Public Storage 2000 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2000 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

P

UBLIC

S

TORAGE

, I

NC

. 2000 A

NNUAL

R

EPORT

18

Construction in process consists primarily of 53 new facilities and 25 expansions of existing facilities with total incurred costs of

approximately $234.3 million (of which 6 facilities with total incurred costs of approximately $23.8 million are held by the second

joint venture), as well as costs associated with facilities we have not acquired the land for.

At December 31, 2000, the unaudited adjusted basis of real estate facilities for Federal income tax purposes was approximately

$3.0 billion.

Note 5 —

Investments in Real Estate Entities

Summarized combined financial data with respect to those real estate entities in which the Company had an ownership interest at

December 31, 2000 are as follows:

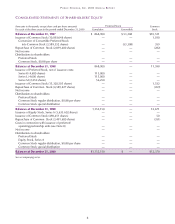

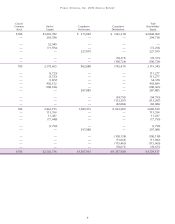

(Amounts in thousands) Other Development

For the year ended December 31, 2000: Equity Investments Joint Venture PSB Total

Rental income $ 41,240 $ 25,548 $144,171 $ 210,959

Other income 1,880 699 6,463 9,042

Total revenues 43,120 26,247 150,634 220,001

Cost of operations 10,469 9,346 39,290 59,105

Depreciation and amortization 4,437 6,290 35,637 46,364

Other expenses 5,700 1,641 5,890 13,231

Total expenses 20,606 17,277 80,817 118,700

Net income before minority interest and gain on

real estate investments 22,514 8,970 69,817 101,301

Minority interest ——(26,741) (26,741)

Income before gain on real estate investments 22,514 8,970 43,076 74,560

Gain on real estate investments ——8,105 8,105

Net income $ 22,514 $ 8,970 $ 51,181 $ 82,665

At December 31, 2000:

Real estate, net $ 67,580 $219,043 $864,711 $1,151,334

Total assets $100,129 $222,670 $930,756 $1,253,555

Total liabilities $ 40,332 $ 3,899 $ 59,935 $ 104,166

Preferred equity $ — $ — $199,750 $ 199,750

Total common/partners’ equity $ 59,797 $218,771 $671,071 $ 949,639

The Company’s investment (book value) at

December 31, 2000 $123,743 $ 65,631 $259,554 $ 448,928

The Company’s effective average ownership interest

at December 31, 2000

(A)

44% 30% 42%

(A) Reflects our ownership interest with respect to total common/partners’ equity.

At December 31, 2000, our investments in real estate entities consist of ownership interests in 11 partnerships, which principally

own self-storage facilities, and an ownership interest in PSB. Such interests are non-controlling interests of less than 50% and are

accounted for using the equity method of accounting. Accordingly, earnings are recognized based upon our ownership interest in

each of the partnerships. The accounting policies of these entities are similar to the Company’s. During 2000, 1999 and 1998,

we recognized earnings from our investments of $36,109,000, $32,183,000 and $26,602,000, respectively, and received cash

distributions totaling $16,984,000, $15,949,000 and $17,968,000, respectively. In addition, during 2000, we recognized a gain of

$3,210,000, representing our share of PSB’s gains on sale of real estate and real estate investments; this gain is presented as “Gain

on the disposition of real estate and real estate investments”.

During 2000, we disposed of investments in real estate entities, for total proceeds of $47,875,000. We recorded a net gain of

$280,000 as “Gain on the disposition of real estate and real estate investments” representing the difference between our cost and

the proceeds received.