Plantronics 2003 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2003 Plantronics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.21

In fiscal 2002, the overall decrease in the level of spending compared with fiscal 2001 was

consistent with the decline in revenues. The reduction in expenses in fiscal 2002 was

attributable to Plantronics focusing on certain limited sales and marketing programs that we

believed gave us a positive return on investment.

General and administrative expenses increased as a percentage of net sales in fiscal 2003

compared to fiscal 2002, mainly driven by higher legal expenses, a larger provision for doubtful

accounts, and the inclusion of a full year of expenses relating to Ameriphone. General and

administrative expenses in fiscal 2002 increased as a percentage of net sales from fiscal 2001,

mainly driven by higher legal expenses, the addition of Ameriphone’s general and

administrative expenses from the date of acquisition during the fourth quarter of fiscal 2002,

and the decline in revenues.

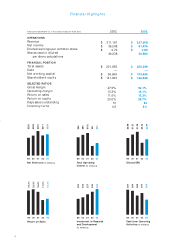

Operating Income. Operating income in fiscal 2003 increased 32.0% to $54.5 million (16.1%

of net sales), compared to $41.3 million (13.3% of net sales) in fiscal 2002. Operating income

in fiscal 2002 decreased 59.5% compared to $102.0 million (26.1% of net sales) in fiscal 2001.

In fiscal 2003, the increase in operating income over fiscal 2002 was primarily driven by

improved gross margin on higher net sales. In fiscal 2002, the decrease in operating income

over fiscal 2001 was primarily driven by lower net sales and the corresponding decrease in

gross profit.

Interest and Other Income, Net. Interest and other income in fiscal 2003 increased $0.4

million to $2.3 million compared to $1.9 million in fiscal 2002, which in turn increased $1.8

million compared to $0.1 million in fiscal 2001. The increase in interest and other income in

fiscal 2003 was primarily attributable to foreign exchange gains due to more favorable

European exchange rates. The increase in interest and other income in fiscal 2002 was also

due to foreign exchange gains as the Euro and Great British Pound values strengthened

against the dollar. Foreign currency transaction losses, net of the effect of hedging activity, for

fiscal 2001 and 2002 were $2.2 million, and $0.4 million, respectively. Foreign currency

transaction gains, net of the effect of hedging activity for fiscal 2003 were $0.9 million.

Income Tax Expense. In fiscal 2003, 2002, and 2001, income tax expense was $15.3 million,

$7.0 million, and $28.6 million, respectively. Our effective tax rates for these years were 27%,

16%, and 28%, and included tax benefits of $1.7 million and $5.1 million, in 2003 and 2002,

respectively, arising from expiration of statutes of limitations and a favorable tax assessment.

In fiscal 2004, we expect the effective tax rate to be approximately 30%.*

20

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

We recognize that although certain economic indicators have improved, the overall economic

environment remains uncertain, and we thus remain cautiously optimistic concerning the

overall demand for our products in the current economic environment and the upcoming

fiscal year. *

Gross Profit. Gross profit in fiscal 2003 increased 14.3% to $168.9 million (50.1% of net

sales), compared to $147.8 million (47.5% of net sales) in fiscal 2002. Gross profit in fiscal 2002

decreased 29.5% compared to gross profit of $209.8 million (53.7% of net sales) in fiscal 2001.

In fiscal 2003, the increase in gross profit as a percentage of net sales was favorably affected by

foreign exchange rates and the achievement of cost reduction goals during the year. In

addition, we were successful at better inventory management which led to lower requirements

for provisions relating to excess and obsolete material. We also experienced lower

requirements for warranty and improved factory utilization due to higher volumes on

relatively fixed manufacturing overhead.

In fiscal 2002, the decrease in gross profit as a percentage of net sales compared to fiscal 2001

mainly reflected the decline in revenues of our higher margin office and contact center

products and a resulting mix shift to lower margin products, particularly our mobile products.

Lower sales volume resulted in fixed overhead costs being spread over a smaller number of

units, causing gross margin to decline. We also increased our warranty provision and our

provision for excess and obsolete inventory during fiscal 2002, reflecting our emphasis on more

consumer-oriented products with higher return rates and more volatile demand.

Research, Development and Engineering. Research, development and engineering

expenses in fiscal 2003 increased 11.8% to $33.9 million (10.0% of net sales), compared to

$30.3 million (9.7% of net sales) in fiscal 2002. Research, development and engineering

expenses in fiscal 2002 increased 12.2% compared to $27.0 million (6.9% of net sales) in fiscal

2001. The increases in these expenses in fiscal 2003 and fiscal 2002 reflected a marked

increase in the number of products in the pipeline at a particularly active stage of

development, our continued investment in new product development including Bluetooth™

and other wireless technologies, and a general broadening of our product line in each of our

markets. As a result of the number of products in the development pipeline and key process

improvements in development, we expect a modest decline in our product development

expense as a percentage of net sales in fiscal 2004.*

Selling, General and Administrative. Selling, general and administrative expenses in

fiscal 2003 increased 5.7% to $80.6 million (23.9% of net sales), compared to $76.3 million

(24.5% of net sales) in fiscal 2002. Selling, general and administrative expenses in fiscal 2002

decreased 5.6% compared to $80.8 million (20.7% of net sales) in fiscal 2001. The overall

increase in the level of spending in fiscal 2003 was to support increased revenues and also

reflected the strengthening of the Euro and the Great British Pound against the dollar during

the year, which increased the cost of marketing programs in Europe.