Pfizer 2005 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2005 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005 Financial Report 59

Notes to Consolidated Financial Statements

Pfizer Inc and Subsidiary Companies

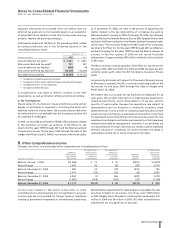

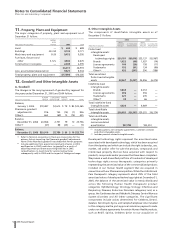

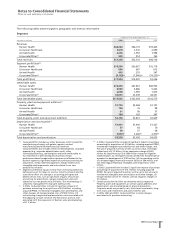

F. Cash Flows

It is our practice to fund amounts for our qualified pension plans

at least sufficient to meet the minimum requirements set forth

in applicable employee benefit laws and local tax laws. Liabilities

for amounts in excess of these funding levels are included in our

consolidated balance sheet, to the extent required by GAAP.

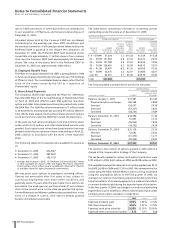

The following table presents expected cash flow information:

FOR THE YEAR ENDED POST-

DECEMBER 31 U.S. QUALIFIED INTERNATIONAL RETIREMENT

(MILLIONS OF DOLLARS) PENSION PLANS PENSION PLANS BENEFITS

Employer Contributions:

2006 (estimated) $ 3 $ 339 $150

Expected Benefit Payments:

2006 $ 321 $ 260 $150

2007 342 271 152

2008 361 286 153

2009 394 303 155

2010 422 310 155

2011—2015 2,717 1,827 769

Employer contributions for U.S. supplemental (non-qualified)

pension plans for 2006 are estimated to be $69 million with

expected benefit payments for 2006 through 2010 estimated to

be $69 million, $74 million, $81 million, $63 million and $68

million, respectively, and for 2011 through 2015 totaling $398

million.

The table reflects the total U.S. plan benefits projected to be paid

from the plans or from the Company’s general assets under the

current actuarial assumptions used for the calculation of the

projected benefit obligation and therefore, actual benefit

payments may differ from projected benefit payments. Under the

provisions of the Medicare Prescription Drug Improvement and

Modernization Act of 2003, the expected benefit payments for our

U.S. postretirement plans were reduced by $156 million through

2015.

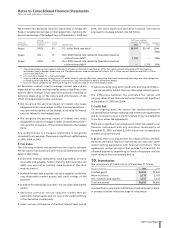

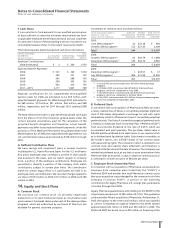

G. Defined Contribution Plans

We have savings and investment plans in several countries

including the U.S., Puerto Rico and Japan. For the U.S. and Puerto

Rico plans, employees may contribute a portion of their salaries

and bonuses to the plans, and we match, largely in company

stock, a portion of the employee contributions. Employees are

permitted to diversify a portion of the company stock match

contribution, subject to certain plan limits. The contribution

match for certain legacy Pfizer U.S. participants are held in an

employee stock ownership plan. We recorded charges related to

our plans of $234 million in 2005, $313 million in 2004 and $180

million in 2003.

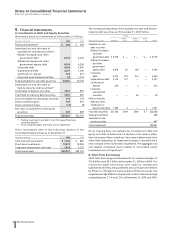

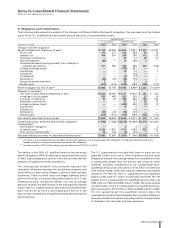

14. Equity and Stock Plans

A. Common Stock

We purchase our common stock via privately negotiated

transactions or in open market purchases as circumstances and

prices warrant. Purchased shares under each of the share-purchase

programs, which are authorized by our Board of Directors, are

available for general corporate purposes.

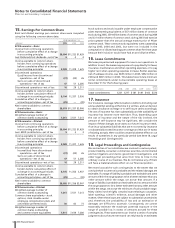

A summary of common stock purchases follows:

FOR THE YEAR ENDED DECEMBER 31, SHARES OF AVERAGE TOTAL COST OF

(MILLIONS OF SHARES AND COMMON STOCK PER-SHARE COMMON STOCK

DOLLARS EXCEPT PER SHARE DATA) PURCHASED PRICE PAID PURCHASED

2005:

June 2005 program(a) 22 $22.38 $ 493

October 2004 program(b) 122 $27.20 3,304

Total 144 $ 3,797

2004:

October 2004 program(b) 63 $26.79 $ 1,696

December 2003 program(c) 145 $34.14 4,963

Total 208 $ 6,659

2003:

December 2003 program(c) 1$34.57 $ 37

July 2002 program(d) 406 $31.99 13,000

Total 407 $13,037

(a) In June 2005, we announced a new $5 billion share-purchase

program.

(b) In October 2004, we announced a $5 billion share-purchase

program, which we completed in June 2005.

(c) In December 2003, we announced a $5 billion share-purchase

program, which we completed in October 2004.

(d) In July 2002, we announced a $16 billion share-purchase program,

which we completed in November 2003.

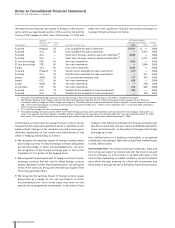

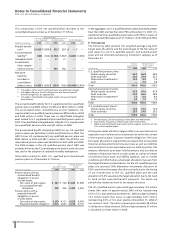

B. Preferred Stock

In connection with our acquisition of Pharmacia in 2003, we issued

a newly created class of Series A convertible perpetual preferred

stock (7,500 shares designated) in exchange for and with rights

substantially similar to Pharmacia’s Series C convertible perpetual

preferred stock. The Series A convertible perpetual preferred stock

is held by an Employee Stock Ownership Plan (“Preferred ESOP”)

Trust and provides dividends at the rate of 6.25% which are

accumulated and paid quarterly. The per-share stated value is

$40,300 and the preferred stock ranks senior to our common stock

as to dividends and liquidation rights. Each share is convertible, at

the holder’s option, into 2,574.87 shares of our common stock

with equal voting rights. The conversion option is indexed to our

common stock and requires share settlement, and therefore, is

reported at the fair value at the date of issuance. The Company may

redeem the preferred stock, at any time or upon termination of the

Preferred ESOP, at its option, in cash, in shares of common stock or

a combination of both at a price of $40,300 per share.

C. Employee Stock Ownership Plans

In connection with our acquisition of Pharmacia, we assumed two

employee stock ownership plans (collectively the “ESOPs”), a

Preferred ESOP and another that held Pharmacia common stock

that upon acquisition was exchanged for the common stock of the

Company (“Common ESOP”). A portion of the matching

contributions for legacy Pharmacia U.S. savings plan participants

is funded through the ESOPs.

Legacy Pharmacia guaranteed a note relating to the ESOPs for the

original principal amount of $80 million (8.13%). This guarantee

continued after Pfizer’s acquisition of Pharmacia. At December 31,

2005, the balance of the note was $2 million, which was classified

as current. Compensation expense related to the ESOPs totaled

approximately $42 million in 2005 and $45 million in 2004. The

Preferred ESOP has access to up to $95 million in financing at the