Public Storage 2012 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2012 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

European Self-Storage

The European self-storage market differs from the U.S. market. Most of Western

Europe has remained in a recession for the past three years. Shurgard Europe,

our 49% owned European self-storage business, has been fortunate to generate

modest growth in net operating income for the past several years. In 2012, its modest

net operating income growth resulted primarily from reduced operating

expenses. Going into 2013, the occupancy of its European Same Store

properties was 80.9%, 2.7% below last year. Rising unemployment, a weak

housing market and an increasing tax burden will likely preclude positive

Same Store growth in 2013.

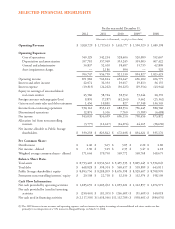

Net Operating Income: European Self-Storage

(Amounts in millions)

2012 2011 2010

Same Store $ 110 $ 108 $ 106

Acquired/developed properties 15 13 10

Total $ 125 $ 121 $ 116

Public Storage’s share $ 61 $ 61 $ 43

Total assets (before depreciation reserves) $ 1,643 $ 1,596 $ 1,618

Shurgard Europe continues to dedicate its free cash flow to reducing debt, primarily

the Wells Fargo term loan, as it seeks alternative long-term financing. Unlike the

U.S. banking system, many European banks still suffer from indigestion associated

with soured commercial real estate loans. When combined with an absence of

CMBS financing and a highly concentrated banking system (few but very large

banks), financing for all but the most credit worthy real estate companies is scarce.

Accordingly, Shurgard Europe either needs to become very credit worthy or limit its