Restoration Hardware 2014 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2014 Restoration Hardware annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

a higher average order value as customers are inspired to purchase a full collection of products to replicate the

design aesthetic experienced in our stores. In addition, because less than 10% of our merchandise assortment is

displayed in our legacy retail stores, our store associates use iPads and other devices to allow customers to shop

our entire merchandise assortment while in the store.

We define leased selling square footage as retail space at our stores used to sell our products. Leased selling

square footage excludes backrooms used for storage, office space or similar purpose, as well as exterior sales

space located outside a store, such as courtyards, gardens and rooftops. We currently operate four distinct store

types with the following leased selling square footage as of January 31, 2015: (1) our next generation Galleries;

we opened our first next generation Gallery in Atlanta, GA in November 2014, which is approximately 46,000

leased selling square feet, (2) our initial larger format Galleries, formerly referred to as Full Line Design

Galleries, which include our Galleries in Houston, Scottsdale, Boston, Indianapolis, Greenwich, and Los

Angeles, which average approximately 18,500 leased selling square feet, (3) our Legacy Gallery format, which

average approximately 7,800 leased selling square feet, and (3) our Baby & Child Gallery format, which average

approximately 3,800 leased selling square feet. We continue to evaluate potential opportunities for stand-alone

Baby & Child Galleries in key markets.

As of January 31, 2015, we operated a total of 67 retail stores throughout the United States and Canada,

consisting of 57 Legacy Galleries, 7 larger format Galleries and 3 Baby & Child Galleries. The following list

shows the number of retail stores in each U.S. state and each Canadian province where we operate as of

January 31, 2015:

Location Store Location Store Location Store

Alabama 1 Massachusetts 1 Tennessee 1

Arizona 1 Michigan 1 Texas 6

California 16 Minnesota 1 Utah 1

Colorado 1 Missouri 2 Virginia 2

Connecticut 2 New Jersey 2 Washington 1

Florida 4 New York 2 District of Columbia 1

Georgia 1 North Carolina 2 Alberta 2

Illinois 3 Ohio 3 British Columbia 1

Indiana 1 Oklahoma 1 Ontario 2

Louisiana 1 Oregon 1

Maryland 1 Pennsylvania 2

Total 67

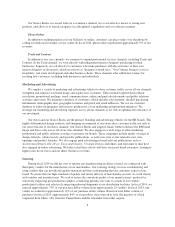

The table below highlights certain information regarding our retail stores opened and closed during the three

years ended January 31, 2015.

Fiscal Year

2014 2013 2012

Stores open at beginning of period 70 71 74

Stores opened 3 2 5

Stores closed 6 3 8

Stores open at end of period 67 70 71

We continually analyze opportunities to selectively consolidate stores in connection with openings of our

next generation Galleries or close stores which have been under-performing or are no longer consistent with our

brand positioning. In many cases, we continue to operate a store until its lease has expired in order to effect the

closure in a cost-efficient manner.

4