limited number of suppliers of ''conflict free'' minerals, we cannot be sure that we will be able to obtain necessary conflict free minerals in sufficient quantities or at competitive prices. Our customers, including OEM and other customers in our commercial channel, may require that our products...

-

Page 136

... PROPERTIES

Our corporate headquarters are located in Milpitas, California. As of December 29, 2013, we owned five buildings in Milpitas comprising approximately 589,000 square feet. These buildings house our corporate offices, including personnel from engineering, sales, marketing, operations and...

-

Page 137

... information about our purchases of equity securities registered pursuant to Section 12 of the Exchange Act based upon settlement date during the three fiscal months ended December 29, 2013 (in millions, except share and per share amounts).

Total Number of Shares Purchased as Part of Publicly...

-

Page 138

... 8, 2014. The total number of shares ultimately delivered, and therefore the average price paid per share, will be determined at the end of the applicable purchase period based on the volume weighted average price of our stock during that period. During the three months ended September 29, 2013, 14...

-

Page 139

...the cumulative total stockholder return on our common stock with that of the S&P 500 Stock Index, a broad market index published by S&P, a selected S&P Semiconductor Company stock index and the Philadelphia, or PHLX, Semiconductor Index for the five-year period ended December 29, 2013. These indices...

-

Page 140

...$18.8 million related to the sale of our investment in certain equity securities. Includes share-based compensation of $77.6 million, which includes $17.3 million due to a non-cash modification of outstanding stock awards pursuant to the retirement of our former Chief Executive Officer, amortization...

-

Page 141

...commercial and retail customers. We design, develop and manufacture data storage solutions in a variety of form factors using flash memory, controller, firmware and software technologies. Our solutions include SSDs, embedded products, removable cards, USB drives, wireless media drives, digital media...

-

Page 142

... vertically integrated business model helps us to reduce the costs of producing our products, increases our ability to control the quality of our products and speeds delivery to our customers. Our vertically integrated manufacturing operations are concentrated in two locations, with Flash Ventures...

-

Page 143

... fiscal year 2012. In fiscal year 2014, we expect our business to experience a modest decline in our blended average selling price per gigabyte compared to no change in fiscal year 2013. Our revenue for fiscal year 2014 will be influenced primarily by our captive bit-supply growth, industry pricing...

-

Page 144

... corporate purposes, including (1) the repurchase, from time-to-time, of shares of our common stock pursuant to our existing stock repurchase program; (2) to fund potential strategic investments or acquisitions of products, technologies or complementary businesses or to obtain the right to license...

-

Page 145

... allowing price protection and/or right of return and, therefore, the sales and related costs of these transactions are deferred until the distributors or retailers sell the merchandise to their end customer, or the rights of return expire. At December 29, 2013 and December 30, 2012, deferred...

-

Page 146

... and assumptions related to revenue growth rates and operating margins, risk-adjusted discount rates based on our weighted average cost of capital, future economic and market conditions and determination of appropriate market comparables. Our estimates of market growth and our market share and costs...

-

Page 147

... Item 8 of this report). Each level of input has different levels of subjectivity and difficulty involved in determining fair value. Level 1 securities represent quoted prices in active markets, and therefore do not require significant management judgment. Our Level 2 securities are primarily valued...

-

Page 148

... in fiscal year 2013, compared to fiscal year 2012, due primarily to increased sales of client and enterprise SSD products, retail cards for mobile devices and USB drives. Revenue in Asia-Pacific increased in fiscal year 2013, compared to fiscal year 2012, due primarily to increased sales of client...

-

Page 149

... to decreased OEM sales of cards and embedded products for mobile devices and lower retail sales of cards for the imaging market, partially offset by increased sales of retail mobile cards, USB drives and client SSD products. Gross Profit and Margin.

FY 2013 Percent Change FY 2012 Percent Change FY...

-

Page 150

... higher third-party engineering costs of $14 million and technology license and equipment expense of $13 million. Sales and Marketing.

FY 2013 Percent Change FY 2012 Percent Change FY 2011

(In millions, except percentages)

Sales and marketing ...Percent of revenue ...

$ 276.3 4.5%

23%

$ 224...

-

Page 151

... in fiscal year 2013. Amortization of acquisition-related intangible assets in fiscal year 2012, compared to fiscal year 2011, was higher due to increased amortization of intangible assets from the acquisitions of FlashSoft Corporation, or FlashSoft, and Schooner Information Technology, Inc., or...

-

Page 152

non-recurring charge incurred by Flash Ventures of $9 million and losses on non-designated foreign exchange contracts included in ''Other income (expense)'' in fiscal year 2012 that did not recur in fiscal year 2013. Our fiscal year 2012 ''Total other income (expense), net'' was a higher net expense...

-

Page 153

...with GAAP.

Annual Report

We believe that the presentation of non-GAAP measures, including non-GAAP net income and non-GAAP diluted net income per share, provides important supplemental information to management and investors about financial and business trends relating to our operating results. We...

-

Page 154

... performance; • establishing internal budgets; • setting and determining variable compensation levels; • calculating return on investment for development programs and growth initiatives; • comparing performance with internal forecasts and targeted business models; • strategic planning; and...

-

Page 155

... Liquidity and Capital Resources Cash Flows. Our cash flows were as follows:

FY 2013 FY 2012

(In millions)

FY 2011

Net cash Net cash Net cash Effect of

provided by operating activities ...used in investing activities ...used in financing activities ...changes in foreign currency exchange rates on...

-

Page 156

... in other companies or purchase or license technologies. These activities may require us to raise additional financing, which could be difficult to obtain, and which if not obtained in satisfactory amounts, could prevent us from funding Flash Ventures, increasing our wafer supply, developing or...

-

Page 157

...at the end of the purchase period based on the volume weighted average price of our common stock during the period. The financial institution initially delivered 14.5 million shares in the third quarter of fiscal year 2013. This does not represent the final number of shares to be delivered under the...

-

Page 158

....3 million shares of our common stock at an exercise price of $122.9220 per share. The 0.5% Notes due 2020 contains provisions whereby the number of shares to be acquired under the warrants and the strike price are adjusted if we pay a cash dividend greater than a regular quarterly cash dividend of...

-

Page 159

..., 2013, we had not purchased any shares under this convertible bond hedge agreement. Ventures with Toshiba. We are a 49.9% owner in each of the Flash Ventures, our business ventures with Toshiba to develop and manufacture NAND flash memory products. These NAND flash memory products are manufactured...

-

Page 160

...Japanese yen purchase rate. Based on wafer purchases made in the fourth quarter of fiscal year 2013 and forward contracts entered into for early 2014, changes in the Japanese yen to U.S. dollar exchange rate after December 2013 are not expected to have a material impact on our cost of revenue in the...

-

Page 161

... changes in interest rates and foreign currency exchange rates. Interest Rate Risk. Our exposure to market risk for changes in interest rates relates primarily to our investment portfolio. The primary objective of our investment activities is to preserve principal while maximizing yields without...

-

Page 162

... amount and unrealized loss of our outstanding foreign exchange forward contracts that are designated as cash flow hedges as of December 29, 2013 based upon the exchange rate as of December 29, 2013 are shown in the table below. In addition, this table shows the change in fair value of these cash...

-

Page 163

... and communicated to our management, including our Chief Executive Officer and Chief Financial Officer, to allow timely decisions regarding required disclosure. There were no changes in our internal control over financial reporting (as defined in Exchange Act Rule 13a-15(f)) during the quarter ended...

-

Page 164

... AND CORPORATE GOVERNANCE

The information required by this item is set forth under ''Business-Executive Officers'' in this report and under ''Election of Directors'' and ''Compliance with Section 16(a) of the Securities Exchange Act of 1934'' in our Proxy Statement for our 2014 Annual Meeting of...

-

Page 165

... STATEMENT SCHEDULES

(a) Documents filed as part of this report 1) All financial statements

Index to Financial Statements Page

Reports of Independent Registered Public Accounting Firm Consolidated Balance Sheets ...Consolidated Statements of Operations ...Consolidated Statements of Comprehensive...

-

Page 166

(This page has been left blank intentionally.)

-

Page 167

SANDISK CORPORATION INDEX TO FINANCIAL STATEMENTS

Page

Reports of Independent Registered Public Accounting Firm Consolidated Balance Sheets ...Consolidated Statements of Operations......

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

...

F-2 F-4 F-5 F-6 F-7 F-8 F-9

Annual Report

F-1

-

Page 168

..., in accordance with the standards of the Public Company Accounting Oversight Board (United States), SanDisk Corporation's internal control over financial reporting as of December 29, 2013, based on criteria established in Internal Control - Integrated Framework issued by the Committee of Sponsoring...

-

Page 169

... OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM The Board of Directors and Stockholders of SanDisk Corporation We have audited SanDisk Corporation's internal control over financial reporting as of December 29, 2013, based on criteria established in Internal Control - Integrated Framework issued...

-

Page 170

...in Flash ...

...Ventures ...

Total assets ...LIABILITIES Current liabilities: Accounts payable trade ...Accounts payable to related parties ...Convertible short-term debt ...Other current accrued liabilities ...Deferred income on shipments to distributors and retailers and deferred revenue ...

$10...

-

Page 171

... 29, December 30, 2013 2012

January 1, 2012

(In thousands, except per share amounts)

Revenue ...Cost of revenue ...Amortization of acquisition-related intangible assets ...Total cost of revenue ...Gross profit ...Operating expenses: Research and development ...Sales and marketing ...General and...

-

Page 172

SANDISK CORPORATION CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

December 29, 2013

Fiscal years ended December 30, 2012

(In thousands)

January 1, 2012

Net income ...Other comprehensive income (loss), before tax: Unrealized holding gain (loss) on marketable securities...(benefit) related to items...

-

Page 173

...-based plans ...Dividends and dividend equivalent rights declared ...Stock repurchases ...Equity value of debt issuance ...Purchased convertible bond hedge, net Sold warrants ...

Balance at December 30, 2012 ...241,432

- (102,896) (582,575) (1,006,940) 349,250 - (338,989) - 217,800 -

Annual Report...

-

Page 174

... accounts ...Share-based compensation expense ...Excess tax benefit from share-based plans ...Impairment and other ...Other non-operating ...Changes in operating assets and liabilities: Accounts receivable, net ...Inventory ...Other assets ...Accounts payable trade ...Accounts payable to related...

-

Page 175

... allowing price protection and/or a right of return and, therefore, the revenue and related costs of these transactions are deferred until the retailers or distributors sell-through the merchandise to their end customer or their rights of return expire. Estimated sales returns are F-9

Annual Report

-

Page 176

...over the life of the license. The Company records estimated reductions of revenue for customer and distributor incentive programs and offerings, including price protection, promotions, co-op advertising and other volume-based incentives and expected returns. All sales incentive programs are recorded...

-

Page 177

... using average exchange rates for the applicable period and reported in net income as a non-operating item in each period. Non-monetary balance sheet items denominated in a currency other than the applicable functional currency are translated using the historical rate. The Company continuously...

-

Page 178

...assumptions about changes in average selling prices. If actual market conditions are less favorable than those projected by management, additional reductions in inventory valuation may be required. The Company's finished goods inventory includes consigned inventory held at customer locations as well...

-

Page 179

... million in fiscal years 2013, 2012 and 2011, respectively. Research and Development Expenses. Research and development (''R&D'') expenditures are expensed as incurred. Note 2: Investments and Fair Value Measurements The Company's total cash, cash equivalents and marketable securities was as follows...

-

Page 180

... agency securities, international government securities, corporate notes and bonds, municipal notes and bonds, asset-backed securities and mortgage-backed securities. The Company's Level 2 securities are primarily valued using quoted market prices for similar instruments and nonbinding market prices...

-

Page 181

.... Available-for-sale securities that were in an unrealized gain position have been excluded from the table.

Fair Value Gross Unrealized Loss

Annual Report

U.S. Treasury securities ...U.S. government-sponsored agency securities . International government securities ...Corporate notes and bonds...

-

Page 182

...loss related to U.S. Treasury securities, U.S. government-sponsored agency securities, international government securities, corporate and municipal notes and bonds, and mortgagebacked securities was primarily due to changes in interest rates. The gross unrealized loss on all available-for-sale fixed...

-

Page 183

... effective portion of the Company's outstanding foreign exchange forward contracts to purchase Japanese yen that are designated as cash flow hedges are shown in both Japanese yen (in billions) and U.S. dollar (in thousands), based upon the exchange rate as of December 29, 2013, as follows:

Notional...

-

Page 184

...1, 2013 2012 2012 2013 2012 2012

Foreign exchange forward contracts ...Equity market risk contract ...

$

(74,834) $ -

(38,197) $ -

33,224 (3,024)

$

(41,523) $ -

(10,946) $ -

27,985 (9,885)

Foreign exchange forward contracts designated as cash flow hedges relate to forecasted wafer purchases...

-

Page 185

...,479

Note 4: Balance Sheet Information Accounts Receivable, net. Accounts receivable, net was as follows (in thousands):

December 29, 2013 December 30, 2012

Accounts receivable ...Allowance for doubtful accounts ...Price protection, promotions and other activities ...Total accounts receivable, net...

-

Page 186

... Guarantees - Flash Ventures'' and Note 13, ''Related Parties and Strategic Investments.'' The Company assesses financing receivable credit quality through financial and operational reviews of the borrower and creditworthiness, including credit rating agency ratings, of significant investors of the...

-

Page 187

... interest and common structure in each Flash Venture entity. For all reporting periods presented, no loans were past due and no loan impairments were recorded. Other Non-current Assets. Other non-current assets were as follows (in thousands):

December 29, 2013 December 30, 2012

Prepaid tax on...

-

Page 188

... future cost related to warranty expense is recorded at the time of customer invoice. The Company's warranty liability is affected by customer and consumer returns, product failures, number of units sold and repair or replacement costs incurred. Should actual product failure rates, or repair...

-

Page 189

... a legal contingency matter during the measurement period for an acquisition from fiscal year 2012.

Annual Report

Goodwill is not amortized, but is reviewed and tested for impairment at least annually, on the first day of the Company's fourth quarter and whenever events or circumstances occur that...

-

Page 190

... 6,300 247,904

Acquisition-related intangible assets ...Technology licenses and patents ...Total intangible assets subject to amortization ...Acquired in-process research and development ...Total intangible assets ...$

562,744

December 30, 2012 Gross Carrying Amount Accumulated Amortization Net...

-

Page 191

... of development, the acquired IPR&D is considered an amortizable finite-lived intangible asset. Amortization expense of technology licenses and patents is recorded to cost of revenue or R&D based upon the use of the technology. In fiscal year 2012, the Company discontinued a project related to...

-

Page 192

... of the 1% Notes due 2013 was 7.4% for the three fiscal years ended December 29, 2013. Bond Repurchase. In the twelve months ended January 1, 2012, the Company repurchased $221.9 million principal amount of its 1% Notes due 2013 in private transactions with a limited number of bondholders for cash...

-

Page 193

..., as of December 29, 2013, the conversion rate was adjusted for dividends paid to date to 19.2307 shares of common stock per $1,000 principal amount of notes (which represents a conversion price of approximately $52.00 per share). The net proceeds to the Company from the sale of the 1.5% Notes due...

-

Page 194

... five business-day period after any five consecutive trading-day period (the ''measurement period'') in which the trading price per note for each day of such measurement period was less than 98% of the product of the last reported sale price of the Company's common stock and the conversion rate on...

-

Page 195

... purchase up to approximately 19.1 million shares of the Company's common stock at an exercise price of $73.3250 per share. The 1.5% Notes due 2017 contains provisions whereby the number of shares to be acquired under the warrants and the strike price are adjusted if the Company pays a cash dividend...

-

Page 196

... five business-day period after any five consecutive trading-day period (the ''measurement period'') in which the trading price per note for each day of such measurement period was less than 98% of the product of the last reported sale price of the Company's common stock and the conversion rate on...

-

Page 197

...purchase up to approximately 16.3 million shares of the Company's common stock at an exercise price of $122.9220 per share. The 0.5% Notes due 2020 contains provisions whereby the number of shares to be acquired under the warrants and the strike price are adjusted if the Company pays a cash dividend...

-

Page 198

...and Major Customers. The Company markets and sells flash memory products in the U.S. and in foreign countries through its sales personnel, dealers, distributors, retailers and subsidiaries. The Company's Chief Operating Decision Maker, its President and Chief Executive Officer, evaluates performance...

-

Page 199

... the Company's revenue, respectively. In fiscal year 2011, Samsung Electronics Co., Ltd. accounted for 10% of the Company's revenue. Apple primarily purchases mobile embedded products and solid state drive (''SSD'') products from the Company. All of the Company's flash memory system products require...

-

Page 200

... equivalents, short and long-term marketable securities and trade receivables. The Company's investment policy restricts investments to high-credit quality investments and limits the amounts invested with any one issuer. The Company sells to Commercial and Retail customers in the Americas; Europe...

-

Page 201

... for shares of the Company's common stock at any time prior to the expiration of the seven-year option term or any earlier termination of those options in connection with the optionee's cessation of service with the Company. Outstanding RSU awards under the 2013 Plan have dividend equivalent rights...

-

Page 202

... yield is based on the annualized dividend and the share price at each dividend record date. The risk-free interest rate is based on the yield from U.S. Treasury zero-coupon bonds with an equivalent term. Valuation Assumptions Option Plan Shares. The fair value of the Company's stock options granted...

-

Page 203

...A summary of stock option and stock appreciation rights (''SARs'') activity under all of the Company's share-based compensation plans as of December 29, 2013 and changes during the three fiscal years ended December 29, 2013 is presented below (in thousands, except for weighted average exercise price...

-

Page 204

... of the Company's common stock on the date of grant, and compensation is recognized on a straight-line basis over the requisite vesting period. A summary of the changes in RSUs outstanding under the Company's share-based compensation plans during the three fiscal years ended December 29, 2013 is...

-

Page 205

...following tables set forth the detailed allocation of the sharebased compensation expense (in thousands):

December 29, 2013 Fiscal years ended December 30, 2012 January 1, 2012

Share-based compensation expense by caption: Cost of revenue ...Research and development ...Sales and marketing ...General...

-

Page 206

...(in thousands):

December 29, 2013 Fiscal years ended December 30, 2012 January 1, 2012

United States ...International ...Total ...

$ 1,436,470 79,679 $ 1,516,149

$ $

518,509 108,407 626,916

$ 1,242,529 234,225 $ 1,476,754

The Company's provision for income taxes differs from the amount computed...

-

Page 207

... Company also has California research credit carryforwards of $54.9 million. California research credits can be carried forward to future years indefinitely. Some of these carryforwards are subject to annual limitations, including under Section 382 and Section 383 of the U.S. Internal Revenue Code...

-

Page 208

.... In February 2012, the Internal Revenue Service (''IRS'') completed its field audit of the Company's federal income tax returns for the years 2005 through 2008 and issued the Revenue Agent's Report. The most significant proposed adjustments are comprised of related party transactions between...

-

Page 209

... anti-dilutive. Note 12: Commitments, Contingencies and Guarantees Flash Ventures Flash Ventures, the Company's business ventures with Toshiba, consists of three separate legal entities: Flash Partners Ltd., Flash Alliance Ltd. and Flash Forward Ltd. The Company has a 49.9%

Annual Report

F-43

-

Page 210

...recorded in AOCI. In the fiscal years ended December 29, 2013, December 30, 2012 and January 1, 2012, the Company recorded a basis adjustment of $1.2 million, $3.0 million and $5.3 million, respectively, to its equity in earnings from Flash Partners related to the difference between the basis in the...

-

Page 211

... year 2010. NAND flash memory products provided to the Company by this venture are manufactured by Toshiba at its 300-millimeter wafer fabrication facility (''Fab 5'') located in Yokkaichi, Japan. Fab 5 is to be built in two phases. As of December 29, 2013, over half of the Phase 1 building has...

-

Page 212

... rate at December 29, 2013. As of December 29, 2013, the total amount outstanding from these master leases was 103.2 billion Japanese yen, or approximately $983 million based upon the exchange rate at December 29, 2013, of which the amount of the Company's guarantee obligation of the Flash Ventures...

-

Page 213

... of settlement associated with such claims. This agreement provides limited protection for the Company against third-party claims that NAND flash memory products manufactured and sold by Flash Ventures infringe third-party patents. The Company has not made any indemnification

Annual Report

F-47

-

Page 214

...due 2020. The Company will pay cash interest on the outstanding notes at an annual rate of 0.5%, payable semi-annually on April 15 and October 15 of each year until October 15, 2020. Includes Flash Ventures, related party vendors and other silicon source vendor purchase commitments. Includes amounts...

-

Page 215

...December 29, 2013 Fiscal years ended December 30, 2012 January 1, 2012

Rent expense, net ...

$

6,473

$

6,366

$

7,926

Note 13: Related Parties and Strategic Investments

Annual Report

Flash Ventures with Toshiba. The Company owns 49.9% of each entity within Flash Ventures and accounts for its...

-

Page 216

.... At December 29, 2013 and December 30, 2012, the Company had accounts payable balances due to Flash Ventures of $146.0 million and $214.5 million, respectively. The Company's maximum reasonably estimable loss exposure (excluding lost profits), based upon the exchange rate at each respective balance...

-

Page 217

... plan to terminate the rights issued under that rights plan, and the Company adopted a new rights plan. Under the new rights plan, rights were distributed as a dividend at the rate of one right for each share of common stock of the Company held by stockholders of record as of the close of business...

-

Page 218

...15: Business Acquisition SMART Storage Systems. On August 22, 2013, the Company completed its acquisition of SMART Storage, a developer of enterprise SSDs. The Company expects this acquisition to enhance its enterprise storage product portfolio. The Company acquired 100% of the outstanding shares of...

-

Page 219

..., 2013 were related to legal, regulatory and accounting fees, and were expensed to General and administrative expense in the Consolidated Statement of Operations. SMART Storage's prior period financial results are not considered material to the Company. Note 16: Litigation

Annual Report

From time...

-

Page 220

... by SanDisk to the counterclaims in this action. These motions are currently pending. Fact discovery has closed in the case. Expert discovery is underway and initial expert reports have been exchanged. Trial is currently scheduled to begin on August 11, 2014. On May 3, 2012, Round Rock filed an...

-

Page 221

... Note 17: Supplementary Financial Data (Unaudited)

March 31, 2013 Fiscal quarters ended June 30, September 29, 2013 2013

(In thousands, except per share data)

December 29, 2013

2013 Revenue ...Gross profit ...Operating income ...Net income ...Net income per share Basic ...Diluted ...

Annual Report...

-

Page 222

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Fiscal quarters ended July 1, September 30, 2012 2012

(In thousands, except per share data)

April 1, 2012

December 30, 2012

2012 Revenue ...Gross profit ...Operating income ...Net income ...Net income per share Basic ...Diluted ...

...

...

...

...

...

...

-

Page 223

... of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized. SANDISK CORPORATION (Registrant) Dated: February 21, 2014 By: /s/ JUDY BRUNER Judy Bruner Executive Vice President, Administration and Chief...

-

Page 224

...Bruner

President and Chief Executive Officer and Director (Principal Executive Officer) Executive Vice President, Administration and Chief Financial Officer (Principal Financial Officer) Vice President, Chief Accounting Officer (Principal Accounting Officer) Chairman of the Board

February 21, 2014...

-

Page 225

...Designations for the Series A Junior Participating Preferred Stock, as filed with the Delaware Secretary of State on September 24, 2003. Amended and Restated Bylaws of the Registrant dated September 11, 2013. Rights..., 2010, by and between the Registrant and The Bank of New York Mellon Trust Company, ...

-

Page 226

... 2005 Employee Stock Purchase Plan and Amended and Restated 2005 International Employee Stock Purchase Plan.†2005 Incentive Plan - Form of Notice of Grant of Stock Option.†2005 Incentive Plan - Form of Notice of Grant of Non-Employee Director Automatic Stock Option (Initial Grant).†2005...

-

Page 227

... (Director Grants).†Flash Partners Master Agreement, dated as of September 10, 2004, by and among the Registrant and the other parties thereto.DŽ Operating Agreement of Flash Partners Ltd., dated as of September 10, 2004, by and between SanDisk International Limited and Toshiba Corporation...

-

Page 228

... 2010, by and among Toshiba Corporation, the Registrant and SanDisk Flash B.V.Ç„ Operating Agreement of Flash Forward, Ltd. by and between Toshiba Corporation and SanDisk Flash B.V.Ç„ Form of Indemnification Agreement entered into between the Registrant and its directors and officers. Form of Change...

-

Page 229