Public Storage 2013 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2013 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

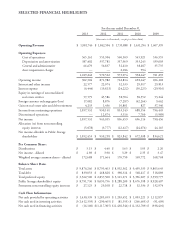

2

Operating expenses declined 1%. Lower marketing and repairs and maintenance costs were partially offset by substantially

higher property taxes. We have enjoyed three years of modest expense growth due to substantially reduced marketing, better

management of R&M and modest wage growth. We expect 2014 will return to a more normalized expense growth rate.

Net Operating Income

(Amounts in millions)

2013 2012 2011

Same Store $ 1,224 $ 1,131 $ 1,048

Acquired/redeveloped properties 102 70 51

Total $ 1,326 $ 1,201 $ 1,099

Total assets (before depreciation reserves) $ 12,176 $ 11,016 $ 10,722

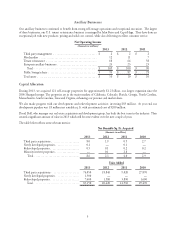

European Self-Storage

Our European operations continue to be challenged by a tough economic climate (Netherlands, one of our larger European

markets, is in its third recession in the past five years), higher VAT taxes on self-storage and persistently high unemployment.

In 2013, aggressive marketing and reduced rates stabilized occupancies. Expense growth has also been modest as we have

streamlined corporate functions, including marketing, and used the savings to invest in field personnel.

We expect a return to positive growth in 2014 consistent with better demand.

Net Operating Income

(Amounts in millions)

2013 2012 2011

Same Store $ 110 $ 114 $ 113

Acquired/developed properties 15 14 12

Total $ 125 $ 128 $ 125

Public Storage’s share $ 61 $ 61 $ 61

Total assets (before depreciation reserves) $ 1,709 $ 1,643 $ 1,596

Commercial Properties

Our commercial properties, primarily our investment in PS Business Parks (PSB), showed continued improvement, with positive

Same Park net operating income growth for the second consecutive year. Joe Russell and his team have done an excellent

job navigating PSB through the great recession and positioning it for accelerated growth as the economy improves. During

the year, PSB acquired $115 million of properties with 1.5 million net rentable sq. ft., expanding the portfolio to 30 million

sq. ft. We also invested $75 million in PSB’s secondary common offering, maintaining our equity ownership at 42%. PSB

continues to be an excellent long-term investment.

Net Operating Income

(Amounts in millions)

2013 2012 2011

PSB’s Same Park operations $ 202 $ 199 $ 193

Acquired/developed properties 39 33 2

Owned commercial properties 9 9 9

Total $ 250 $ 241 $ 204

Public Storage’s share $ 110 $ 105 $ 89

Total assets (before depreciation reserves) $ 3,284 $ 3,131 $ 3,032