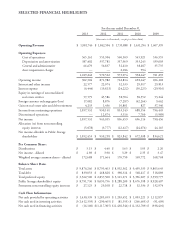

Public Storage 2013 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2013 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

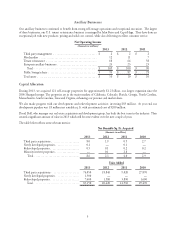

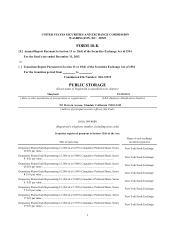

Public Storage’s Market Share Estimate

in the Top Ten Metropolitan Statistical Areas (MSA)

PSA’s Percentage

Current Change

Rank MSA Market Share from 2012

1 New York 10.3% 0.5% 1.0%

2 Los Angeles 21.8% 0.6% 1.0%

3 Chicago 16.8% 0.0% 0.8%

4 Dallas-Fort Worth 11.0% 0.2% 1.4%

5 Houston 11.7% 1.6% 1.4%

6 Philadelphia 12.9% 0.0% 0.7%

7 Washington DC 20.1% 1.2% 1.5%

8 Miami–West Palm Beach 24.6% 6.3% 1.1%

9 Atlanta 15.6% 1.4% 1.3%

10 Boston 7.1% 1.5% 0.8%

Scale is important to our business for many reasons. It enhances our brand recognition in a market (customers drive by

and see our orange doors), greatly improves the efficacy of our internet and television marketing programs, enhances our

operational efficiency and our ability to recruit, train and develop people within a market. Scale generally lowers our operating

costs and improves our competitive position.

Financing

To fund our growth, we obtained a one-year $700 million term loan from our long-time relationship bank, Wells Fargo.

I have often written about the adroit skills of our CFO, John Reyes, especially with respect to the capital markets. Given

the short-term nature of the $700 million loan, John will be busy in 2014 applying his skills to procure longer term

financing while creating significant shareholder value in the process.

Conclusion

The fundamentals of our businesses today, higher demand and modest new supply, provide a nice tailwind for solid

growth over the next couple of years. Our recent acquisition and newly developed properties will also provide another

source of growth.

Our success could not be achieved without the 5,000 plus employees who work hard to provide value and service

to our over one million customers. They are a competitive advantage that enhances our industry leading position.

Ronald L. Havner, Jr.

Chairman and CEO

February 28, 2014

Estimated Annual

Population Growth

2013-2018