Sallie Mae 2002 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2002 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

Dear Fel lo w Shar eho l ders : As we pause to reflect on 2002, Sallie Mae’s 30th year,

we first want to thank you for your confidence in our company. The recognition is truly

gratifying. Again in 2002, we exceeded our earnings performance goals and delivered a

24-percent share price improvement. It is worth noting we have achieved an 18-percent

compound annual growth rate over our 20 years as a publicly traded company.

Demographic and tuition projections point to even greater credit demand for the balance

of this decade and give us ample opportunity to add to this success story.

Wall Street refers to us as a financial services company, yet our fortunes follow

almost exclusively the direction of higher education spending. That sector includes

more than $50 billion of credit annually, up from just $7 billion 20 years ago. Why? The

need for higher education, and therefore its price, has climbed without pause. Simply

stated: America’s education system delivers the highest return of any investment. And

like other high cost, high value investments (such as home ownership), some portion

must be borrowed.

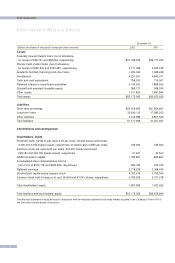

We incorporated financial data for this report by reference to the Form 10-K we filed

with the SEC. That document (which must weigh five pounds!) would indicate we man-

age a highly complex business. Not so. We earn most of our revenues from providing

capital for higher education’s financing needs. Our margins are narrow on government

guaranteed loans; wider on our own underwritten loan products. We also derive an

increasing portion of our revenues from fee-based outsourcing services. We deliver our

products on campus where we work closely with financial aid administrators to match

limited student resources with growing school price tags. Usually, this is more art than

science. America’s financial aid officers seemingly work miracles at tuition time. Our

customized, one-school-at-a-time marketing approach was started in earnest only a few

years ago. Today, it builds our business.

Collecting the loans we make can also be challenging, but 30 years has built our

know-how. In late 2001, we decided to capitalize on that experience and collect loans

made by other lenders, too. Internal expansion and our successful recent acquisitions,

Pioneer Credit Recovery and General Revenue Corporation, put us quickly and deeply

Letter from the CEO and President

Sallie Mae’s non-voting

common stock is listed

on the New York Stock

Exchange under SLM.

198 4 198 7

Sallie Mae’s Wilkes-Barre,

Pennsylvania, center opens

its doors with 48 employees

servicing 53,000 accounts

within one year.

198 5

Sallie Mae launches the

First-Year Teacher Awards.

198 1

Sallie Mae introduces its

first loan consolidation

program called OPTIONs.

198 8

Sallie Mae now

owns 24 percent

of student loans

outstanding. The

company’s Killeen,

Texas, servicing

center opens for

business .

“Demographic and tuition

projections point to even

greater credit demand for

the balance of this decade

and give us ample opportunity

to add to this success story.”

ALBERT L. LORD

VICE CHAIRMAN & CHIEF EXECUTIVE OFFICER