SanDisk 2004 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2004 SanDisk annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

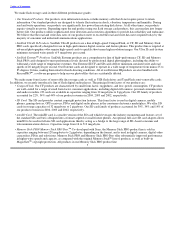

ITEM 6. SELECTED FINANCIAL DATA

SANDISK CORPORATION SELECTED FINANCIAL DATA

Years Ended

January 2, December 28, December 29, December 30, December 31,

2005(1) 2003(2) 2002(3) 2001(4) 2000(5)

(In thousands, except per share data)

Revenues

Product $1,602,836 $ 982,341 $492,900 $ 316,867 $526,359

License and royalty 174,219 97,460 48,373 49,434 75,453

Total revenues 1,777,055 1,079,801 541,273 366,301 601,812

Cost of revenues 1,091,350 641,189 352,452 392,293 357,017

Gross profit (loss) 685,705 438,612 188,821 (25,992) 244,795

Operating income (loss) 418,591 257,038 58,151 (152,990) 124,666

Net income (loss) $ 266,616 $ 168,859 $ 36,240 $(297,944) $298,672

Net income (loss) per share(6)

Basic $ 1.63 $ 1.17 $ 0.26 $ (2.19) $ 2.24

Diluted $ 1.44 $ 1.02 $ 0.25 $ (2.19) $ 2.06

Shares used in per share

calculations (6)

Basic 164,065 144,781 137,610 136,296 133,722

Diluted 188,837 171,616 142,460 136,296 145,302

At

January 2, December 28, December 29, December 30, December 31,

2005 2003 2002 2001 2000

Working capital $1,526,675 $1,378,070 $584,450 $419,289 $ 525,950

Total assets 2,320,180 2,040,156 980,725 934,261 1,107,907

Long−term convertible

subordinated

notes — 150,000 150,000 125,000 —

Total stockholders’ equity 1,940,150 1,515,872 634,867 675,379 863,058

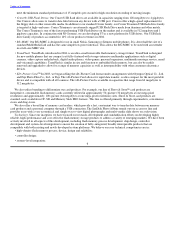

(1) Includes other−than−temporary impairment charges of ($11.8) million, or ($7.4) million net of tax related to our investment in

Tower, an adjustment to the fair value of our Tower warrant of ($0.2) million, or ($0.1) million net of tax and a gain from a

settlement of $6.2 million, or $3.9 million net of tax, from a third−party brokerage firm related to the 2003 unauthorized

disposition of our investment in UMC.

(2) Includes a loss of approximately ($18.3) million, or ($12.8) million net of tax, as a result of the unauthorized sale of

approximately 127.8 million shares of UMC stock, a gain of approximately $7.0 million, or $4.9 million net of tax, related to the

sale of 35 million shares of our UMC investment, write−downs related to the recoverability of our Tower wafer credits of

($3.9) million, or ($2.7) million net of tax, and an adjustment to the fair value of our Tower warrant of ($0.6) million, or

($0.5) million net of tax.

(3) Includes other−than−temporary impairment charges of ($14.4) million on our Tower shares, or ($8.7) million net of tax,

write−downs related to the recoverability of our Tower wafer credits of ($2.8) million, or ($1.8) million net of tax, and an

adjustment to the fair value of our Tower warrant of ($0.7) million, or ($0.5) million net of tax.

(4) Includes other−than−temporary impairment charges of ($302.3) million on our UMC shares and Tower shares, or

($188.1) million net of tax, and restructuring charges of ($8.5) million or ($6.7) million net of tax.

(5) Includes gain on investment of UMC of $344.2 million, or $203.9 million net of tax.

(6) Net income (loss) per share and the share numbers each gives retroactive effect to a 2−for−1 stock split, in the form of a 100%

stock dividend, effected on February 18, 2004. 15