Pfizer 2005 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2005 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005 Financial Report 43

Notes to Consolidated Financial Statements

Pfizer Inc and Subsidiary Companies

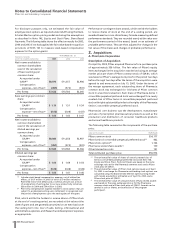

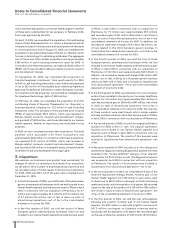

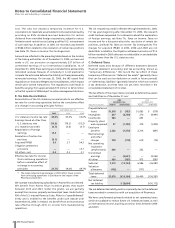

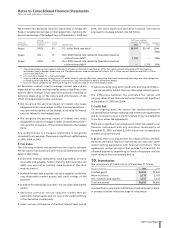

Allocation of Pharmacia Purchase Price

The purchase price allocation, finalized in the early part of 2004,

was based on an estimate of the fair value of assets acquired and

liabilities assumed.

(MILLIONS OF DOLLARS) AMOUNT

Book value of net assets acquired $ 8,795

Less: Recorded goodwill and other intangible assets 1,559

Tangible book value of net assets acquired 7,236

Remaining allocation:

Increase inventory to fair value 2,939

Increase long-term investments to fair value 40

Decrease property, plant and equipment to fair value (317)

Record in-process research and development charge 5,052

Record identifiable intangible assets(a) 37,066

Increase long-term debt to fair value (370)

Increase benefit plan liabilities to fair value (1,471)

Decrease other net assets to fair value (477)

Restructuring costs(b) (2,182)

Tax adjustments(c) (12,947)

Goodwill(a) 21,403

Purchase price $ 55,972

(a) See Note 12, Goodwill and Other Intangible Assets.

(b) See Note 5, Merger-Related Costs.

(c) See Note 7, Taxes on Income.

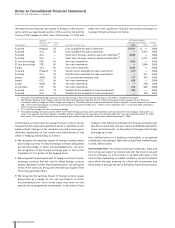

Since our interim allocation in the fourth quarter of 2003, the

significant revisions to our estimates relate primarily to fixed

assets ($756 million decrease), identifiable intangible assets ($155

million decrease) and tax adjustments ($645 million decrease). In

addition, in 2004, we recorded an additional $604 million in

restructuring charges as a component of the purchase price

allocation.

The more significant revisions to our estimates relating to our

initial allocation of the purchase price in the second quarter of

2003 include inventory ($1.3 billion increase), fixed assets ($1.1

billion decrease), identifiable intangible assets ($560 million

increase) and tax adjustments ($986 million decrease). In addition,

we recorded an additional $1.4 billion in restructuring charges.

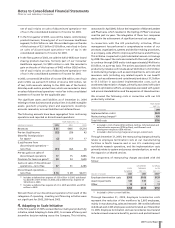

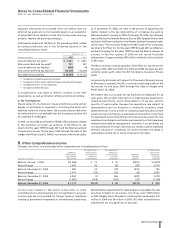

Pro Forma Results of Pharmacia Acquisition

The following unaudited pro forma financial information presents

the combined results of operations of Pfizer and Pharmacia as if

the acquisition had occurred as of the beginning of 2003. The

unaudited pro forma financial information is not necessarily

indicative of what our consolidated statement of income actually

would have been had we completed the acquisition at the

beginning of the year. In addition, the unaudited pro forma

financial information does not attempt to project the future

results of operations of the combined company.

YEAR ENDED DEC. 31,

________________________

(MILLIONS OF DOLLARS, EXCEPT PER COMMON SHARE DATA) (UNAUDITED) 2003

Revenues $48,292

Income from continuing operations before

cumulative effect of a change in accounting

principles 8,265

Net income 10,536

Per share amounts:

Income from continuing operations before

cumulative effect of a change in accounting

principles per common share—basic 1.06

Net income per common share—basic 1.36

Income from continuing operations before

cumulative effect of a change in accounting

principles per common share—diluted 1.05

Net income per common share—diluted 1.34

The unaudited pro forma financial information above reflects the

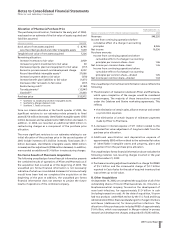

following:

•The elimination of transactions between Pfizer and Pharmacia,

which upon completion of the merger would be considered

intercompany. The majority of these transactions occurred

under the Celebrex and Bextra marketing agreements. This

reflects:

•the elimination of certain sales, alliance revenue and certain

co-promotion expenses

•the elimination of certain impacts of milestone payments

made by Pfizer to Pharmacia

•A decrease in interest expense of $11 million related to the

estimated fair value adjustment of long-term debt from the

purchase price allocation.

•Additional amortization and depreciation expense of

approximately $993 million related to the estimated fair value

of identifiable intangible assets and property, plant and

equipment from the purchase price allocation.

The unaudited pro forma financial information above excludes the

following material, non-recurring charges incurred in the year

ended December 31, 2003:

•Purchase accounting adjustments related to a charge for IPR&D

of $5.1 billion and the incremental charge of $2.7 billion

reported in Cost of sales for the sale of acquired inventory that

was written up to fair value.

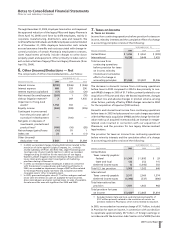

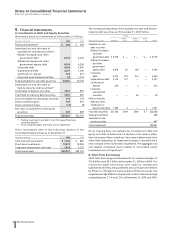

B. Other Acquisitions

On September 14, 2005, we completed the acquisition of all of the

outstanding shares of Vicuron Pharmaceuticals, Inc. (Vicuron), a

biopharmaceutical company focused on the development of

novel anti-infectives, for approximately $1.9 billion in cash

(including transaction costs). At the date of acquisition, Vicuron

had two products under NDA review by the U.S. Food and Drug

Administration (FDA): Eraxis (anidulafungin) for fungal infections

and Zeven (dalbavancin) for Gram-positive infections. The

allocation of the purchase price includes IPR&D of approximately

$1.4 billion, which was expensed in Merger-related in-process

research and development charges, and goodwill of $243 million,