Principal Financial Group 2013 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2013 Principal Financial Group annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 LETTER FROM OUR CHAIRMAN

5 LETTER FROM OUR BOARD

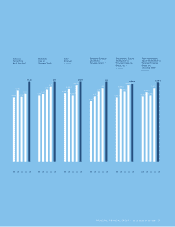

6 2013 FINANCIAL HIGHLIGHTS

8 THIS IS WHY. THIS IS HOW.

16 THE PRINCIPAL AT A GLANCE

18 2013 NON-GAAP FINANCIAL MEASURES

19 BOARD OF DIRECTORS

20 SENIOR MANAGEMENT

21 REPORTABLE SEGMENTS AND PRINCIPAL FUNDS

This 2013 Year in Review provides a company overview and financial highlights. For complete financial statements, including notes and management’s discussion and

analysis of financial condition and results of operations, please refer to the 2013 Form 10-K filed by the company with the Securities and Exchange Commission, which

can be found at www.principal.com/10k.

Certain statements made by the company which are not historical facts may be considered forward-looking statements, including, without limitation, statements as to operating earnings,

net income available to common stockholders, net cash flows, realized and unrealized gains and losses, capital and liquidity positions, sales and earnings trends, and management’s beliefs,

expectations, goals and opinions. The company does not undertake to update these statements, which are based on a number of assumptions concerning future conditions that may ultimately

prove to be inaccurate. Future events and their effects on the company may not be those anticipated, and actual results may differ materially from the results anticipated in these forward-looking

statements. The risks, uncertainties and factors that could cause or contribute to such material differences are discussed in the company’s annual report on Form 10-K for the year ended Dec.

31, 2013, filed by the company with the Securities and Exchange Commission, as updated or supplemented from time to time in subsequent filings. These risks and uncertainties include, without

limitation: adverse capital and credit market conditions may significantly affect the company’s ability to meet liquidity needs, access to capital and cost of capital; continued difficult conditions in

the global capital markets and the economy generally; continued volatility or further declines in the equity markets; changes in interest rates or credit spreads; the company’s investment portfolio

is subject to several risks that may diminish the value of its invested assets and the investment returns credited to customers; the company’s valuation of securities may include methodologies,

estimations and assumptions that are subject to differing interpretations; the determination of the amount of allowances and impairments taken on the company’s investments requires

estimations and assumptions that are subject to differing interpretations; gross unrealized losses may be realized or result in future impairments; competition from companies that may have

greater financial resources, broader arrays of products, higher ratings and stronger financial performance; a downgrade in the company’s financial strength or credit ratings; inability to attract

and retain sales representatives and develop new distribution sources; international business risks; the company’s actual experience could differ significantly from its pricing and reserving

assumptions; the company’s ability to pay stockholder dividends and meet its obligations may be constrained by the limitations on dividends or distributions Iowa insurance laws impose on

Principal Life; the pattern of amortizing the company’s DAC and other actuarial balances on its universal life-type insurance contracts, participating life insurance policies and certain investment

contracts may change; the company may need to fund deficiencies in its “Closed Block” assets that support participating ordinary life insurance policies that had a dividend scale in force at the

time of Principal Life’s 1998 conversion into a stock life insurance company; the company’s reinsurers could default on their obligations or increase their rates; risks arising from acquisitions

of businesses; changes in laws, regulations or accounting standards; a computer system failure or security breach could disrupt the company’s business, and damage its reputation; results of

litigation and regulatory investigations; from time to time the company may become subject to tax audits, tax litigation or similar proceedings, and as a result it may owe additional taxes,

interest and penalties in amounts that may be material; fluctuations in foreign currency exchange rates; and applicable laws and the company’s certificate of incorporation and by-laws may

discourage takeovers and business combinations that some stockholders might consider in their best interests.

“The Principal Financial Group” and “The Principal” are registered service marks of Principal Financial Services, Inc., a member of the Principal Financial Group.

To see an expanded version of the 2013 Year in Review, visit

www.principal.com/yearinreview