Sallie Mae 2002 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2002 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

into this business. Now, in early 2003, we can say we like this business even more

than we told you we did just a year ago.

Our capital deployment philosophy is straightforward. Our capital is your property,

the earnings thereon, yours. We seek only to keep sufficient levels to maintain our

financial strength, which is most clearly demonstrated by our high quality, long-term

earnings. Your managers at Sallie Mae are financially astute and very careful. We carry

your assets at conservative valuations.

The vast opportunities presented by the education market excite us. Meeting them

will test our operational and financial capabilities. We still must further differentiate

ourselves with even higher service levels. Diminished margins on our guaranteed loan

business dictate more creative financing solutions as we move more fully into the pri-

vate sector. The corporate finance group also bears the brunt of completing our “privati-

zation” by refinancing almost $46 billion of GSE assets (as of year-end) over the next

three-and-a-half years. We face a somewhat daunting, but very exciting, future. Our

employees are up to the task. They are our greatest asset.

No Sallie Mae communication would be complete without discussion of life in

Washington. The guaranteed portion of our loan business will be considered in the

Higher Education Act Reauthorization, a process now under way that will likely be com-

pleted in 2004. We expect little structural change, since the basic system needs little

change. It is not broken. Its stability is necessary to annually finance $45 billion of

America’s education costs, and policymakers who review this unique public/ private

partnership understand that. As business people, we see opportunities to save taxpayer

dollars and hope to assist Congress with our ideas. For example, we support new pro-

posals to restore the loan consolidation program to its original purpose—an administrative

tool to stretch payments or streamline billing, rather than a refinancing bonanza that

has cost the taxpayer dearly. We want to see the program continue to serve more

Americans each year while costing the taxpayer less. We look forward to the day when

the program pays for itself!

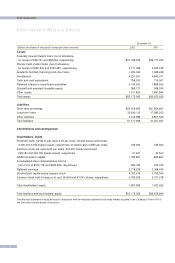

A word about our financial statements. We believe our oversized 10-Kmanifests

much of the reason today’s companies struggle with financial disclosure: one-size-fits-

The federal government

begins making loans

directly to students.

1993199 0

Sallie Mae’s assets

exceed $40 billion.

199 1

Sallie Mae establishes

a loan-servicing operation

in Lynn Haven, Florida,

near Panama City.

1992

Sallie Mae launches borrower benefit

programs with Great Rewards®; the

company’s charitable arm, now called

The Sallie Mae Fund, is established.

“We want to see the program

continue to serve more

Americans each year while

costing the taxpayer less.”

ALBERT L. LORD

VICE CHAIRMAN & CHIEF EXECUTIVE OFFICER