Public Storage 1997 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 1997 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

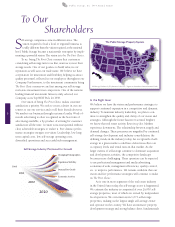

$8.76 per square foot for 1996.

Realized rent per square foot

represents the actual revenue

earned per occupied square foot.

This is believed to be a more

relevant measure than posted or

scheduled rates, since posted

rates can be discounted through

promotions. Same Store rental

income increased 6.6 percent

($475.2 million for 1997 versus

$445.6 million for 1996). Same

Store cost of operations increased

6.0 percent ($167.7 million for

1997 versus $158.2 million

for 1996).

Dividend

The Board of Directors declared

a $.22 per common share

quarterly dividend on March 2,

1998, along with quarterly

dividends on the Company’s

various series of preferred

stock. Distributions are payable

on March 31, 1998 to share-

holders of record as of the close

of business on March 16, 1998.

Dividends of $.88 per share

were paid on the common

stock in 1997.

The Company believes

that its practice of minimizing

distributions adds to share-

holder value. Retaining a sub-

stantial portion of funds from

operations (after funding distrib-

utions and capital improve-

ments) enables the Company to

acquire and develop properties,

invest in its other operations,

and reduce debt using internal

cash resources. This is one of the

ways the Company believes its

vision and strategies separate

it from its competitors. The

Company distributed 44 per-

cent of funds from operations

per common share for 1997 and

43 percent for 1996. Through its

relatively moderate payout ratio

in 1997 it retained $78.5 million

of capital ($110.2 million adding

back losses on PSPUD operations) to

purchase and develop properties

and invest in its other operations.

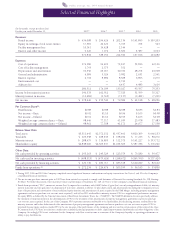

0

0.5

1.0

1.5

2.0

2.5

$3.0

1995 1996 1997

Shareholders’ Equity

In Billions

Public Storage, Inc. 1997 Annual Report

7

0

2.00

4.00

6.00

8.00

$10.00

1995 1996 1997

Annual Realized Rent

Per Square Foot

Same Store Facilities

(1)

(1) “Same Store” refers to self-storage

facilities in which the Company had

an interest since January 1, 1993.

$8.40 $8.76 $9.24

0

.50

1.00

1.50

2.00

$2.50

Funds From Operations

Per Diluted Common Share

(1)

1995 1996 1997

(1) Assumes conversion of the Company’s

Convertible Preferred Stock into

common stock.

$1.73

$1.98 $1.97

0

2

4

6

8

10%

1995 1996 1997

Debt as Percent of

Shareholders’ Equity

82

84

86

88

90

92%

1995 1996 1997

Weighted Average

Occupancy Levels

Same Store Facilities

(1)

(1) “Same Store” refers to self-storage

facilities in which the Company had

an interest since January 1, 1993.

7

0

50

100

150

$200

1995 1996 1997

Funds From Operations

Allocable to

Common Shareholders

In Millions

0

50

100

150

$200

1995 1996 1997

Net Income

In Millions

0

1.0

2.0

3.0

$4.0

1995 1996 1997

Total Assets

In Billions

0

100

200

300

400

$500

Total Revenues

In Millions

1995 1996 1997