Ryanair 2016 Annual Report Download

Download and view the complete annual report

Please find the complete 2016 Ryanair annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1

Other

CONTENTS

2

Financial Highlights

4

Chairman’s Report

5

Chief Executive’s Report

7

Summary Operating and Financial Overview

9

Directors’ Report

13

Corporate Governance Report

28

Environmental and Social Report

35

Report of the Remuneration Committee on Directors’ Remuneration

37

Statement of Directors’ Responsibilities

39

Independent Auditor’s Report

44

Presentation of Financial and Certain Other Information

46

Detailed Index*

49

Key Information

54

Principal Risks and Uncertainties

68

Information on the Company

91

Operating and Financial Review

93

Critical Accounting Policies

107

Directors, Senior Management and Employees

115

Major Shareholders and Related Party Transactions

116

Financial Information

124

Additional Information

135

Quantitative and Qualitative Disclosures About Market Risk

140

Controls and Procedures

143

Consolidated Financial Statements

198

Company Financial Statements

204

Directors and Other Information

205

Appendix

*See Index on page 46 and 47 for detailed table of contents.

Information on the Company is available online via the internet at our website, http://corporate.ryanair.com.

Information on our website does not constitute part of this Annual Report. This Annual Report and our 20-F are

available on our website.

Table of contents

-

Page 1

... Accounting Policies Directors, Senior Management and Employees Major Shareholders and Related Party Transactions Financial Information Additional Information Quantitative and Qualitative Disclosures About Market Risk Controls and Procedures Consolidated Financial Statements Company Financial... -

Page 2

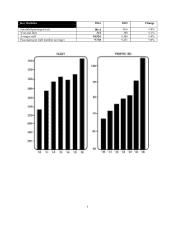

Financial Highlights Operating revenue Adjusted profit after tax (i) Profit after tax Adjusted EPS (euro cent) (i) EPS (euro cent) (i) 2016 â,¬m 6,535.8 1,241.6 1,559.1 92.59 116.26 2015 â,¬m 5,654.0 866.7 866.7 62.59 62.59 Change +16% +43% +80% +48% +86% Year ended March 31, 2016 excludes an ... -

Page 3

Key Statistics Scheduled passengers (m) 2016 106.4 341 10,926 9,738 2015 90.6 308 9,586 9,451 Change +18% +11% +14% +30% Year-end fleet Average staff Passengers per staff member (average) 3 -

Page 4

... delivery of 41 new Boeing 737-800 aircraft which facilitated our expansion into more primary airports and routes. Our punctuality remains the best in the industry with over 90% of our flights on time in fiscal 2016. In September 2015 your Board accepted the IAG Group offer of â,¬398m for Ryanair... -

Page 5

... our website and mobile app to deliver new Leisure Plus and Business Plus products, travel extras in the app and our "one flick" payment feature, an improved "My Ryanair" customer profile and a "Rate My Flight" feature. These enhancements make it easier for our customers to find Ryanair's low fares... -

Page 6

... will continue to support the Company, and will continue to enjoy superior returns on their investment over the coming years as we strive to grow our low fare model, safely, in the best interests of our customers, our people, and our shareholders. Yours sincerely, Michael O'Leary Chief Executive 6 -

Page 7

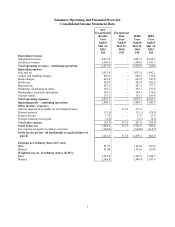

... and Financial Overview Consolidated Income Statement Data (preExceptional) Results Year Ended Mar 31, 2016 â,¬M Operating revenues Scheduled revenues Ancillary revenues Total operating revenues - continuing operations Operating expenses Fuel and oil Airport and handling charges Route charges Staff... -

Page 8

...and the addition of more primary airports to the network. Unit costs excluding fuel fell by 2%, however, and unit costs including fuel fell by 6%. Operating margin, excluding exceptional item, as a result of the above, increased by 4 points to 22% whilst operating profit increased by 40% to â,¬1,460... -

Page 9

... of the Company's financial risk management objectives and po licies and exposures to market risk are set forth in Note 11 on pages 168 to 179 of the consolidated financial statements. Share capital The number of ordinary shares in issue at March 31, 2016 was 1,290,739,865 (2015: 1,377,661,859; 2014... -

Page 10

...executive team reporting to the Board of Directors) is set out in Note 27 on page 197 of the consolidated financial statements. Details of total remuneration paid to the directors is set out in Note 19 on pages 188 to 190. Executive director's service contract In October 2014, Michael O'Leary (Chief... -

Page 11

... 196 of the consolidated financial statements. Following the June 23, 2016 referendum vote by the U.K. to leave the E.U., the Company announced that it had increased the size of its buy-back program to the 5% buy-back limit approved by the shareholders at the Company's 2015 Annual General Meeting... -

Page 12

... 383(2) of the Companies Act 2014, the auditor KPMG, Chartered Accountants, will continue in office. Annual General Meeting The Annual General Meeting will be held on September 14, 2016 at 9 a.m. in the Radisson Blu Hotel, Dublin Airport, Co. Dublin, Ireland. On behalf of the Board David Bonderman... -

Page 13

... Stock Exchange's website, www.ise.ie. The Board of Directors ("the Board") Roles The Board of Ryanair is responsible for the leadership, strategic direction and oversight of management of the Group. The Board's primary focus is on strategy formulation, policy and control. It has a formal schedule... -

Page 14

... Chairman with an extensive background in this industry, and significant public company experience. Historically, the Company has always separated the roles of Chairman and Chief Executive for the running of the business and implementation of the Board's strategy and policy. Years on Committees Role... -

Page 15

... character and judgement and the Board views his depth of experience and service as enhancing his independence in representing shareholder interests. In light of the number of issued shares in Ryanair Holdings plc and the personal financial interests of the director, the Board has concluded that the... -

Page 16

... PayPal (service provider to Ryanair) Yes Other relevant factors Other than Capt. Mike O'Brien, who was appointed to the Board in May 2016, all of the non -executive directors hold share options over 30,000 shares. Whilst the 2014 Code notes that the remuneration of non-executive directors should... -

Page 17

... NASDAQ listing and U.S. shareholder base, where U.S. investors encourage and promote non-executive directors' options to align interests of shareholders and directors, the Company has granted a small amount of share options to non-executive directors. The Company in accordance with the 2014 Code... -

Page 18

...designated senior management. Covered Persons are prohibited from undertaking such transactions during Closed Periods as defined by the code and at any time during which the individual is in possession of inside information (as defined in the E.U. Market Abuse Regulation (596/2014). Board Succession... -

Page 19

...the annual report and Form 20-F is fair balanced and understandable and provides the information necessary for shareholders to assess the company's performance, business model and strategy; reviewing the effectiveness of the Group's internal financial controls and risk management systems; monitoring... -

Page 20

... with the United States Securities and Exchange Commission and with the Irish Companies Office; The Committee regularly reviews risk management reports completed by management; The Committee conducts an annual assessment of the operation of the Group's system of internal control based on a detailed... -

Page 21

... issues relating to these matters, having regard to matters communicated to the Audit Committee by the external auditors; the Annual Report and Form 20-F, which is filed annually with the United States Securities and Exchange Commission, the Irish Stock Exchange and the London Stock Exchange, is... -

Page 22

... 1996. This committee has authority to determine the remuneration of senior executives of the Company and to administer the stock option plans described below. Senior Management remuneration is comprised of a fixed basic pay and performance related bonuses which are awarded based on a combination of... -

Page 23

... Director, meet annually without the Chairman present to evaluate his performance, having taken into account the views of the executive director. The non-executive directors also evaluate the performance of the executive director. These evaluations are designed to determine whether each director... -

Page 24

... All shareholders are given adequate notice of the Annual General Meeting ("AGM") at which the Chairman reviews the results and comments on current business activity. Financial, operational and other information on the Company is provided on the Company website, http://corporate.ryanair.com. Ryanair... -

Page 25

... and issue of financial reports to shareholders and the markets, including the Annual Report and consolidated financial statements, is overseen by the Audit Committee. The Company's financial reporting process is controlled using documented accounting policies and reporting formats, supplemented by... -

Page 26

... on pages 183 to 185 of the consolidated financial statements. Shares in the Ryanair employee share schemes carry no control rights and shares are only issued (and gain voting rights) when options are exercised by employees. Ryanair's Articles of Association do not contain any restrictions on voting... -

Page 27

...set out in their report on page 39. Viability Statement The Company's internal strategic planning processes currently extend to March 2024 which covers the delivery timeframe for the Company's existing aircraft orders and its long-term passenger growth target to 180m customers. Future assessments of... -

Page 28

... detection system that provides aircraft crews with information relating to the aircraft's position relative to the airport's runway. The RAAS is a significant mitigation for three of the Company's Key Operational Risk Areas ("KORAs"): ï,· a 24-hour Safety Office, training and reporting systems... -

Page 29

... Efficiency Current Fleet Ryanair operates a fleet of over 350 Boeing 737-800NG aircraft, each with 189 seats with an average fleet age of under 6 years. Ryanair expects to grow to approximately 550 aircraft by 2024. Morgan Stanley Capital International ("MSCI") "ESG Rating R eport, February 2016... -

Page 30

... MyRyanair App which allows customers to secure their boarding cards and travel documents on their laptop or mobile devices; ï,· operates a "good neighbour" policy of no through -the-night aircraft movements, reducing noise emissions; and ï,· utilises energy efficient LED lighting in its new Boeing... -

Page 31

... 9, 2016 and titled "ESG Ratings Report", that "Ryanair continues to lead its industry on fuel efficiency, driven by its relatively young fleet. The Co mpany's carbon emissions per revenue passenger kilometres are the lowest among peers". Company Facilities Environmental controls are generally... -

Page 32

.... Ryanair's pilots and cabin crew operate under industry leading rosters and return home to their base at the end of every working day which is the most family friendly crew roster in aviation and offers personnel a good work/life balance. European Works Councils ("EWC") Ryanair runs an annual forum... -

Page 33

... to only use suppliers that adhere to these principles and provide a safe and healthy working environment for their employees. Customer Charter, "Always Getting Better" ("AGB") In 2014 Ryanair launched its "Always Getting Better" Customer Charter. This underpins the Company's relentless drive... -

Page 34

...Less than 1.1 complaints per 1,000 passengers Less than 0.5 bag complaints per 1,000 passengers Over 99% complaints answered within 7 days Ryanair's on time performance ("OTP") for the last five years is as follows: Year FY 2016 FY 2015 FY 2014 FY 2013 FY 2012 6. Corporate Governance For a detailed... -

Page 35

... the level of non-executive director fees is low by E.U. airline industry comparatives. Directors can only be appointed following selection by the Nomination Committee and approval by the Board and must be elected by the shareholders at the Annual General Meeting following their appointment. Ryanair... -

Page 36

...listing and US shareholder base, where US investors encourage and promote non-executive directors' options, the Company has granted a small amount of share options to non -executive directors. Details of employee share option plans are set forth in Note 15(c) to the consolidated Financial Statements... -

Page 37

...a true and fair view of the assets, liabilities and financial position of the Group and the Company and of the Group's profit or loss for that year. In preparing each of the consolidated and Company financial statements, the directors are required to: ï,· select suitable accounting policies and then... -

Page 38

...Annual Report and financial statements taken as a whole, provides the information necessary to assess the Group's performance, business model and strategy and is fair, balanced and understandable and provides the information necessary for shareholders to assess the company's position and performance... -

Page 39

... with International Standards on Auditing ("ISAs") (U.K. & Ireland). In our opinion the consolidated financial statements give a true and fair view of the assets, liabilities and financial position of the group as at 31 March 2016 and of its profit for the year then ended; the Company balance sheet... -

Page 40

... and the costs associated with the restitution of life limited parts are accrued and charged to profit and loss over the lease term for the individual contractual obligation. At each balance sheet date, the maintenance provision is calculated using a model that incorporates a number of assumptions... -

Page 41

... Report), page 152 (accounting policy) and pages 179 to 181 (financial disclosures). The risk: While Ryanair is headquartered, managed and controlled from Ireland, the Group operates extensively across Europe and also North Africa. Airlines' profits on international flights are taxed in the country... -

Page 42

... we acquired during our audit and the Directors' statement that they consider the annual report is fair, balanced and understandable and provides information necessary for shareholders to assess the entity's performance, business model and strategy; or the Report from the Audit Committee included in... -

Page 43

... of significant accounting estimates made by the Directors; and the overall presentation of the financial statements. In addition, we read all the financial and non-financial information in the Annual Report to identify material inconsistencies with the audited financial statements and to... -

Page 44

...Ryanair® in certain jurisdictions. See "Item 4. Information on the Company-Trademarks." This report also makes reference to trade names and trademarks of companies other than the Company. The Company publishes its annual and interim consolidated financial statements in accordance with International... -

Page 45

...the Company, including statements concerning its future operating and financial performance, the Company's share of new and existing markets, general industry and economic trends and the Company's performance relative thereto and the Company's expectations as to requirements for capital expenditures... -

Page 46

... Financial Data Exchange Rates Selected Operating and Other Data Risk Factors Information on the Company Introduction Strategy Route System, Scheduling and Fares Marketing and Advertising Reservations on Ryanair.Com Aircraft Ancillary Services Maintenance and Repairs Safety Record Airport Operations... -

Page 47

Item 8. Related Party Transactions Financial Information Consolidated Financial Statements Other Financial Information Significant Changes The Offer and Listing Trading Markets and Share Prices Additional Information Description of Capital Stock Options to Purchase Securities from Registrant or ... -

Page 48

...'s bases." For a list of these bases, see "Item 4. Information on the Company-Route System, Scheduling and Fares." Ryanair pioneered the low-fares air travel model in Europe in the early 1990s. As of June 30, 2016, the Company offered over 2,000 short-haul flights per day serving over 200 airports... -

Page 49

... euro to US$ using the Federal Reserve Rate on March 31, 2016. This information should be read in conjunction with: (i) the audited consolidated financial statements of the Company and related notes thereto included in Item 18 and (ii) "Item 5. Operating and Financial Review and Prospects." Income... -

Page 50

Cash Flow Statement Data: Fiscal year ended March 31, 2015 2014 (in millions) â,¬ 1,689.4 1,044.6 300.7 (856.1) 489.2 â,¬ 2016(a) Net cash inflow from operating activities Net cash (outflow)/inflow from investing activities Net cash (outflow)/inflow from financing activities Increase/(decrease) in... -

Page 51

... euro; (ii) the U.K. pound sterling and the euro; and (iii) the U.K. pound sterling and the U.S. dollar. Such rates are provided solely for the convenience of the reader and are not necessarily the rates used by the Company in the preparation of its consolidated financial statements included in Item... -

Page 52

... Based on the Federal Reserve Rate for euro. The average of the relevant exchange rates on the last business day of each month during the relevant period. Based on the composite exchange rate as quoted at 5 p.m., New York time, by Bloomberg/Reuters. Based on the Federal Reserve Rate for U.K. pound... -

Page 53

... from the Company's consolidated financial statements prepared in accordance with IFRS and from certain other data, and are not audited. For definitions of the terms used in this table, see the Glossary in Appendix A. Operating Data: Operating Margin Break-even Load Factor Avg. Booked Passenger Fare... -

Page 54

... as market speculation. While oil prices increased substantially in fiscal years 2012, 2013 and 2014, they declined significantly in the second half of fiscal 2015 and in fiscal 2016 remained at lower levels. As international prices for jet fuel are denominated in U.S. dollars, Ryanair's fuel costs... -

Page 55

... scheduling more flights to primary airports, selling flights via corporate travel agents on global distribution systems ("GDS"), a higher marketing spend, and adjusting the airline's yield management strategy with the goal of increasing load factors. In fiscal years 2014, 2015 and 2016, Ryanair... -

Page 56

... Not Be Successful in Increasing Fares to Cover Rising Business Costs. Ryanair operates a low-fares airline. The success of its business model depends on its ability to control costs so as to deliver low fares while at the same time earning a profit. Ryanair has limited control over its fuel costs... -

Page 57

... Ryanair is hedged at levels that are expected to deliver unit cost savings over the next two fiscal years, it is hedged at prices that are above the current spot prices. There is no guarantee that lower fuel prices will not lead to greater price competition and encourage new entrants to the market... -

Page 58

...unsecured or secured debt to pay for aircraft is subject t o potential volatility in the worldwide financial markets. Using the debt capital markets to finance the Company and the 2013 and 2014 Boeing Contracts requires the Company to retain its investment grade credit ratings (the Company has a BBB... -

Page 59

... a passenger travel tax of NOK80 (approximately â,¬8.50) which resulted in Ryanair announcing the closure of its Oslo Rygge base with effect from late October 2016. For additional information, see "Item 4. Information on the Company-Airport Operations-Airport Charges." See also "-The Company Is... -

Page 60

... effect upon Ryanair's business, operating results, and financial condition. The Company Faces Risks Related to its Internet Reservations Operations and its Announced Elimination of Airport Check-in Facilities. Ryanair's flight reservations are made through its website, mobile app and GDSs. Ryanair... -

Page 61

... of reservations in the event of a major breakdown of its booking engine or other related systems, which, in turn, could have a material adverse effect on Ryanair's operating results or financial condition . Since October 1, 2009, all Ryanair passengers have been required to use Internet check-in... -

Page 62

... on Ryanair's balance sheet, the Company has a number of cross currency risks as a result of the jurisdictions of the operating business including non-euro revenues, fuel costs, certain maintenance costs and insurance costs. A weakening in the value of the euro primarily against U.K. pound sterling... -

Page 63

... with EU Regulation No. 1008/2008. For additional information, please see "Item 3 - Risks Related to Ownership of the Company's Ordinary Shares or ADRs". The Referendum has also caused, and Brexit may continue to cause, both significant volatility in global stock markets and currency exchange rate... -

Page 64

... adverse effect on demand for air travel and thus on Ryanair's busines s, operating results, and financial condition. EU Regulation on Passenger Compensation Could Significantly Increase Related Costs. EU Regulation (EC) No. 261/2004 requires airlines to compensate passengers (holding a valid ticket... -

Page 65

... of bookings, and adversely affecting Ryanair's financial condition and result s of operations. The Company is Dependent on the Continued Acceptance of Low-fares Airlines. Ryanair has an excellent 31-year safety record. In past years, however, accidents or other safety-related incidents involving... -

Page 66

...retain an operating license, an EU air carrier must be majority-owned and effectively controlled by EU nationals. The regulation does not specify what level of share ownership will confer effective control on a holder or holders of Ordinary Shares. The Board of Directors of Ryanair Holdings is given... -

Page 67

... portion of airline travel (both business and personal) is discretionary, the industry tends to experience adverse financial results during general economic downturns. The Company is substantially dependent on discretionary air travel. The trading price of Ryanair Holdings' Ordinary Shares and ADRs... -

Page 68

...low-fares operating model in Europe under a new management team in the early 1990s. See "Item 5. Operating and Financial Review and Prospectsï,¾History." As of June 30, 2016, Ryanair had a principal fleet of over 350 Boeing 737-800 aircraft and offered over 2,000 scheduled short-haul flights per day... -

Page 69

... of flight punctuality, levels of lost baggage, and rates of flight cancellations. The address of Ryanair Holdings' registered office is: c/o Ryanair Limited, Dublin Office, Airside Business Park, Swords, County Dublin, K67 NY94, Ireland. The Company's contact person regarding this Annual Report on... -

Page 70

...to the Company. Direct sales via the Ryanair website and mobile app continues to be the prime generator of scheduled passenger revenues. Airport Access and Handling Costs. Ryanair attempts to control airport access and service charges by focusing on airports that offer competitive prices. Management... -

Page 71

... fares. The new "My Ryanair" registration services, which allows customers to securely store their personal and payment details, has also significantly quickened the booking process and made it easier for customers to book a flight. The Company also launched a new mobile app in July 2014, which... -

Page 72

... new bases; and (ix) initiating new routes not currently served by any carrier. Responding to Market Challenges. In recent periods, and with increased effect in the 2012, 2013 and 2014 fiscal years, Ryanair's low-fares business model faced substantial pressure due to significantly increased fuel... -

Page 73

... consolidated financial statements included in Item 18 for more information regarding the geographical sources of the Company's revenue. Management's objective is to schedule a sufficient number of flights per day on each of Ryanair's routes to satisfy demand for Ryanair's low-fares service. Ryanair... -

Page 74

... boards. Ryanair also regularly contacts people registered in its database to inform them about promotions and special offers. RESERVATIONS ON RYANAIR.COM Passenger airlines generally rely on travel agents (whether traditional or online) for a significant portion of their ticket sales and pay travel... -

Page 75

... Factor" will be app lied to the basic price to reflect increases in the Employment Cost Index and Producer Price Index between the time the basic price was set in the 2013 Boeing Contract and the period 18 to 24 months prior to the delivery of any such new aircraft. Boeing has granted Ryanair... -

Page 76

... B737NG Level D flight simulators, two of which were delivered in fiscal 2016. Ryanair has also purchased 3 new state of the art fixed base simulators from Multi Pilot Simulations ("MPS") which will be used for pilot assessments and pilot training. Management believes that Ryanair is currently in... -

Page 77

... Ryanair's standard terms and conditions. Excess baggage charges are recorded as non-flight scheduled revenue. Ryanair primarily markets accommodation services and travel insurance through its website. For hotel and accommodation services, Ryanair currently has a contract with Booking.com to market... -

Page 78

...Part 145-approved companies. Heavy Maintenance As noted above, Ryanair currently has sufficient capacity to be able to carry out all of the routine maintenance work required on its Boeing 737-800 fleet itself. Ryanair opened a new three-bay maintenance hangar at Glasgow (Prestwick) airport in winter... -

Page 79

... U.K. CAA as an alternative confidential reporting channel. Ryanair has installed an automatic data capturing system on each of its Boeing 737-800 aircraft which captures and downloads aircraft performance information for use as part of Operational Flight Data Monitoring (OFDM) which automatically... -

Page 80

... affect the Company's operations. As a result of rising airport charges and the introduction of an Air Travel Tax of â,¬10 on passengers departing from Irish airports on routes longer than 300 kilometers from Dublin Airport (â,¬2 on shorter routes), Ryanair reduced its fleet at Dublin airport to 13... -

Page 81

...to regulation. See "Item 3. Risk Factorsï,¾Risks Related to the Companyï,¾Ryanair's Continued Growth is Dependent on Access to Suitable Airports; Charges for Airport Access are Subject to Increase." See also "Item 8. Financial Information ï,¾Other Financial Informationï,¾Legal Proceedingsï,¾EU State... -

Page 82

... of Certain Rules Relating to Transportation by Air, as amended by the Montreal Convention of 1999. Ryanair has extended its liability insurance to meet the appropriate requirements of the legislation. See "Item 3. Key Information-Risk Factors-Risks Related to the Airline Industry-The Company Faces... -

Page 83

... Aircraft Maintenance Administrative Offices Ryanair has agreements with the DAA, the Irish government authority charged with operating Dublin Airport, to lease check-in counters and other space at the passenger and cargo terminal facilities at Dublin Airport. The airport office facilities used... -

Page 84

... trademark in all EU member states. The registration gives Ryanair an exclusive monopoly over the use of its trade name with regard to similar services and the right to sue for trademark infringement should another party use an identical or confusingly similar trademark in relation to identical, or... -

Page 85

... must at all times be effectively controlled by such EU member states or EU nationals. The CAR has broad authority to revoke an operating license. See "Item 10. Additional Information--Limitations on Share Ownership by Non-EU Nationals." See also "Item 3. Risk Factors--Risks Related to Ownership of... -

Page 86

... been denied boarding on a flight for which they hold a valid ticket (Regulation (EC) No. 261/2004), which came into force on February 17, 2005. See "Item 3. Risk Factors-Risks Related to the Airline Industry-EU Regulation on Passenger Compensation Could Significantly Increase Related Costs." The... -

Page 87

...Other Financial Informationï,¾Legal Proceedingsï,¾EU State Aid-Related Proceedings." The European Union also passed legislation calling for increased transparency in airline fares, which requires the inclusion of all mandatory taxes, fees, and charges in advertised prices. Ryanair currently includes... -

Page 88

... Factorsï,¾Risks Related to the Company-The Company Is Subject to Legal Proceedings Alleging State Aid at Certain Airports" and "Item 8. Financial Information ï,¾Other Financial Informationï,¾Legal Proceedings." Environmental Regulation Aircraft Noise Regulations. Ryanair is subject to international... -

Page 89

... Director s' Report) Regulations 2013, Ryanair is obliged to state its annual quantity of emissions in tons of carbon dioxide equivalent. Ryanair's EU Emissions Trading Scheme monitoring, reporting and allowance surrender obligations are mandated on a calendar year basis. During calendar year 2015... -

Page 90

... by the EU institutions since 2014 and is currently stalled. Slot values depend on several factors, including the airport, time of day covered, the availability of slots and the class of aircraft. Ryanair' s ability to gain access to and develop its operations at slot-controlled airports will be... -

Page 91

... of service on a number of its principal routes. During that period, Ryanair established 84 airports as bases of operations, including Dublin. See "Item 4. Information on the Company-Route System, Scheduling and Fares" for a list of these bases. Ryanair has increased the number of booked passengers... -

Page 92

... air traffic controller strikes in Europe; the rates of income and corporate taxes paid, and the impact of the financial and Eurozone crisis. Ryanair expects its depreciation, staff and fuel charges to increase as additional aircraft and related flight equipment are acquired. Future fuel costs may... -

Page 93

... taxes, changes in new aircraft fuel efficiency and changing market prices for new and used aircraft of the same or similar types. Ryanair evaluates its estimates and assumptions in each reporting period, and, when warranted, adjusts these assumptions. Generally, these adjustments are accounted... -

Page 94

... industry experience, industry regulations and recommendations from Boeing; however, these estimates can be subject to revision, depending on a number of factors, such as the timing of the planned maintenance, the ultimate utilization of the aircraft, changes to government regulations and increases... -

Page 95

... of Ryanair's total revenues for the 2016 fisca l year, compared with 75.4% of total revenues in the 2015 fiscal year. Ancillary revenues. Ryanair's ancillary revenues, which comprise revenues from non -flight scheduled operations, in-flight sales and Internet-related services, increased 12.5%, from... -

Page 96

...2016 2015 (in millions of euro, except percentage data) Non-flight Scheduled In-flight Sales Internet-related Total 1,329.6 153.4 85.6 1,568.6 84.8 % 1,164.4 9.8 % 128.1 5.4 % 101.2 100.0 % 1,393.7 83.5 % 9.2 % 7.3 % 100.0 % Operating expenses. As a percentage of total revenues, Ryanair's operating... -

Page 97

...'s fuel hedging activities. Airport and handling charges. Ryanair's airport and handling charges per passenger decreased 0.9% in the 2016 fiscal year, while route charges per passenger decreased 3.2%. In absolute terms, airport and handling charges increased 16.5%, from â,¬712.8 million in the 2015... -

Page 98

... revenues per booked passenger increased to â,¬15.39 from â,¬15.27. Revenues from non-flight scheduled operations, including revenues from excess baggage charges, administration/credit card fees, sales of rail and bus tickets, priority boarding, reserved seating, accommodation, travel insurance... -

Page 99

... Fuel and oil Airport and handling charges Route charges Staff costs Depreciation Marketing, distribution and other Maintenance, materials and repairs Aircraft rentals Total operating expenses Fuel and oil. Ryanair's fuel and oil costs per passenger decreased by 10.8%, while in absolute terms... -

Page 100

... in passenger volumes, the mix of new routes and bases launched at primary airports and the strengthening of U.K. pound sterling against the euro. Route charges. In absolute terms, route charges increased 4.9%, from â,¬522.0 million in the 2014 fiscal year, to â,¬547.4 million in the 2015 fiscal... -

Page 101

... debt capital market issuances and bank loans for the acquisition of aircraft. See "Item 3. Key Information- Risk Factors-Risks Related to the Company-The Company Will Incur Significant Costs Acquiring New Aircraft and Any Instability in the Credit and Capital Markets Could Negatively Impact Ryanair... -

Page 102

... no outstanding debt remaining. Ryanair has generally been able to generate sufficient funds from operations to meet its non-aircraft acquisitionrelated working capital requirements. Management believes that the working capital available to the Company is sufficient for its present requirements and... -

Page 103

... Opening Fleet Deliveries under 2013 Boeing Contract Firm deliveries under 2014 Boeing Contract Option Aircraft under 2014 Boeing Contract Planned returns or disposals Closing Fleet Total 341 131 100 100 (126) 546 Capital Resources. Ryanair's long-term debt (including current maturities) totaled... -

Page 104

..., Ryanair intends to finance the New Aircraft obtained under the 2013 and 2014 Boeing Contracts through a combination of internally generated cash flows, debt financing from commercial banks, debt financing through the capital markets in a secured and unsecured manner, JOLCOs and sale and operating... -

Page 105

... aircraft, an accounting provision is made during the lease term for this obligation based on estimated future costs of major airframe, engine maintenance checks and restitution of major life limited parts by making appropriate charges to the income statement calculated by reference to the number... -

Page 106

..., capital market transactions and bank advances, including those relating to aircraft financing and related hedging transactions. This amount excludes guarantees given in relation to the 2013 Boeing Contract which total approximately $14.4 billion at list prices and which became effective following... -

Page 107

... as a director since August 2014. Mr. Cawley previously worked with Ryanair for 17 years prior to his retirement and contributed enormously to Ryanair's growth and success until he retired in March 2014. He served as Ryanair's Deputy CEO and Chief Operating Officer. Mr. Cawley's other non -executive... -

Page 108

... 2014 and before that as Ryanair's Director of Finance from 1993 and Financial Controller in 1992. Howard is Chairman of BDO Ireland, Chief Executive Officer of Stellwagen Capital, Chief Operating Officer of the Stellwagen Group and a member of Irelandia Aviation's advisory board. He is also a non... -

Page 109

... and the Director of Safety and Security, Ms. Carol Sharkey. A number of other managers are invited to attend, as required, from time to time. Powers of, and Action by, the Board of Directors The Board of Directors is empowered by the Articles to carry on the business of Ryanair Holdings, subject to... -

Page 110

...attend our annual general meetings or other shareholder meetings. NASDAQ requires that all members of a listed company's Nominating Committee be independent directors, unless the Company, as a foreign private issuer, provides an attestation of non-conforming practice based upon home country practice... -

Page 111

... Howard Millar is an independent non-executive director within the spirit and meaning of the Code Rules. The Board has considered Mike O'Brien's independence given that he served as Chief Pilot and Flight Operations Manager of Ryanair from 1987 to 1991. The Board has considered Mike's employment and... -

Page 112

... Manager at both Intuition Publishing Ltd and Education Multimedia Group and has 17 years of experience in the IT industry. Kenny Jacobs (Chief Marketing Officer). Kenny was appointed Chief Marketing Officer in January 2014. He is responsible for sales, marketing and customer service at Ryanair... -

Page 113

...further details of stock options that have been granted to the Company's employees, including the executive officers, see "Item 10. Additional Information-Options to Purchase Securities from Registrant or Subsidiaries," as well as Note 15 to the consolidated financial statements included herein. The... -

Page 114

... pay for his or her own training and, based on his or her performance, he or she may be offered a position operating on Ryanair aircraft. This program enables Ryanair to secure a continuous stream of type-rated co-pilots. Ryanair's crews earn productivity-based incentive payments, including a sales... -

Page 115

... the aggregate 41.7% of the number of Ordinary Shares then outstanding. See "Item 10. Additional Information ï,¾Articles of Association" and "ï,¾Limitations on Share Ownership by Non-EU Nationals." MAJOR SHAREHOLDERS Based on information available to Ryanair Holdings, the following table summarizes... -

Page 116

... meaning of EU rules, because these arrangements were in line with market terms. In July 2012, the European Commission similarly concluded that the financial arrangements between Tampere airport in Finland and Ryanair do not constitute state aid. In February 2014, the European Commission found that... -

Page 117

... appealable to the EU General Court. State aid complaints by Lufthansa about Ryanair's cost base at Frankfurt (Hahn) have been rejected by German courts, as have similar complaints by Air Berlin in relation to Ryanair's arrangement with Lübeck airport, but following a German Supreme Court ruling on... -

Page 118

... 2014). In July 2012 the European Commission found that Ryanair, Aer Lingus and Aer Arann had received state aid from the Irish government by way of a two-tier air travel tax levied on passengers departing from Irish airports. Ryanair appealed this decision and on February 5, 2015 the EU General... -

Page 119

...profitability through the sale of car hire, hotels and travel insurance etc. Also, some customers may be lost to the Company once they are presented by a screenscraper website with a Ryanair fare inflated by the screenscraper's intermediary fee. See Item 3. Key Information-Risk Factors-Risks Related... -

Page 120

... to leave the EU, Ryanair announced that it had increased the size of its buy-back program to the 5% buy-back limit approved by shareholders at the Company's 2015 Annual General Meeting. Under this increased share buy-back program, the Company purchased just over 65 million shares at a total cost of... -

Page 121

... regarding share buy-backs. SIGNIFICANT CHANGES Following the June 23, 2016 Referendum vote by the U.K. to leave the EU, the Company announced that it had increased the size of its buy-back program to the 5% buy-back limit approved by the shareholders at the Company's 2015 Annual General Meeting... -

Page 122

...2011 2012 2013 2014 First Quarter Second Quarter Third Quarter Fourth Quarter 2015 First Quarter Second Quarter Third Quarter Fourth Quarter 2016 January 31, 2016 February 29, 2016 March 31, 2016 April 30, 2016 May 31, 2016 June 30, 2016 July 21, 2016 Ordinary Shares (Irish Stock Exchange) (in euro... -

Page 123

... 2012 2013 2014 First Quarter Second Quarter Third Quarter Fourth Quarter 2015 First Quarter Second Quarter Third Quarter Fourth Quarter 2016 January 31, 2016 February 29, 2016 March 31, 2016 April 30, 2016 May 31, 2016 June 30, 2016 July 21, 2016 Ordinary Shares (London Stock Exchange) (in euro... -

Page 124

... 2013 2014 2015 2016 Period through July 21, 2016 Total All Ordinary Shares repurchased have been cancelled. The maximum price at which the Company may repurchase Ordinary Shares traded on the Irish Stock Exchange or the London Stock Exchange is the higher of (i) 5% above the average market value... -

Page 125

... Plan 2000, each of the non-executive directors at that time were granted 25,000 share options, at a strike price of â,¬4.96, during the 2008 fiscal year. These options were exercisable between June 2012 and June 2014. In addition, 39 senior managers (including five of the current executive officers... -

Page 126

... are called upon 21 days' advance notice. A ll Ryanair shareholders may appoint proxies electronically to attend, speak, ask questions and vote on behalf of them at annual general meetings and to reflect certain other provisions of those Regulations. All holders of Ordinary Shares are entitled to... -

Page 127

... Company agreed to purchase an additional three Boeing 737-800 next generation. This brings the total number of 737-800 next generation aircraft on order to 183, with a list value of approximately $14.4 billion. At March 31, 2016, 52 of these aircraft had been delivered. In September 2014, the Group... -

Page 128

... effect on its business. LIMITATIONS ON SHARE OWNERSHIP BY NON-EU NATIONALS The Board of Directors of Ryanair Holdings is given certain powers under the Articles to take action to ensure that the number of Ordinary Shares held in Ryanair Holdings by non-EU nationals does not reach a level which... -

Page 129

... Shares and the name of the person or persons who will answer queries relating to Restricted Shares on behalf of Ryanair Holdings. The directors shall publish information as to the number of shares held by EU nationals annually. In an effort to increase the percentage of its share capital held by EU... -

Page 130

... stock tracking indices. Any such exclusion may adversely affect the market price of the Ordinary Shares and ADRs. See also "Item 3. Risk Factors--Risks Related to Ownership of the Company's Shares or ADRs-EU Rules Impose Restrictions on the Ownership of Ryanair Holdings' Ordinary Shares by Non -EU... -

Page 131

... by persons who are not resident for tax purposes in a tax treaty country or EU member state; Companies not resident in Ireland the principal class of shares of which is substantially and regularly traded on a recognized stock exchange in a tax treaty country or an EU member state including... -

Page 132

... system" where the recorded addresses of such holder, as listed in the depositary bank's register of depositar y receipts, is in the United States. Taxation on Dividends. Companies resident in Ireland other than those taxable on receipt of dividends as trading income are exempt from corporation tax... -

Page 133

... hold Ordinary Shares or ADRs as capital assets and generally does not address the tax treatment of U.S. Holders that may be subject to special tax rules such as banks, insurance companies, dealers in securities or currencies, partnerships or partners therein, entities subject to the branch profits... -

Page 134

... Treaty currently in effect, in the event the Company were to pay any dividend, the tax credit attaching to the dividend (as used herein the "Tax Credit"; see "-Irish Tax Considerations") generally should be treated as a foreign income tax eligible for credit against such U.S. Holder's United State... -

Page 135

... with the goal of hedging its operational and balance sheet risk. However, Ryanair's exposure to commodity price, interest ra te and currency exchange rate fluctuations cannot be neutralized completely. In executing its risk management strategy, Ryanair currently enters into forward contracts... -

Page 136

... Based on Ryanair's fuel consumption for the 2016 fiscal year, a change of $1.00 in the average annual price per metri c ton of jet fuel would have caused a change of approximately â,¬2.5 million in Ryanair's fuel costs. See "Item 3. Key Information- Risk Factors-Risks Related to the Company-Changes... -

Page 137

.... A plus or minus change of 10% in relevant foreign currency exchange rates, based on outstanding foreign currency-denominated financial assets and financial liabilities at March 31, 2016 would have a respective positive or negative impact on the income statement of â,¬0.1 million (net of tax) (2015... -

Page 138

... of tax), as compared with a loss of â,¬10.7 million at March 31, 2015. See Note 11 to the consolidated financial statements included in Item 18 for additional information. If Ryanair had not entered into such derivative agreements, a plus or minus one percentage point movement in interest rates... -

Page 139

Reimbursement of Fees From April 1, 2015 to June 30, 2016 the Depositary collected annual depositary services fees equal to approximately $4.0 million from holders of ADSs, net of fees paid to the Depositary by the Company. 139 -

Page 140

...or timely detection of unauthorized acquisition, use or disposition of the Company's assets that could have a material effect on the financial statements. ï,· The Company's management evaluated the effectiveness of the Company's internal control over financial reporting as of March 31, 2016, based... -

Page 141

..., chief financial officer, chief accounting officer, controller and persons performing similar functions, as well as to all of the Company's other officers, directors and employees. The Code of Business Conduct and Ethics is available on Ryanair's website at http://www.ryanair.com. (Information... -

Page 142

... of the issued share capital of the Company at July 21, 2016. See "Item 8. Financial Information-Other Financial Information-Share Buy-Back Program" and "Item 9. The Offer and Listing-Trading Markets and Share Prices" for further information regarding the Company's Ordinary Share buy-back program... -

Page 143

... III Item 17. Financial Statements Not applicable. Item 18. Financial Statements RYANAIR HOLDINGS PLC INDEX TO FINANCIAL STATEMENTS Page Consolidated Balance Sheets of Ryanair Holdings plc at March 31, 2016, March 31, 2015 and March 31, 2014 Consolidated Income Statements of Ryanair Holdings plc... -

Page 144

... Non-current liabilities Provisions Derivative financial instruments Deferred tax Other creditors Non-current maturities of debt Total non-current liabilities Shareholders' equity Issued share capital Share premium account Other undenominated capital Retained earnings Other reserves Shareholders... -

Page 145

... Airport and handling charges Route charges Staff costs Depreciation Marketing, distribution and other Maintenance, materials and repairs Aircraft rentals Total operating expenses Operating profit - continuing operations Other income/(expense) Gain on disposal of available for sale financial asset... -

Page 146

...-flow hedge reserve Available for sale financial asset: Net increase in fair value of available-for-sale financial asset - reclassified to profit or loss Disposal of available-for-sale financial asset Total other comprehensive (loss)/income for the year, net of income tax Total comprehensive income... -

Page 147

... plan Net movements in cash-flow reserve Net change in fair value of available for sale financial asset Total other comprehensive income/(loss) Total comprehensive income Transactions with owners of the Company, recognised directly in equity Issue of ordinary equity shares Share-based payments... -

Page 148

...-flow reserve Net change in fair value of available-for -sale asset Total other comprehensive income/(loss) Total comprehensive income Transactions with owners of the Company, recognised directly in equity Issue of ordinary equity shares Share capital reorganisation Share-based payments Repurchase... -

Page 149

... Statement of Cash Flows Year ended March 31, 2016 â,¬M Operating activities Profit after tax Adjustments to reconcile profit after tax to net cash provided by operating activities Depreciation Retirement costs Tax expense on profit on ordinary activities Share-based payments charge (Increase... -

Page 150

... euro millions, the euro being the functional currency of the parent entity and the majority of the group companies. They are prepared on the historical cost basis, except for derivative financial instruments and available-for-sale securities which are stated at fair value, and share-based payments... -

Page 151

... to governmental regulations on aging aircraft, and changing market prices for new and used aircraft of the same or similar types. Ryanair evaluates its estimates and assumptions in each reporting period, and, when warranted, adjusts these assumptions. Generally, these adjustments are accounted for... -

Page 152

... industry experience, industry regulations and recommendations from Boeing; however, these estimates can be subject to revision, depending on a number of factors, such as the timing of the planned maintenance, the ultimate utilisation of the aircraft, changes to government regulations and increases... -

Page 153

...: Number of Owned Aircraft at March 31, 2016 298(a) Aircraft Type Boeing 737-800s Useful Life 23 years from date of manufacture Residual Value 15% of current market value of new aircraft, determined periodically (a) The Company operated 341 aircraft as of March 31, 2016, of which 43 were leased... -

Page 154

...and the costs associated with the restitution of major life-limited parts, are accrued and charged to profit or loss over the lease term for this contractual obligation, based on the present value of the estimated future cost of the major airframe overhaul, engine maintenance checks, and restitution... -

Page 155

...amortised cost, using the effective interest method in the balance sheet. Derivative financial instruments Ryanair is exposed to market risks relating to fluctuations in commodity prices, interest rates and currency exchange rates. The objective of financial risk management at Ryanair is to minimise... -

Page 156

... are operating leases and the associated leased assets are not recognised on the Company's balance sheet. Expenditure arising under operating leases is charged to the income statement as incurred. The Company also enters into sale-and-leaseback transactions whereby it sells the rights to an aircraft... -

Page 157

... internal reporting information provided to the chief operating decision maker, who is responsible for allocating resources and assessing performance of operating segments. The Company is managed as a single business unit that provides low fares airline-related services, including scheduled services... -

Page 158

... interest rate, the expected volatility of the Ryanair Holdings plc share price over the life of the option and other relevant factors. Nonmarket vesting conditions are taken into account by adjusting the number of shares or share options included in the measurement of the cost of employee services... -

Page 159

... as treasury shares and are presented as a deduction from total equity, until they are cancelled. Dividend distributions are recognised as a liability in the period in which the dividends are approved by the Company's shareholders. Prospective accounting changes, new standards and interpretations... -

Page 160

...Total â,¬M 7,681.6 1,217.7 (75.5) 8,823.8 2,210.5 427.3 (75.5) 2,562.3 6,261.5 Aircraft â,¬M Year ended March 31, 2015 Cost At March 31, 2014 Additions in year Disposals in year At March 31, 2015 Depreciation At March 31, 2014 Charge for year Eliminated on disposal At March 31, 2015 Net book value... -

Page 161

...'s new Boeing 737-800 "next generation" aircraft, the Company does not hold legal title to those aircraft while these loan amounts remain outstanding. At March 31, 2016, the cost and net book value of aircraft included advance payments on aircraft of â,¬687.1 million (2015: â,¬631.1 million; 2014... -

Page 162

...income statement. The investment had previously been impaired to â,¬0.50 per share in prior periods. As at March 31, 2015 Ryanair's total percentage shareholding was 29.8% (2014: 29.8%). The balance sheet value at March 31, 2015 of â,¬371.0 million (2014: â,¬260.3 million) reflected the market value... -

Page 163

... revenues are sometimes used to fund forward foreign exchange contracts to hedge U.S. dollar currency exposures that arise in relation to fuel, maintenance, aviation insurance, and capital expenditure costs and excess U.K. pounds sterling are converted into euro. Additionally, the Company swaps euro... -

Page 164

...the income statement relating to these hedges in the current year. Foreign currency forward contracts may be utilised in a number of ways: forecast U.K. pounds sterling and euro revenue receipts are converted into U.S. dollars to hedge against forecasted U.S. dollar payments principally for jet fuel... -

Page 165

...these arrangements in the current or preceding years. The European Union Emissions Trading System (EU ETS) began operating for airlines on January 1, 2012. In order to manage the risks associated with the fluctuation in the price of carbon emission credits, the Company entered into swap arrangements... -

Page 166

... cash flows associated with derivatives that are designated as cash-flow hedges were expected to occur and to impact on profit or loss, as of March 31, 2016, 2015 and 2014: Expected Cash Flows â,¬M 26.2 54.7 Carrying Amount â,¬M At March 31, 2016 Interest rate swaps U.S. dollar currency forward... -

Page 167

... position Derivative financial liabilities Interest rate swaps Related financial instruments that are not offset Restricted cash Net amount 6. Inventories (1.0) 1.6 0.6 2014 â,¬M (11.0) 13.3 2.3 Consumables 2016 â,¬M 3.3 At March 31, 2015 â,¬M 2.1 2014 â,¬M 2.5 In the view of the directors... -

Page 168

..., 2015 â,¬M 9.7 423.6 433.3 PAYE (payroll taxes) Other tax (principally air passenger duty in various countries) 2016 â,¬M 12.9 503.1 516.0 2014 â,¬M 6.7 301.4 308.1 11. Financial instruments and financial risk management The Company utilises financial instruments to reduce exposures to market... -

Page 169

...for-sale financial assets Cash and cash equivalents Financial asset: cash > 3 months Restricted cash Derivative financial instruments:- U.S. dollar currency forward contracts - Interest rate swaps - Jet fuel derivative contracts Trade receivables Other assets Total financial assets at March 31, 2015... -

Page 170

... 31, 2016 At March 31, 2015 Current and non-current maturities of debt Derivative financial instruments:-GBP currency forward contracts -Jet fuel derivative contracts -Interest rate swaps Trade payables Accrued expenses Total financial liabilities at March 31, 2015 At March 31, 2014 Current and non... -

Page 171

...The table below analyses financial instruments carried at fair value in the balance sheet categorised by the type of valuation method used. The different valuation levels are defined as follows: ï,· ï,· Level 1: Inputs are based on unadjusted quoted prices in active markets for identical instruments... -

Page 172

... into or out of Level 3 fair-value measurement. (b) Commodity risk The Company's exposure to price risk in this regard is primarily for jet fuel used in the normal course of operations. At the year-end, the Company had the following jet fuel arrangements in place: At March 31, 2016 2015 2014... -

Page 173

... of 194 Boeing 737-800 "next generation" aircraft (2015: 202; 2014: 210) were provided on the basis of guarantees granted by the Export-Import Bank of the United States. The guarantees are secured with a first fixed mortgage on the delivered aircraft. The remaining long-term debt relates to two... -

Page 174

..., aircraft provisions, trade payables and accrued expenses) at March 31, 2014 was as follows: Weighted average fixed rate (%) Fixed rate Secured long term-debt Debt swapped from floating to fixed Secured long-term debt after swaps Finance leases Total fixed rate debt Floating rate Secured long-term... -

Page 175

... payments on debt) of the Company's financial liabilities are as follows: Total Carrying Value â,¬M Total Contractual Cash flows â,¬M At March 31, 2016 Long term debt and finance leases: -Fixed rate debt (excluding Swapped debt) -Swapped to fixed rate debt - Fixed rate debt - Floating rate debt... -

Page 176

... liabilities are generally referenced to European inter-bank interest rates (EURIBOR). Secured long-term debt and interest rate swaps typically re-price on a quarterly basis with finance leases repricing on a semi-annual basis. We use current interest rate settings on existing floating rate debt at... -

Page 177

... U.K. pound sterling revenues are used to fund U.S. dollar currency exposures that arise in relation to fuel, maintenance, aviation insurance and capital expenditure costs or are sold for euro. The Company also sells euro forward to cover certain U.S. dollar costs. Further details of the hedging... -

Page 178

... to 3 years. The Board of Directors monitors the return on capital as well as the level of dividends to ordinary shareholders on an ongoing basis. The Company's revenues derive principally from airline travel on scheduled services, internet income and inflight and related sales. Revenue is primarily... -

Page 179

... proportions of debt and equity. Ryanair has generally been able to generate sufficient funds from operations to meet its non-aircraft acquisitionrelated working capital requirements. Management believes that the working capital available to the Company is sufficient for its present requirements and... -

Page 180

.... The components of the tax expense in the income statement were as follows: Year ended Year ended March 31, 2016 March 31, 2015 â,¬M â,¬M 149.2 90.1 13.6 162.8 25.6 115.7 Year ended March 31, 2014 â,¬M 31.1 37.5 68.6 Corporation tax charge in year Deferred tax charge relating to origination and... -

Page 181

...benefit pension obligations Derivative financial instruments Total tax charge in other comprehensive income The majority of current and deferred tax recorded in each of fiscal 2016, 2015 and 2014 relates to domestic tax charges and there is no expiry date associated with these temporary differences... -

Page 182

... expected timing of the outflows of economic benefits associated with the provision at March 31, 2016, 2015 and 2014 are as follows: Carrying Value â,¬M At March 31, 2016 Provision for leased aircraft maintenance 144.4 Carrying Value â,¬M At March 31, 2015 Provision for leased aircraft maintenance... -

Page 183

...as at 31 March 2016. Other movement in the share capital balance year-on-year principally relates to 0.3 million (2015: 5.0 million; 2014: 5.7 million) new shares issued due to the exercise of share options, less the cancellation of 53.5 million shares relating to share buy-backs (2015: 10.6 million... -

Page 184

... The Company has accounted for its share option grants to employees at fair value, in accordance with IFRS 2, using a binomial lattice model to value the option grants. This has resulted in a charge of â,¬5.9 million to the income statement (2015: â,¬0.5 million charge; 2014: â,¬1.9 million charge... -

Page 185

... services, internet and other related services to third parties across a European route network. The Company operates a single fleet of aircraft that is deployed through a single route scheduling system. The Company determines and presents operating segments based on the information that internally... -

Page 186

The Company's major revenue-generating asset class comprises its aircraft fleet, which is flexibly employed across the Company's integrated route network and is directly attributable to its reportable segment operations. In additio n, as the Company is managed as a single business unit, all other ... -

Page 187

... In-flight Internet income Non-flight scheduled revenue arises from the sale of rail and bus tickets, hotel reservations, car hire and other sources, including excess baggage charges and administration fees, all directly attributable to the low-fares business. All of the Company's operating profit... -

Page 188

... under finance leases Operating lease charges, principally for aircraft (i) 0.6 1.6 1.9 4.1 0.4 0.3 0.7 - 0.1 0.1 403.4 23.9 115.1 Audit services comprise audit work performed on the consolidated financial statements. In 2016, â,¬1,000 (2015: â,¬1,000; 2014: â,¬1,000) of audit fees relate to the... -

Page 189

..., 2015, and 2014 the Company did not make contributions to the defined-contribution plan for Michael O'Leary. No non-executive directors are members of the Company defined-contribution plan. (d) Shares and share options (i) Shares Ryanair Holdings plc is listed on the Irish, London and NASDAQ stock... -

Page 190

... fiscal 2015 at an exercise price of â,¬8.345 (the market value at the date of grant) and are exercisable between September 2019 and November 2021 subject to him still being an employee of the Company through July 31, 2019. In the 2016 fiscal year the Company incurred total share-based compensation... -

Page 191

... Fair value of plan assets Present value of net obligations Related deferred tax asset Net pension liability Defined-contribution schemes The Company operates defined-contribution retirement plans in Ireland and the U.K. The costs of these plans are charged to the consolidated income statement in... -

Page 192

... as the 2013 Boeing Contract. In March 2015, the Company announced the purchase of an additional three Boeing 737-800 aircraft for delivery in early 2016 on the same terms as the 2013 Boeing Contract. This brings the total "firm" new deliveries to 183 aircraft. In September 2014, the Group agreed to... -

Page 193

... the Basic Price mentioned above. At March 31, 2016 and March 31, 2015, the total potential commitment to acquire all 283 "firm" aircraft, not taking such increases and decreases into account, will be approximately U.S. $24.6 billion. Operating leases The Company financed 76 of the Boeing 737-800... -

Page 194

The following table sets out the total future minimum payments of leasing the remaining 26 aircraft (2015: 26 aircraft; 2014: 30 aircraft) under JOLCOs at March 31, 2016, 2015 and 2014, respectively: At March 31, 2015 Present value of Minimum Minimum payments payments â,¬M â,¬M 52.7 49.8 565.7 284.1... -

Page 195

... meaning of EU rules, because these arrangements were in line with market terms. In July 2012, the European Commission similarly concluded that the financial arrangements between Tampere airport in Finland and Ryanair do not constitute state aid. In February 2014, the European Commission found that... -

Page 196

... to shareholders. 26. Post-balance sheet events Following the June 23, 2016 Referendum vote by the U.K. to leave the EU, the Company announced that it had increased the size of its buy-back program to the 5% buy-back limit approved by the shareholders at the Compa ny's 2015 Annual General Meeting... -

Page 197

... to above has been consolidated in the financial statements of Ryanair Holdings plc for the years ended March 31, 2016, 2015 and 2014. The total amount of remuneration paid to senior key management (defined as the executive team reporting to the Board of Directors) and directors amounted to â,¬10... -

Page 198

Company Balance Sheet 2016 â,¬M At March 31, 2015 â,¬M 2014 â,¬M Note Non-current assets Investments in subsidiaries Current assets Loans and receivables from subsidiaries Cash and cash equivalents Total assets Current liabilities Amounts due to subsidiaries Shareholders' equity Issued share ... -

Page 199

Company Statement of Cash Flows Year ended March 31, 2016 â,¬M Operating activities Profit for the year Net cash provided by operating activities Investing activities (Increase)/decrease in loans to subsidiaries Net cash (used in)/from investing activities Financing activities Shares purchased under... -

Page 200

Company Statement of Changes in Shareholders' Equity Issued Share Capital â,¬M 9.2 Other Undenominated Capital â,¬M 0.8 - Balance at March 31, 2013 Comprehensive income Profit for the year Total comprehensive income Transactions with owners of the Company, recognised directly in equity Issue of ... -

Page 201

... employees of a subsidiary as an increase in its investment in that subsidiary. The fair value of such options is determined in a consistent manner to that set out in the Group share-based payment accounting policy and as set out in Note 15 (c) to the consolidated financial statements. Income taxes... -

Page 202

..., non-current interest bearing loans are measured at amortised cost, using the effective interest yield methodology. 30 Investments in subsidiaries Year ended March 31, 2016 â,¬M Balance at start of year New investments in subsidiaries by way of share option grant to subsidiary employees Reversal... -

Page 203

... the Company's balance sheet and all transactions entered into by the Company are euro denominated. As such, the Company does not have any significant foreign currency risk. The credit risk associated with the Company's financial assets principally relates to the credit risk of the Ryanair group as... -

Page 204

...and Other Information Directors D. Bonderman M. Cawley C. McCreevy D. McKeon K. McLaughlin H. Millar D. Milliken M. O'Brien M. O'Leary J. O'Neill J. Osborne L. Phelan Chairman Chief Executive Secretary J. Komorek Registered Office Airside Business Park Swords Co. Dublin Ireland KPMG - Chartered... -

Page 205

...a fare-paying passenger who has booked a ticket. Represents the average number of flight hours flown in service per day per aircraft for the total fleet of operated aircraft. Represents the average cost per U.S. gallon of jet fuel for the fleet (including fueling charges) after giving effect to fuel...