SanDisk 2002 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2002 SanDisk annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12 Sa nD isk C o rp ora tio n

Re struc turing Charg es. In the third quarter of 2001, w e

adopted a plan to transfer all of our card assem bly and

test manufacturing operations from our Sunnyvale location

to offshore subcontractors. As a result w e recorded a

restructuring charge of $8.5 m illion in the third quarter of

2001. The charge included $1.4 million of severance and

em ployee related costs for a reduction in w orkforce of

approxim ately 193 personnel, equipm ent w rite-off charges

of $6.0 m illion and lease comm itm ents of $1.1 m illion on a

vacated w arehouse facility. As a part of our plan to transfer

all card assem bly and test m anufacturing operations to off-

shore subcontractors, w e abandoned excess equipm ent

and recorded a charge of $6.4 m illion in the third quarter

of fiscal 2001.

As of January 2003, w e have subleased a portion of our

w arehouse building in San Jose, California. Given the current

real estate m arket conditions in the San Jose area, w e do

not expect to be able to sublease the rem ainder of this

building before the end of 2003. Any sublease incom e w ill

be offset against the balance of the lease com m itm ent

restructuring charge recorded in the third quarter of 2001.

Of the $8.5 m illion restructuring charge, cash paym ents

of $0.8 m illion and $1.1 m illion w ere paid in 2001 and 2002

respectively. After w riting off certain non-cash charges

related to abandoned excess equipm ent, accruals of $0.6

m illion remain as of Decem ber 31, 2002, related to am ounts

to be paid out for excess facility lease charges, net of facility

sub-lease income, over the respective lease term s.

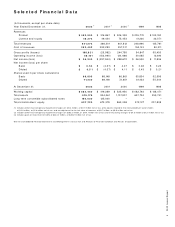

The follow ing table sum marizes our restructuring activities

from the inception of our plan through the end of 2002:

Wo rkforc e Co m m it-

(In thousands) Equipm ent Reduction m ents Total

Restructuring charge $ 6,383 $ 1,094 $ 1,033 $ 8,510

Non-cash charges (6,027) – – (6,027)

Cash paym ents – (805) – (805)

Accrual balance,

Decem ber 31, 2001 $ 356 $ 289 $ 1,033 $ 1,678

Non-cash charges (17) – – (17)

Ad justm ents (339) 321 18 –

Cash paym ents – (610) (471) (1,081)

Accrual balance,

Decem ber 31, 2002 $ – $ – $ 580 $ 580

Eq uity in Inc om e o f Joint Ve nture. In 2002 and 2001,

equity in incom e of joint ventures of $0.9 m illion and $2.1

m illion included our share of net incom e from our

FlashVision joint venture and losses from our Digital Portal

Inc., or DPI, joint venture. Under the equity m ethod of

accounting, our share of losses w ere deducted from our DPI

investm ent account and therefore, as of Decem ber 31, 2002

there is no value related to DPI on our consolidated balance

sheet. In Septem ber 2002, w e agreed to sell a significant

portion of our DPI shares to a nom inee of Photo-M e

International, PLC., or PM I, to reduce our ow nership per-

centage below 20%, and w e gave up our seat on DPI’s

board of directors. Under the agreem ent, w e discontinued

our kiosk related activities, are no longer required to m ake

additional equity investm ents in DPI, guarantee DPI’s equip-

m ent leases or otherw ise pay any of DPI’s expenses and

DPI w ill no longer use the SanDisk brand name. In future

periods, w e w ill account for our rem aining investment in DPI

on a cost basis.

Inte res t Inco m e /Exp e nse . Interest incom e w as $8.7

m illion in 2002 com pared to $12.4 m illion in 2001 and $22.8

m illion in 2000. The decrease in interest incom e in 2002

compared to 2001 w as prim arily due to reductions in m ar-

ket interest rates. The decrease in interest incom e in 2001

compared to 2000 w as also due to reductions in interest

rates and as w ell as the funding of our strategic invest-

m ents in Tow er and FlashVision. Interest expense w as $6.7

m illion in 2002 on our convertible subordinated notes, or

notes, issued in late 2001 and early 2002. In 2003, w e

expect interest expense to be consistent and interest

incom e to rem ain flat w ith an increase in cash balances

offset by the additional im pact of low er interest rates on

our portfolio as existing securities m ature and low er-yield-

ing securities are purchased.

Lo s s o n Inve s tm e nt in Fo undrie s. The m arket value of

our investm ent in Tow er and related wafer credits has

declined significantly over 2002 and 2001 due to the con-

tinuing semiconductor industry dow nturn. As of Decem ber

31, 2002, w e had invested $68.0 m illion in Tow er and

obtained 6,100,959 ordinary Tower shares, $6.0 m illion of

prepaid w afer credits, and a w arrant to purchase 360,313

ordinary Tow er shares at an exercise price of $7.50 per

share. This w arrant expires on October 31, 2006. At

Decem ber 31, 2002, the value of our Tow er investm ent and

w afer credits had declined to $27.3 m illion. Losses totaling

$15.2 m illion, or $9.4 m illion net of tax, w ere recorded in

2002, com prised of a $11.6 m illion related to the other-

than-tem porary decline of our equity investm ent, a $0.7

m illion adjustm ent to the fair value of w arrants purchased

during 2002 as determ ined using a Black-Scholes option

pricing m odel, and a $2.8 m illion w rite down in the value of

w afer credits. At Decem ber 31, 2001, the value of our

Tow er investment and w afer credits had declined to $16.6

m illion. Therefore, w e recorded a loss of $20.6 m illion,

w hich included the w rite-off of w afer credits received in

2001. In addition, w e recorded a loss of $5.5 m illion on our

exchange of 75% of our Tower w afer credits for 1,284,007

ordinary Tow er shares at $12.75 per share. These losses

totaled $26.1 m illion, or $15.8 m illion net of tax benefit in

2001. In both 2002 and 2001, Tow er losses w ere recorded

in loss on investm ent in foundry . If the fair value of our

Tow er investment declines further, it may be necessary to

record additional losses. We periodically assess the value

of the prepaid w afer credits for recoverability and w rite

down the value as necessary.

In 2001, w e determ ined that our investm ent in UM C had

sustained a substantial decline in its value as defined by

generally accepted accounting principles The value of our

investm ent in UM C had declined to $194.9 m illion at

Decem ber 31, 2001. We recorded a loss of $275.8 m illion

on our UM C investm ent in 2001, or $166.9 million net of

taxes. At Decem ber 31, 2002, the m arket value of the avail-

able- for-sale portion of our UM C investm ent had declined

$6.6 m illion, before tax, below its adjusted cost of $112.0

m illion, and this unrealized loss of approximately $6.6 m illion

is included in accum ulated other com prehensive incom e

(loss) on our consolidated balance sheet as this unrealized

loss w as deem ed to be tem porary. If the fair value of our

UM C investm ent declines further, it m ay be necessary to

record additional losses. In addition, in future periods, if our

UM C shares are sold, there m ay be a gain or loss, due to

fluctuations in the m arket value of UM C’s stock.