PSE&G 2006 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2006 PSE&G annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

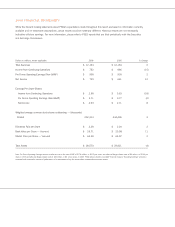

PSEG

S&P 500

DJ Utilities

0

50

100

150

200

250

300

350

400

450

1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006

10-year cumulative total comparitive returns

as of december 29, 2006

Among the major reasons for this:

•Our Hope Creek and Salem nuclear sta-

tions have greatly improved performance,

setting new plant records for electric gen-

eration in 2005 and again in 2006;

•We have continued to improve the balance

sheet, strengthening our financial position;

•We further reduced international risk and

exposure by selling a number of overseas

assets; and

•We are also benefiting from a period of

higher energy prices.

These developments have not gone unno-

ticed by the financial community. Our

stock price was approximately 50 percent

higher at year end 2006 than it was

prior to the announcement of the proposed

merger in mid-December 2004.

Investors have continued to benefit as well

from our emphasis on long-term shareholder

value: The value of your investment dou-

bled during the past five years, assuming

you held shares throughout the period.

Dividends are one of the key ways we

have traditionally rewarded shareholders.

In 2006, we paid dividends once again,

extending PSEG’s record of paying annual

dividends to 100 consecutive years. We

increased our dividend modestly in 2006

and again early in 2007, bringing our

annual indicated dividend rate to $2.34

per share. We expect to continue modest

increases in the dividend as our financial

conditions allows.

Energy prices in 2006 were again volatile,

but generally remained at significantly

higher levels than three years ago. Strong

operations, a period of higher energy

prices and an improving picture for elec-

tric capacity markets are contributing to

a very positive trend for your company. In

addition to being solidly positioned for

growth in 2007 and 2008, we continue to

benefit from the stability provided by a

strong, balanced mix of energy businesses.

PSEG Power

PSEG Power, our large wholesale energy

supply business, had an outstanding

year in 2006. It continued to strengthen

its position as our main earnings driver.

Power has a low-cost generation fleet of

nuclear and fossil units, and is reaping

benefits from strong operations in a favor-

able pricing environment. As Power’s

older contracts for its output have rolled

off, they have been replaced by newer

contracts at much higher prices, boosting

profitability.

Our Salem and Hope Creek nuclear gener-

ating facilities in southern New Jersey

continued their excellent operations in

2006. The plants have been producing more

energy than ever before; they have set

new refueling duration records, including a

world record at one of the Salem units;

and have made significant and measura-

ble improvements in a broad range of

other key operational areas. Importantly, this

strong performance has been recognized

by the Nuclear Regulatory Commission,

which oversees the industry, and INPO, the

nuclear industry’s evaluation arm.

Our fossil units also significantly improved

performance and reliability in 2006, gen-

erating all-time highs for output. In addition

to responding well in the peak summer

season, our fossil operations focused on

long-term maintenance to lay the founda-

tion for continued strong performance.

PSEG’s total return for the last 10 years has outpaced two major market indices. This chart shows the value at

each year’s end of $100 invested at year end 1996. The value assumes reinvested dividends.