Sallie Mae 2014 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

management incentive compensation and (ii) we believe it better reflects the financial results for derivatives that are economic

hedges of interest rate risk but do not qualify for hedge accounting treatment.

GAAP provides a uniform, comprehensive basis of accounting. Our “Core Earnings” basis of presentation differs from

GAAP in the way it treats ineffective hedges as described above.

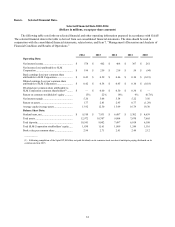

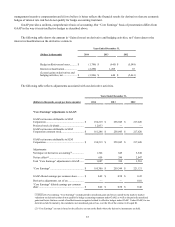

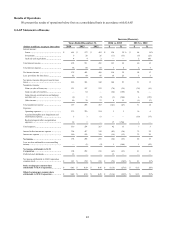

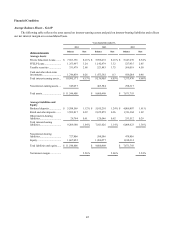

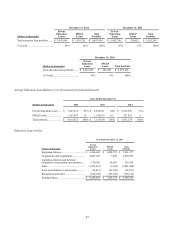

The following table shows the amount in “Gains (losses) on derivative and hedging activities, net” that relates to the

interest reclassification on the derivative contracts.

Years Ended December 31,

(Dollars in thousands)

2014

2013

2012

Hedge ineffectiveness losses .........

$

(1,746

)

$

(645

)

$

(5,548

)

Interest reclassification.................

(2,250

)

1,285

87

(Losses) gains on derivatives and

hedging activities, net ..................

$

(3,996

)

$

640

$

(5,461

)

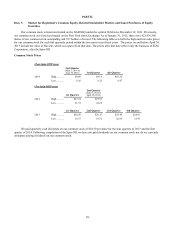

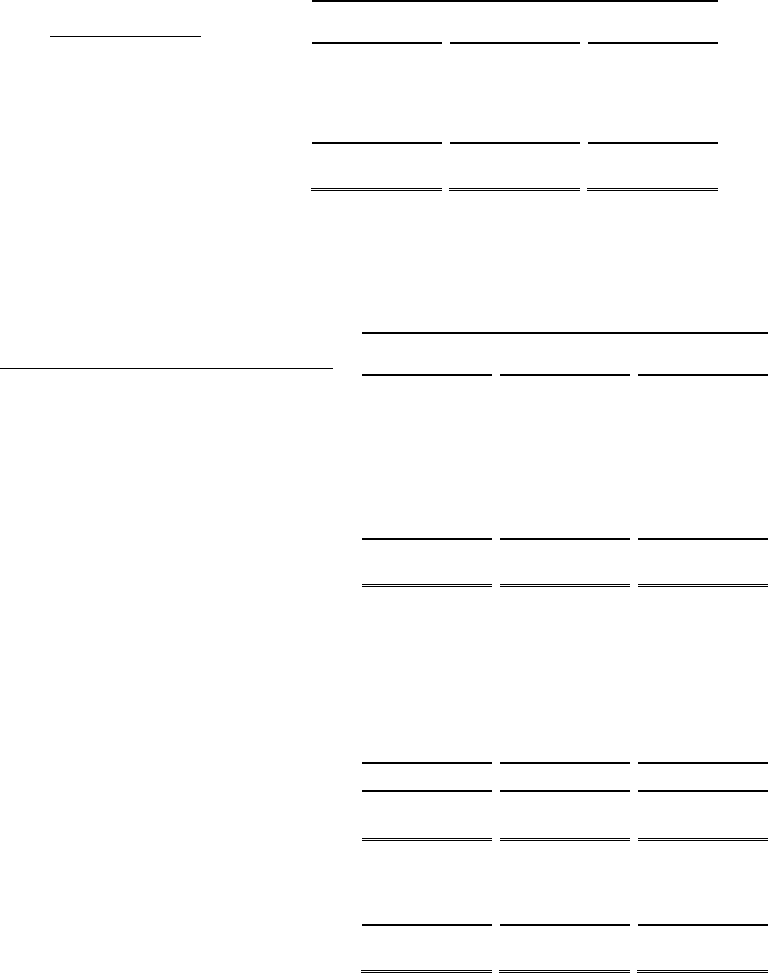

The following table reflects adjustments associated with our derivative activities.

Years Ended December 31,

(Dollars in thousands, except per share amounts)

2014

2013

2012

“Core Earnings” adjustments to GAAP:

GAAP net income attributable to SLM

Corporation ....................................................

$

194,219

$

258,945

$

217,620

Preferred stock dividends .................................

12,933

—

—

GAAP net income attributable to SLM

Corporation common stock ...............................

$

181,286

$

258,945

$

217,620

GAAP net income attributable to SLM

Corporation ....................................................

$

194,219

$

258,945

$

217,620

Adjustments:

Net impact of derivative accounting

(1)

................

1,746

645

5,548

Net tax effect

(2)

................................................

659

246

2,047

Total “Core Earnings” adjustments to GAAP ......

1,087

399

3,501

“Core Earnings” ..............................................

$

195,306

$

259,344

$

221,121

GAAP diluted earnings per common share .........

$

0.42

$

0.58

$

0.45

Derivative adjustments, net of tax .....................

—

—

0.01

“Core Earnings” diluted earnings per common

share ..............................................................

$

0.42

$

0.58

$

0.46

______

(1) Derivative Accounting: “Core Earnings” exclude periodic unrealized gains and losses caused by the mark-to-market

valuations on derivatives that do not qualify for hedge accounting treatment under GAAP, as well as the periodic unrealized

gains and losses that are a result of ineffectiveness recognized related to effective hedges under GAAP. Under GAAP, for our

derivatives held to maturity, the cumulative net unrealized gain or loss over the life of the contract will equal $0.

(2) “Core Earnings” tax rate is based on the effective tax rate at the Bank where the derivative instruments are held.

37