Public Storage 2000 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2000 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

P

UBLIC

S

TORAGE

, I

NC

. 2000 A

NNUAL

R

EPORT

F

INANCIAL

R

EVIEW

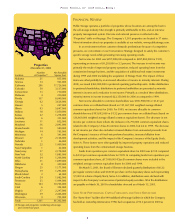

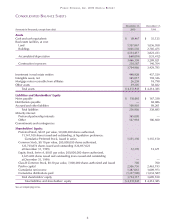

Properties

(December 31, 2000)

Number Net Rentable

Location of Properties

(1)

Square Feet

Alabama 21 835,000

Arizona 14 943,000

California 296 17,726,000

Colorado 50 3,137,000

Connecticut 13 710,000

Delaware 4 230,000

Florida 137 8,049,000

Georgia 62 3,626,000

Hawaii 5 247,000

Illinois 93 5,647,000

Indiana 18 1,050,000

Kansas 22 1,278,000

Kentucky 6 331,000

Louisiana 11 852,000

Maryland 36 2,043,000

Massachusetts 10 580,000

Michigan 14 765,000

Minnesota 6 341,000

Missouri 37 2,128,000

Nebraska 1 46,000

Nevada 22 1,409,000

New Hampshire 1 62,000

New Jersey 37 2,178,000

New York 32 1,885,000

North Carolina 24 1,266,000

Ohio 31 1,899,000

Oklahoma 8 429,000

Oregon 25 1,171,000

Pennsylvania 19 1,293,000

Rhode Island 2 64,000

South Carolina 24 1,082,000

Tennessee 25 1,494,000

Texas 164 10,766,000

Utah 6 324,000

Virginia 37 2,247,000

Washington 39 2,466,000

Wisconsin 9 703,000

Totals 1,361 81,302,000

(1) Storage and properties combining self-storage

and commercial space.

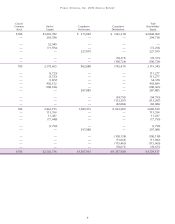

WA

39

OR

25

CA

296

NV

22

AZ

14

UT

6CO

50

NE

1

KS

22

OK

8

TX

164

MO

37

IL

93 IN

18

KY

6

OH

31

MN

6WI

9MI

14 PA

19

TN

25

AL

21

LA

11

GA

62

SC

24

FL

137

NC

24

VA

37

NY

32

MD

36

DE

4

NJ

37

CT

13

RI

2

MA

10

NH

1

HI

5

Public Storage operates a portfolio of properties whose locations are among the best in

the self-storage industry. Our strength is primarily attributable to this, and an intensive

property management system. Our size and national presence is reflected in the

“Properties” table on this page. The Company’s 1,361 properties are located in 37 states.

More information about our properties is available at our website, www.publicstorage.com.

In an environment where customer demands predominate because of competitive

pressures, we concentrate on our Convenience Strategy, designed to satisfy the customer’s

specific storage needs while generating increasing operating results.

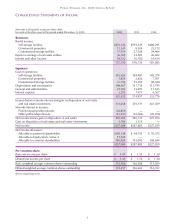

Net income for 2000 was $297,088,000 compared to $287,885,000 for 1999,

representing an increase of $9,203,000 or 3.2 percent. The increase in net income was

primarily the result of improved property operations, reduced operating losses from the

containerized storage business, and the acquisition of additional real estate investments

during 1999 and 2000 (including the acquisition of Storage Trust). The impact of these

items was offset partially by an increased allocation of income to minority interests. During

2000, we issued $365,000,000 in preferred operating partnership units. Unlike distributions

to preferred shareholders, distributions to preferred unitholders are presented as minority

interest in income and a reduction in net income. Primarily as a result of these distributions,

minority interest in income increased $22,350,000 for 2000 as compared to 1999.

Net income allocable to common shareholders was $185,908,000 or $1.41 per

common share on a diluted basis (based on 131,657,000 weighted average diluted

common equivalent shares) for 2000. For 1999, net income allocable to common

shareholders was $193,092,000 or $1.52 per common share on a diluted basis (based on

126,669,000 weighted average diluted common equivalent shares). The decrease in net

income per common share reflects the inclusion of 6,790,000 common equivalent shares

related to the Company’s Class B common shares in 2000, but not in 1999. The decrease

in net income per share also includes increased dilution from uninvested proceeds from

the Company’s issuance of fixed-rate preferred securities, increased dilution from

development activities, and the impact of the Company’s issuance of the Equity Stock,

Series A. These factors were offset partially by improved property operations and reduced

operating losses from the containerized storage business.

Funds from operations per common equivalent share for 2000 was $2.59 compared

to $2.50 per common equivalent share for 1999. In computing funds from operations per

common equivalent share, all 7,000,000 Class B common shares were included in the

weighted average common equivalent shares for 2000 and 1999.

On March 5, 2001, the Board of Directors declared quarterly distributions of $0.22

per regular common share and $0.6125 per share on the depositary shares each representing

1/1,000 of a share of Equity Stock, Series A. In addition, distributions were declared with

respect to the Company’s various series of preferred equity securities. All of the distributions

are payable on March 30, 2001 to shareholders of record as of March 15, 2001.

S

AME

S

TORE

P

ERFORMANCE

, C

APITAL

F

ORMATION AND

S

TOCK

R

EPURCHASE

The “Same Store” facilities (the 949 stabilized self-storage facilities in which the Company

has held an ownership interest since 1994) had occupancies of 92.3 percent in 2000 as