Principal Financial Group 2013 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2013 Principal Financial Group annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

I’ve been fortunate to spend my entire career at the Principal

Financial Group® (The Principal®). You may wonder why, after

more than 40 years, I’m still excited to come to work each day.

There are lots of reasons.

This is why:

Purpose

The need for our products and services is greater than ever

before. That gives us purpose.

• There are currently more than 1 billion people over the

age of 60 worldwide. That number is expected to double

by 20501.

• $2.4 trillion. That’s what U.S. households spent on credit

cards in 20122 – more than 10 times the amount employees

contributed to 401(k)s and other private defi ned contribu-

tion retirement plans3. We have to change this.

• According to the Employee Benefi ts Research Institute, less

than 2 percent of U.S. workers identify retirement planning

as their most pressing fi nancial issue, and 43 percent

of workers reported neither they nor their spouse are

currently saving for retirement4. We need to do a better job

of teaching fi nancial literacy.

• By 2025, millennials, also known as Gen Y or those born

in the ’80s and ’90s, will make up the majority of the

workforce5. We need to help them secure their fi nancial

future.

Pride

The Principal is uniquely positioned to fulfi ll these massive

needs. We’re executing the right strategy at the right time in

the right markets. That gives all of us at The Principal pride

in what we do.

People

In fulfi lling those needs, I get to work with some of the most

talented, committed individuals you’ll ever fi nd—in offi ces

around the globe. Our people keep me coming back, day

after day.

1 - U.N. Department of Economic and Social Affairs; 2 - U.S. Census Bureau estimate;

3 - Based on Cerulli estimates for 2012; 4 - 2013 Retirement Confi dence Survey,

Employee Benefi ts Research Institute, March 2013; 5 – GenY Women in the Work-

place, BPW Foundation, April 2011.

So there’s the why. But in a competitive and ever-changing

industry, how is The Principal able to fulfi ll our commitments

to customers, advisors and shareholders?

This is how:

Executing our strategy

A sound strategy, strong business fundamentals and effective

execution yield strong fi nancial results. That’s exactly what

The Principal achieved in 2013:

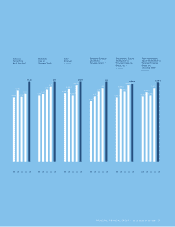

• Total company operating earnings were a record at nearly

$1.1 billion.

• Net income grew 14 percent compared to 2012.

• Return on equity increased to 12.1 percent.

• Assets under management were a record $483 billion as of

Dec. 31, 2013.

• Total company net cash fl ows were $17.4 billion.

Three of our businesses hit a signifi cant milestone in 2013.

Principal International and Principal Funds each crossed the

$100 billion mark in assets under management. And Principal

Global Investors crossed the same mark in third-party assets.

All three were aspirational businesses for us a little more than

a decade ago; today they account for the majority of our assets

under management.

LARRY ZIMPLEMAN

Chairman, President and Chief Executive Offi cer

2 2013 YEAR IN REVIEW | PRINCIPAL FINANCIAL GROUP

DEAR

FELLOW

SHAREHOLDERS