Public Storage 1997 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 1997 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

Public Storage, Inc. 1997 Annual Report

Summarized combined financial data (based on historical cost) with respect to those real estate entities in which the Company had an

ownership interest at December 31, 1997 are as follows:

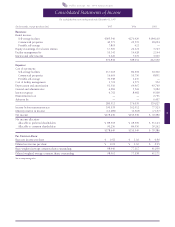

(In thousands) 1997 1996

Year ended December 31,

Rental income $ 94,652 $ 86,581

Total revenues $ 96,650 $ 87,945

Cost of operations $ 33,077 $ 30,306

Depreciation $ 12,805 $ 11,648

Net income $ 40,775 $ 35,660

At December 31,

Total assets, net of accumulated depreciation $467,002 $363,490

Total debt $ 77,513 $ 80,549

Total equity $370,546 $271,623

As indicated above, in April 1997, the Company and a state pension fund formed a joint venture partnership for the purpose of developing

up to $220 million of self-storage facilities. As of December 31, 1997, the joint venture partnership had completed construction on seven

self-storage facilities with a total cost of approximately $40.8 million, and had 17 facilities under construction with an aggregate cost

incurred to date of approximately $48.9 million and total additional estimated cost to complete of $29.3 million. The partnership is funded

solely with equity capital consisting of 30% from the Company and 70% from the state pension fund.

Note 6. Revolving Line of Credit

As of December 31, 1997, the Company had borrowings of $7 million (none at March 27, 1998) on its unsecured credit agreement with

a group of commercial banks. The credit agreement (the “Credit Facility”) has a borrowing limit of $150 million and an expiration date

of July 31, 2001. The expiration date may be extended by one year on each anniversary of the credit agreement. Interest on outstanding

borrowings is payable monthly. At the option of the Company, the rate of interest charged is equal to (i) the prime rate or (ii) a rate ranging

from the London Interbank Offered Rate (“LIBOR”) plus 0.40% to LIBOR plus 1.10% depending on the Company’s credit ratings and

coverage ratios, as defined. In addition, the Company is required to pay a quarterly commitment fee of 0.250% (per annum) of the unused

portion of the Credit Facility. The Credit Facility allows the Company, at its option, to request the group of banks to propose the interest rate

they would charge on specific borrowings not to exceed $50 million; however, in no case may the interest rate proposal be greater than the

amount provided by the Credit Facility.

Under covenants of the Credit Facility, the Company is required to (i) maintain a balance sheet leverage ratio of less than 0.40 to 1.00,

(ii) maintain net income of not less than $1.00 for each fiscal quarter, (iii) maintain certain cash flow and interest coverage ratios (as defined)

of not less than 1.0 to 1.0 and 5.0 to 1.0, respectively and (iv) maintain a minimum total shareholders’ equity (as defined). In addition, the

Company is limited in its ability to incur additional borrowings (the Company is required to maintain unencumbered assets with an aggregate

book value equal to or greater than three times the Company’s unsecured recourse debt) or sell assets. The Company was in compliance with

the covenants of the Credit Facility at December 31, 1997.

Note 7. Notes Payable

Notes payable at December 31, 1997 and 1996 consist of the following:

1997 1996

Carrying Carrying

(In thousands) amount Fair value amount Fair value

7.08% unsecured senior notes, due November 2003 $53,250 $ 53,250 $ 59,750 $ 59,750

Mortgage notes payable:

10.55% mortgage notes secured by real estate facilities,

principal and interest payable monthly, due August 2004 30,355 34,571 32,115 34,964

7.07% to 11.00% mortgage notes secured by real estate

facilities, principal and interest payable monthly, due at

varying dates between July 1998 and September 2028 12,953 12,953 16,578 16,578

$96,558 $100,774 $108,443 $111,292

During 1995, in connection with the PSMI Merger, the Company assumed the 7.08% unsecured senior notes payable. The senior notes

require interest and principal payments to be paid semi-annually and have various restrictive covenants, all of which have been met at

December 31, 1997.