Progressive 2005 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2005 Progressive annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

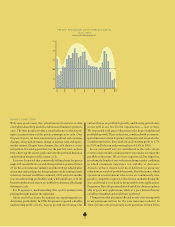

INVESTMENTS AND CAPITAL MANAGEMENT

Solid growth in the economy and improving profits supported the

equity markets in 2005 while “measured” interest rate increases

from the Federal Reserve pushed short-term rates higher to essen-

tially flat with steady longer maturity yields. We took advantage

of interest rate volatility during the year to shorten our portfolio’s

average maturity when rates were low and extend it when rates

increased. We decreased our exposure to corporate and other non-

government issued bonds early in the year, believing the incremen-

tal yield premium relative to U.S. treasury bonds was insufficient

for the risk taken. Our portfolio produced a 4% total return

in 2005 with equities tracking their benchmark and fixed-income

securities performing better than the general bond market.