Polaris 2007 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2007 Polaris annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 ANNUAL REPORT ONE

Dear Fellow Shareholders:

A year ago, Polaris developed an ambitious three-year plan for

getting back to great. Investors were understandably skeptical.

Our 2006 performance was disappointing. And 2007 looked bleak:

The housing market crashed. The economy was slow. Durable

goods were hit hard and discretionary goods even harder.

But we made the tough decisions and took bold actions. We

reduced inventory at the dealer and factory levels and streamlined

operations well before competitors. We did this while continuing

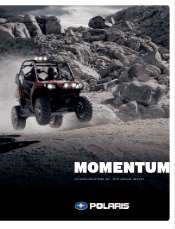

to introduce revolutionary new products like the RANGER RZR

and Victory Vision, and gained market share in every business,

both domestically and internationally.

As a result, we delivered a strong 2007 and got the company

back on track. Here’s a quick recap of 2007:

• Sales increased by 7 percent to $1.78 billion.

• Earnings per share from continuing operations increased

14 percent to $3.10 per diluted share.

• Gross margins increased by 40 basis points to 22.1 percent.

• We won the competitive battle in 2007. We gained market

share in every business we compete in — both in North America

and internationally.

• Dealer inventories are at much lower levels today than a year ago.

• We grew aggressively in our side-by-side business, particularly

with the introduction of the new RANGER RZR, and made

good progress in further developing our military business.

• Our snowmobile business is on the road to recovery. We grew

sales 14 percent in 2007 and gained market share for the

calendar year.

• The accelerated share repurchase transaction executed in

December 2006, together with the 1.9 million shares repurchased

during 2007, have resulted in a 12 percent reduction in average

diluted shares outstanding in 2007.

• Our total annual return to shareholders was 5 percent. Over

the past five years, our total return to shareholders has been

83 percent.

As in most years, there were some things that did not go well in 2007:

• We expected the overall North American core ATV market

environment to remain challenging in 2007, and that was the

case. But it was even tougher than we expected, declining

13 percent for the full year.

• Even more unexpected was the decline of the U.S. motorcycle

industry. It had grown consistently for 16 years, but the cruiser

and touring markets combined declined 5 percent in 2007.

The slowdown in the motorcycle industry negatively impacted

the cruiser side of our motorcycle business, so we reduced

cruiser production to maintain a balance of supply and demand.

However, we continue to be excited about our Victory motorcycle

business, and particularly the luxury touring segment we

entered in 2007 with the all-new Victory Vision.

• We did not anticipate the significant decline in our financial

services income during the second half of 2007. This was due

to our revolving retail credit provider, HSBC, no longer financing

non-Polaris products at our dealerships beginning July 2007.

A LETTER FROM THE CEO AND COO

Thomas C. Tiller

Chief Executive Officer

Bennett J. Morgan

President and

Chief Operating Officer