Pfizer 2005 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2005 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 2005 Financial Report

Notes to Consolidated Financial Statements

Pfizer Inc and Subsidiary Companies

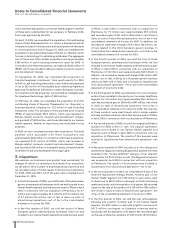

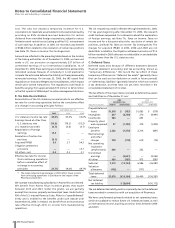

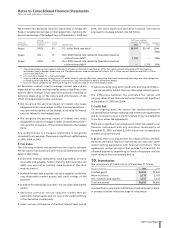

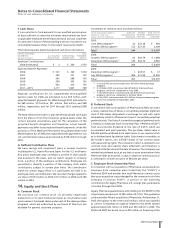

11. Property, Plant and Equipment

The major categories of property, plant and equipment as of

December 31 follow:

USEFUL

LIVES

(MILLIONS OF DOLLARS) (YEARS) 2005 2004

Land — $645 $688

Buildings 331⁄3-50 9,735 9,771

Machinery and equipment 8-20 9,453 9,395

Furniture, fixtures and

other 3-121⁄24,540 4,670

Construction in progress — 2,244 2,395

26,617 26,919

Less: accumulated depreciation 9,527 8,534

Total property, plant and equipment $17,090 $18,385

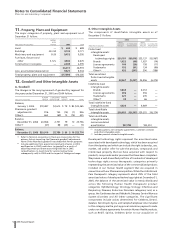

12. Goodwill and Other Intangible Assets

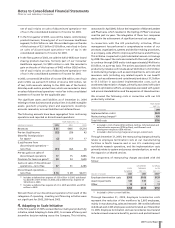

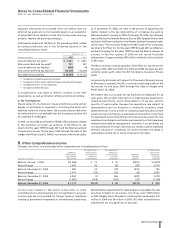

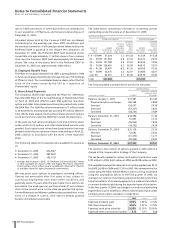

A. Goodwill

The changes in the carrying amount of goodwill by segment for

the years ended December 31, 2005 and 2004 follow:

HUMAN CONSUMER ANIMAL

(MILLIONS OF DOLLARS) HEALTH HEALTHCARE HEALTH OTHER TOTAL

Balance,

January 1, 2004 $19,487 $2,615 $ 78 $ 85 $22,265

Pharmacia goodwill

adjustments(a) 816 155 (14) (1) 956

Other(b) 663 (69) 15 (74) 535

Balance,

December 31, 2004 20,966 2,701 79 10 23,756

Other(b) (47) 88 (23) — 18

Balance,

December 31, 2005 $20,919 $2,789 $ 56 $ 10 $23,774

(a) Refer to Note 2A, Acquisitions: Pharmacia Corporation for the

primary factors impacting the Pharmacia goodwill adjustments.

None of the Pharmacia goodwill was deductible for tax purposes.

(b) Includes additions from acquisitions (primarily Vicuron in 2005

and Esperion in 2004), reductions to goodwill as a result of

adjusting certain purchase accounting liabilities in 2005,

reclassifications to Assets held for sale (including those

subsequently sold) in 2004 and the impact of foreign exchange.

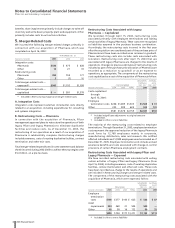

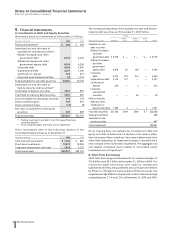

B. Other Intangible Assets

The components of identifiable intangible assets as of

December 31 follow:

2005 2004

GROSS GROSS

CARRYING ACCUMULATED CARRYING ACCUMULATED

(MILLIONS OF DOLLARS) AMOUNT AMORTIZATION AMOUNT AMORTIZATION

Finite-lived

intangible assets:

Developed

technology rights $30,781 $(8,819) $33,137 $(5,967)

Brands 1,022 (60) 1,037 (14)

License agreements 160 (30) 158 (17)

Trademarks 152 (91) 134 (90)

Other(a) 452 (207) 390 (186)

Total amortized

finite-lived intangible

assets 32,567 (9,207) 34,856 (6,274)

Indefinite-lived

intangible assets:

Brands 3,864 — 4,012 —

License agreements 296 — 356 —

Trademarks 227 — 235 —

Other(b) 39 — 66 —

Total indefinite-lived

intangible assets 4,426 — 4,669 —

Total identifiable

intangible assets $36,993 $(9,207) $39,525 $(6,274)

Total identifiable

intangible assets,

less accumulated

amortization $27,786 $33,251

(a) Includes patents, non-compete agreements, customer contracts

and other intangible assets.

(b) Includes pension-related intangible assets.

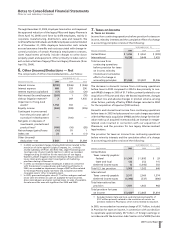

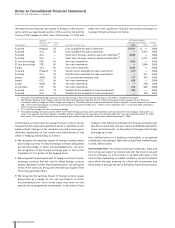

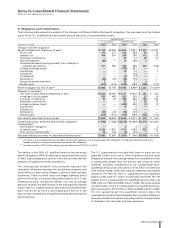

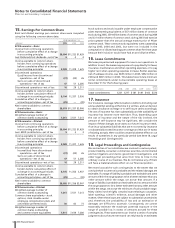

Developed technology rights represent the amortized value

associated with developed technology, which has been acquired

from third parties and which can include the right to develop, use,

market, sell and/or offer for sale the product, compounds and

intellectual property that we have acquired with respect to

products, compounds and/or processes that have been completed.

We possess a well-diversified portfolio of hundreds of developed

technology rights across therapeutic categories primarily

representing the amortized value of the commercialized products

included in our Human Health segment that we acquired in

connection with our Pharmacia acquisition. While the Arthritis and

Pain therapeutic category represents about 28% of the total

amortized value of developed technology rights at December 31,

2005, the balance of the amortized value is evenly distributed

across the following Human Health therapeutic product

categories: Ophthalmology; Oncology; Urology; Infectious and

Respiratory Diseases; Endocrine Disorders categories; and, as a

group, the Cardiovascular and Metabolic Diseases; Central Nervous

System Disorders and All Other categories. The significant

components include values determined for Celebrex, Detrol,

Xalatan, Genotropin, Zyvox, and Campto/Camptosar. Also included

in this category are the post-approval milestone payments made

under our alliance agreements for certain Human Health products,

such as Rebif, Spiriva, Celebrex (prior to our acquisition of