Plantronics 2003 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2003 Plantronics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

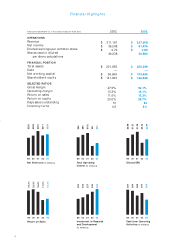

NOTE 3. DETAILS OF CERTAIN BALANCE SHEET ACCOUNTS

March 31,

(in thousands) 2002 2003

Accounts receivable, net:

Accounts receivable $58,195 $65,931

Less: sales returns, promotions and rebates (11,347) (12,067)

Less: allowance for doubtful accounts (3,010) (3,361)

$43,838 $50,503

Inventory, net:

Finished goods $23,576 $18,273

Work in process 831 1,229

Purchased parts 18,068 22,664

Less: allowance for excess and obsolete inventory (6,372) (8,408)

$36,103 $33,758

Property, plant and equipment, net:

Land $4,693 $4,693

Buildings and improvements (useful life 7-30 years) 16,350 19,189

Machinery and equipment (useful life 2-10 years) 52,747 61,496

73,790 85,378

Less: accumulated depreciation (38,090) (48,421)

$35,700 $36,957

Accrued liabilities:

Employee benefits $11,008 $12,283

Accrued advertising and sales and marketing 1,938 2,150

Warranty accrual 6,420 5,905

Accrued other 6,502 6,897

$25,868 $27,235

NOTE 4. DEBT

We have an unsecured revolving credit facility and letter of credit subfacility, with a major

bank for $75 million that matures on July 31, 2003. Any principal outstanding bears interest at

our choice of prime rate minus 1% or LIBOR plus 0.875%, depending on the rate choice and

performance level ratios. As of March 31, 2003, we had no borrowings under the revolving

credit facility and $0.9 million outstanding under the letter of credit subfacility. The revolving

credit facility includes certain covenants including a net funded debt to EBITDA ratio, an

interest coverage ratio, and a quick ratio, that materially limit our ability to incur debt and pay

dividends, among other matters. We were in compliance with the terms of the covenants as of

March 31, 2003.

34

Notes to Consolidated Financial Statements

In January 2003, the FASB issued Financial Interpretation No. 46 (“FIN 46”), “Consolidation

of Variable Interest Entities, an Interpretation of ARB No. 51.” FIN 46 requires certain

variable interest entities to be consolidated by the primary beneficiary of the entity if the

equity investors in the entity do not have the characteristics of a controlling financial interest

or do not have sufficient equity at risk for the entity to finance its activities without additional

subordinated financial support from other parties. FIN 46 is effective for all new variable

interest entities created or acquired after January 31, 2003. For variable interest entities

created or acquired prior to February 1, 2003, the provisions of FIN 46 must be applied for the

first interim or annual period beginning after June 15, 2003. We believe that the adoption of

FIN 46 will not have a material impact on our financial position or results of operations.

In April 2003, the FASB issued SFAS No. 149, “Amendment of Statement 133 on Derivative

Instruments and Hedging Activities.” SFAS 149 amends and clarifies accounting for

derivative instruments, including certain derivative instruments embedded in other

contracts, and for hedging activities under SFAS 133. In particular, this Statement clarifies

under what circumstances a contract with an initial net investment meets the characteristic

of a derivative and when a derivative contains a financing component that warrants special

reporting in the statement of cash flows. This Statement is generally effective for contracts

entered into or modified after June 30, 2003 and is not expected to have a material impact on

our financial statements.

Reclassifications. Certain reclassifications have been made to prior year balances in order to

conform to the current year presentation.