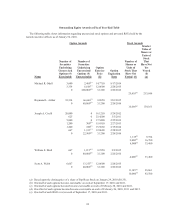

Pep Boys 2009 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2009 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18

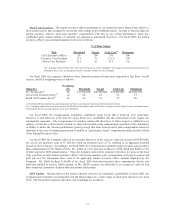

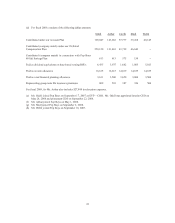

Objective

Weighting

(%)(a)

Pre-Tax Income(b) 50

Return on Invested Capital 25

Revenue Growth 25

(a) Payouts may be increased or decreased by a factor up to 10% based upon net promoter scores.

(b) Calculated before unusual non-operating gains and losses.

In addition, a further change was made to the Annual Incentive Bonus Plan which requires that any amounts

achieved above the Cash Cap level by an officer who has not yet achieved his required share ownership level (see

below) be placed into a Pep Boys Stock account, rather than a money market account.

Long-Term Incentives. Compensation through equity grants directly aligns the interests of management with that

of its shareholders. The Stock Incentive Plan provides for the grant of stock options, at exercise prices equal to the

fair market value (the mean between and the high and low quoted selling prices) of Pep Boys stock on the date of

grant, and the grant of restricted stock units.

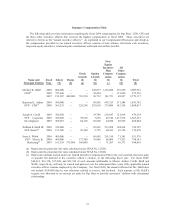

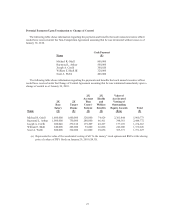

For the fiscal 2009 equity grants, the Compensation Committee established target grants designed to be

competitive at market median of our peer group and to assist the named executive officers in achieving our

established share ownership guidelines, described below. In order to further incent our named executive officers to

improve our operating performance, such target grants consisted solely of stock options that expire seven years from

the date of grant and become exercisable in thirds on the first three anniversaries of the date of grant. In fiscal 2009,

in respect of fiscal 2008 performance, the Compensation Committee recommended, and the full Board approved,

stock option grants to each of the named executive officers at their target levels.

2010 Update. Working with Towers Watson, the Compensation Committee surveyed our peer group’s practices

and emerging trends in long-term incentive compensation in an effort to further align this component of the

compensation program with the interests of shareholders, namely building long-term shareholder value.

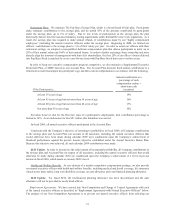

Accordingly, beginning with the fiscal 2010 equity grants, the annual long-term incentive grants will consist of 40%

time-based vesting stock options and 60% performance-based vesting restricted stock units (RSUs). The RSUs will

only vest if predetermined objectives are achieved over a three-year period. Two-thirds of the RSUs will be linked

to return on invested capital and the one-third will be linked to total shareholder return measured against the new, 17

company peer group.

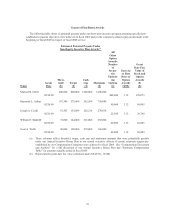

Share Ownership Guidelines. We have had share ownership guidelines in place for our officers since 2004.

Under these guidelines, each officer was expected to acquire and then hold a multiple of their annual salary in Pep

Boys shares. For Senior Vice Presidents and above, the expected multiple was at least two times annual salary. For

Vice Presidents, the expected multiple was at least one times annual salary. These share ownership guidelines could

be satisfied through direct share ownership and/or by holding RSUs and officers were given five years to attain the

required level of ownership.

2010 Update. To be consistent with the changes made to the long-term incentive component of executive

compensation and to better reflect current market norms, we revised our share ownership guidelines in fiscal 2010.

Each officer is now expected to hold shares equal to the following multiples of their annual salary: Chief Executive

Officer 5x; Executive Vice President 3x; Senior Vice President 2x; and Vice President 1x. The share ownership

levels may be satisfied through direct share ownership and/or by holding unvested time-based RSUs and vested “in

the money” stock options. Officers have five years from the later of the establishment of the new higher guidelines

for their position or their appointment as an officer to achieve their expected ownership levels. If in a shortfall

position, an officer may not sell Pep Boys Stock and all net after-tax shares acquired upon the exercise of stock

options or the vesting of RSUs must be retained.