SanDisk 2004 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2004 SanDisk annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

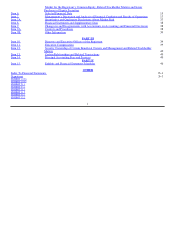

Table of Contents

in its allocation. Flash Partners will sell wafers to us and Toshiba at a price equal to manufacturing cost.

Flash Partners is expected to generate cash over time as a result of being paid as part of its manufacturing cost for its non−cash

depreciation expense. This cash is currently expected to be used to fund expansion of Flash Partners’ flash memory

manufacturing capacity and ultimately to repay loans from us and Toshiba.

• Research and Development. We and Toshiba each have teams that are currently working in parallel on the 70−nanometer and

55−nanometer designs. Our research and development cost sharing is similar to that of FlashVision. See Note 5 to our

consolidated financial statements included as Item 8 and the common R&D participation agreement which is an exhibit to this

report. That agreement should be read carefully in its entirety in order to more fully understand the details of our obligations.

We refer to our wafer purchases from the Toshiba ventures and foundry arrangement with Toshiba as captive capacity as

compared with our market−priced purchases of flash memory from Samsung and Renesas, which we refer to as non−captive capacity.

Competition

Our industry is very competitive. See “Item 7−Factors That May Affect Future Results−We face competition from numerous

manufacturers and marketers of products using flash memory, as well as from manufacturers of new and alternative technologies, and

if we cannot compete effectively, our results of operations and financial condition will suffer.”

Our Key Competitive Advantages. We believe our key competitive advantages in NAND flash products include:

• Our intellectual property ownership, in particular our patent claims and manufacturing know−how over MLC, provides a cost

advantage to ourselves and Toshiba;

• Through the ventures with Toshiba, we benefit from Toshiba’s manufacturing and research and development experience and

expertise;

• We manufacture and sell a broader range of card formats than any of our competitors which gives us an advantage in obtaining

retail and OEM distribution; and

• Our captive NAND flash wafer supply enables us to control our supply chain and provides cost advantages over our competitors

who only have contractual relationships with their suppliers.

Semiconductor Competitors. Our primary semiconductor competitors currently include our historical competitors Renesas,

Samsung and Toshiba. New competitors include Hynix Semiconductor, Inc., or Hynix, Infineon Technologies, A.G., or Infineon,

Micron Technology, Inc., or Micron, and ST Microelectronics N.V., or ST Micro, who began shipping NAND or NAND−competitive

memory in 2004. If any of these competitors increase their memory output, it will likely result in a decline in the prevailing prices for

packaged NAND semiconductor components. Additionally, manufacturers of NOR flash memory, such as Intel and Spansion LLC, or

Spansion, are attempting to use their flash memory for traditional NAND applications, both embedded and in data storage cards.

Card and USB Flash Drive Competitors. We compete with manufacturers and resellers of flash memory cards and USB flash

drives. These companies purchase (or have captive supply of) flash memory components and assemble memory cards. These

companies include, among others, Buffalo, Dane−Elec Manufacturing, Delkin Devices, Inc., Fuji, Hagiwara Sys−Com Co., Ltd.,

Hama, I/ O Data Device, Inc., Infineon, Kingston Technology Company, Inc., Kodak, Lexar, M−Systems, Matsushita, Micron,

Memorex Products, Inc., PNY Technologies, Inc., PQI Corporation, Pretec Electronics Corporation (USA), Renesas, Samsung, Sharp,

Simple Technology, Inc., Sony, Toshiba and Viking Components, Inc.

10