Principal Financial Group 2013 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2013 Principal Financial Group annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THIS IS HOW:

SO IS

OUR

BOUTIQUE

STRATEGY

“When it comes to long-term investing, distraction is the enemy,” says Jim McCaughan, president of

Global Asset Management. “Our clients want investment teams who spend their entire day intensely

involved in the marketplace, understanding what’s going on both tactically and strategically. Preferred

securities, high yield bonds, emerging market equities, currency, real estate debt—those are all very different

markets, and you need people who are 100 percent absorbed in them to be successful.”

Our multi-boutique approach combines asset-management boutiques with a common operational support

structure. Each boutique can maintain its individual, independent investment process and culture, while

Principal Global Investors provides the operational support and distribution reach each needs to prosper.

Case in point: In 2011 we acquired a majority stake in Origin Asset Management, a London-based global

equity specialist. The transaction enhanced our global equity capabilities. It also benefited Origin. Nigel

Dutson, managing partner of Origin, explains, “The Principal’s global presence, product development

expertise and support infrastructure have enhanced our business, while we’ve been able to maintain our

operating independence and distinctive investment process.” The end result is a stronger offering for clients.

Take that example. Multiply it by the 17 Principal Global Investors boutiques. That’s a powerful franchise.

PRINCIPAL FINANCIAL GROUP | 2013 YEAR IN REVIEW 13

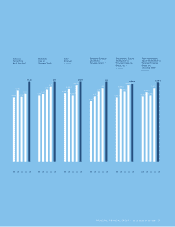

Spectrum

Asset

Management

CIMB Principal

Islamic Asset

Management

Principal

Global

Equities

REITs

CMBS

Principal

Global Fixed

Income

Columbus

Circle

Investors

Edge Asset

Management

Origin Asset

Management

Finisterre

Capital

Liongate

Capital

Management

Macro

Currency

Group

Post

Advisory

Group

Morley

Financial

Services

Multi-Asset

Advisors

Private

Real Estate

Principal

Enterprise

Capital

PRINCIPAL

GLOBAL

INVESTORS

More than a collection

of boutiques, Principal

Global Investors’ multi-

boutique business model

offers control where

it’s needed, intensive

collaboration where

it drives growth and

profitability, and

autonomy in the core

investment process.