PSE&G 2006 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2006 PSE&G annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

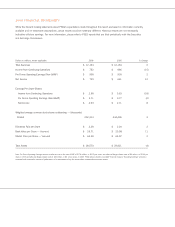

$2.00

$1.00

$0.00

$3.00

$4.00 $3.71

Excess of 10% Growth

$5.00

$6.00

2006 ACTUAL*

$4.60–$5.00

2007 GUIDANCE 2008 OUTLOOK

pseg operating earnings per share

Another priority is to continue progress

at the Salem and Hope Creek nuclear

generating stations. On January 1, 2007

the senior management team at Salem

and Hope Creek became PSEG employ-

ees as part of our plan to resume direct

management at the stations before

the expiration of our Nuclear Operating

Services Agreement with Exelon. This

was an important step toward assuring

Salem and Hope Creek continue on their

journey toward operational excellence

under the guidance of one of the most

capable and experienced management

teams in the industry.

We recently advised the Nuclear

Regulatory Commission that we intend

to pursue life extension of all three

nuclear units at Salem and Hope Creek

in 2009. We are determined to continue

building the type of nuclear expertise

that will contribute clean, reliable power

to meet the energy needs of New Jersey

and surrounding areas for years to come.

We are also focusing on improving our

balance sheet by further reducing debt.

Cash flow from operations was $1.9

billion in 2006, enabling us to achieve

a meaningful reduction in our financial

leverage. We are quite comfortable

with our liquidity position, with available

liquidity at year-end 2006 exceeding

$3 billion.

Approaching Investment Decisions with

Discipline…from a Position of Strength

While focused on our near-term objec-

tives, we are also hard at work planning

how to sustain a strong growth trajectory

over the long term. The outlook for

2007 and 2008 is extremely bright. As

Jim Ferland mentioned in his letter, we

are anticipating about a one-third improve-

ment in operating earnings in 2007 with

growth in 2008 in excess of 10 percent.

Our company is well served by having one

of the nation’s most diverse generation

fleets, giving us the ability to meet energy

needs in a wide variety of conditions,

around the clock and throughout the year.

We expect cash flow to remain robust

based on a combination of strong opera-

tions, the prices we have contracted for

our anticipated energy supply, and positive

developments in electric capacity mar-

kets. This should yield ample resources to

keep strengthening our financial position,

thereby providing more and better options

for future growth. The advantages of diver-

sification will remain an important strategic

consideration for us.

We intend to pursue opportunities in

new energy markets as they develop —

concentrating on areas where our expertise

lies. Global climate change and other

environmental concerns will create oppor-

tunities for new, clean generation. In the

fossil generation area, we are examining

questions such as at what point might

conditions be right for building new plants

or acquiring them. Also, nuclear power

is increasingly recognized as an abundant

source of clean, emissions-free electric

generation that promotes energy independ-

ence while combating global warming. We

will be ready to act on this option for

future growth if and when the time comes

to build additional nuclear generation.

At PSE&G, we will also keep an eye on

growth opportunities — making investments

that further improve customer service and

produce fair returns for shareholders. We

are eager to take advantage of advances

in metering technology to better enable

energy efficiency as well as improvements

in our operations without compromising

* See 2006 financial highlights on page one for GAAP reconciliation.