Plantronics 2003 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2003 Plantronics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

In July 2002, we renewed our revolving credit facility with a major bank at $75 million,

including a $10 million letter of credit subfacility. The renewed facility and subfacility both

expire on July 31, 2003, and we intend to renew these facilities in the ordinary course of

business. As of April 30, 2003, we had no cash borrowings under the revolving credit facility

and $0.9 million outstanding under the letter of credit subfacility. The terms of the credit

facility contain covenants including a net funded debt to earnings before income taxes,

depreciation and amortization (“EBITDA”) ratio, an interest coverage ratio, and a quick ratio,

that materially limit our ability to incur debt and pay dividends, among other matters. These

covenants may adversely affect our financial position to the extent we cannot comply with

them. We are currently in compliance with the covenants under this agreement.

Beginning in the first quarter of fiscal year 2002, and throughout fiscal 2003, we entered into

foreign currency forward-exchange contracts, which typically mature in one month, to hedge

the exposure to foreign currency fluctuations of expected foreign currency-denominated

receivables, payables and cash balances. We record on the balance sheet at each reporting

period the fair value of our forward-exchange contracts and record any fair value adjustments

in results of operations. Gains and losses associated with currency rate changes on the

contracts are recorded as other income (expense), offsetting transaction gains and losses on the

related assets and liabilities.

In April of 2003, Plantronics began an additional hedging program to hedge a portion of Euro

and Great British Pound revenues with put and call option contracts.

The following table summarizes our contractual obligations that were reasonably likely to

occur as of March 31, 2003, and the effect such obligations are expected to have on our

liquidity and cash flows in future periods.

CONTRACTUAL OBLIGATIONS

Payments Due by Period

March 31, 2003 Less than 1 - 3 4 - 5 After 5

(in thousands) Total 1 year years years years

Operating leases $11,050 $ 2,556 $3,294 $1,443 $ 3,757

Unconditional purchase obligations 28,874 28,874 — — —

Forward exchange contracts 3,200 3,200 — — —

Total contractual cash obligations $43,124 $ 34,630 $3,294 $1,443 $ 3,757

We believe that our current cash, cash equivalents, and marketable securities balances

together with anticipated cash flows from operations, will be sufficient to fund operations for

at least the next 12 months.* However, any projections of future financial needs and sources

of working capital are subject to uncertainty. See “Certain Forward-Looking Information”

included herein and “Risk Factors Affecting Future Operating Results” set forth in our 2003

Annual Report on Form 10-K, as filed with the Securities and Exchange Commission, for

factors that could affect our estimates of future financial needs and sources of working capital.

22

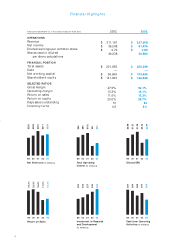

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

FINANCIAL CONDITION

Operating Activities. During the fiscal year ended March 31, 2003, we generated $50.1

million of cash from operating activities, due primarily to $41.5 million in net income,

depreciation and amortization of $11.5 million, an income tax benefit of $2.4 million associated

with the exercise of stock options, a decrease of $2.3 million in inventory and an increase of

$1.4 million in accrued liabilities, respectively, offset by an increase of $6.7 million in accounts

receivable and a decrease of $3.4 million in income taxes payable. In comparison, we

generated $76.8 million in cash from operating activities for the fiscal year ended March 31,

2002, due mainly to $36.2 million in net income, depreciation and amortization of $9.5 million,

decreases of $14.5 and $12.6 million in inventory and accounts receivable, respectively, an

increase of $2.5 million in accounts payable, and an income tax benefit of $1.1 million

associated with the exercise of stock options.

Investing Activities. During fiscal 2003, we purchased marketable securities of $13.0

million and received proceeds from maturities of marketable securities of $25.3 million.

Expenditures for capital assets of $11.8 million were incurred principally in tooling for new

products, furniture and fixtures and leasehold improvements for facilities expansion. During

fiscal 2002, we purchased marketable securities of $27.3 million and received proceeds from

maturities of marketable securities of $23.1 million. Expenditures for capital assets of $11.4

million were incurred principally in tooling for new products, furniture and fixtures and

leasehold improvements for facilities expansion. In January 2002, we purchased Ameriphone,

a leading supplier of amplified telephones and other solutions to address the needs of

individuals with hearing impairment and other special needs. The net cash expended for this

acquisition was $10.4 million.

Financing Activities. During the fiscal year ended March 31, 2003, we repurchased 2.9

million shares of our Common Stock for $44.8 million at an average price of $15.56 per share,

and reissued through employee benefit plans 152,700 shares of our Treasury Stock for $2.2

million. As of March 31, 2003, we remained authorized to repurchase 265,400 shares under all

repurchase plans. We also received $2.2 million in proceeds from the exercise of stock options

during the fiscal year ended March 31, 2003. In the fiscal year ended March 31, 2002, we

repurchased 3.6 million shares of our Common Stock at an average price of $20.10 for $72.1

million and reissued through employee benefit plans 133,110 shares of our Treasury Stock for

$2.5 million. We also received $1.2 million in proceeds from the exercise of stock options

during the fiscal year ended March 31, 2002.

Liquidity and Capital Resources. We generated positive cash flows from operations for

fiscal 2003 and fiscal 2002 totaling $50.1 million and $76.8 million, respectively. Our primary

cash requirements have been, and are expected to be, for capital expenditures, mainly for

tooling for new products and leasehold improvements for facilities improvements and

expansion, and for the repurchase of our Common Stock.* We estimate that fiscal 2004 capital

expenditures will be approximately $13 million.* As of March 31, 2003, we had working

capital of $103.6 million, including $59.7 million of cash, cash equivalents and marketable

securities, compared with working capital of $96.7 million, including $60.3 million of cash,

cash equivalents and marketable securities, as of March 31, 2002.