Sallie Mae 2014 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.monitored by our management-level Enterprise Risk Committee with escalation to the Risk Committee of the Board or the

Board of Directors, as appropriate. Our Board of Directors approves the risk appetite statement annually and requires that

management provide periodic updates on compliance to the Risk Committee of our Board.

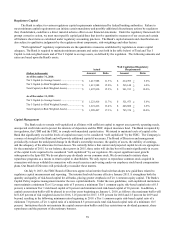

Board of Directors Committee Structure

We have a robust committee structure that facilitates oversight, effective challenge and escalation of risk and control

issues. The structure was enhanced during 2014 to provide greater clarity to the governance process and strengthen decision

making.

Risk Committee. The Risk Committee of the Board was established to assist the Board in fulfilling its oversight

responsibilities of risk and controls. The Risk Committee recommends the ERM framework, Policies and governance structure

to the Board of Directors for approval. The Risk Committee receives periodic updates on compliance with the ERM framework

as well as emerging or horizon risks from the Enterprise Risk Committee.

Audit Committee. The Audit Committee is responsible for oversight of the Internal Audit function. In this capacity, the

Audit Committee oversees the quality and integrity of our financial reporting process and financial statements; the

qualifications, hiring, performance and independence of our independent registered accounting firm; the performance of the our

Internal Audit function; our system of internal controls; and, our compliance with its Code of Business Conduct.

Nominations, Governance and Compensation Committee. In addition to other responsibilities as described in the 2014

Proxy Statement, the NGC Committee is to: 1) periodically review our compliance and performance against the risk measures

and limits as contained in our Board approved risk appetite framework relating to our personnel, including compensation

policies and practices, attrition and succession planning, and aspects of shareholder confidence relating to compensation

policies, and assess whether any such risks are reasonably likely to have a materially adverse effect on us; and 2) periodically

review our compliance and performance against the risk measures as contained in our Board approved risk appetite framework

relating to political risk, reputational risk and governance risks as related to compliance with NASDAQ listing standards and

applicable rules and regulations relating to Board of Directors and management composition, governance, and independence.

Preferred Stock Committee. The Preferred Stock Committee monitors and evaluates proposed actions that may impact

the rights of holders of preferred stock.

Compliance Committee. The purpose of the Compliance Committee of the Board of the Bank is to assist the Board in: 1)

overseeing the continuing maintenance and enhancement of a strong and sustainable compliance culture; 2) providing oversight

of the compliance management system; 3) approving sound policies and objectives and effectively supervising all compliance -

related activities; 4) ensuring that the Bank has a qualified Chief Compliance Officer with sufficient authority, independence

and resources to administer an effective compliance management system; and 5) exercising and performing all other duties and

responsibilities delegated to the Committee.

Management-Level Committee Structure

Enterprise Risk Committee. The Enterprise Risk Committee is authorized by the Board of Directors to provide

management oversight of the ERM framework. The ERC is the conduit from management to the Board Risk Committee and

provides for escalation in the instances of non-compliance with the framework. Additionally, the ERC is authorized to create

sub - committees to assist in the fulfillment of its oversight activities. During 2014, we consolidated our management level risk

oversight committees into three sub-committees of the ERC: Credit committee, Operational Risk committee and Asset and

Liability Committee ("ALCO"). Each of these three standing sub-committees is comprised of subject matter experts from the

senior management team and is accountable to the ERC. Moreover, these sub-committees may be supported by one or more

working groups. These working groups include the Allowance for Loan Loss, Critical Accounting Assumptions and New

Product and Services working groups.

Human Resources/ Incentive Compensation Plan Committee. Our Human Resources/ Incentive Compensation Plan

("ICP") Committee is comprised of a cross-functional team of senior officers from human resources, compliance, finance,

customer service, legal, marketing, and risk who oversee our incentive compensation plans. The committee’s responsibilities

include ensuring our incentive compensation plans do not incentivize our employees to take inappropriate risks which could

impact our financial position and controls, reputation and operations; reviewing the annual risk assessment of our incentive

compensation plans conducted by our Chief Compliance Officer, Chief Risk Officer, and audited by our Chief Audit Officer;

and developing policies and procedures for the development and approval of new incentive compensation plans in line with our

business goals and within acceptable risk parameters. The committee periodically reports to the Nominations, Governance, and

Compensation Committee of our Board of Directors on our controls and reviews of our incentive compensation plans.

65