PNC Bank 2015 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

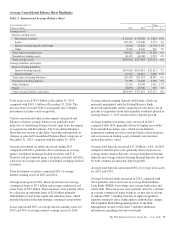

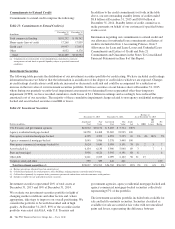

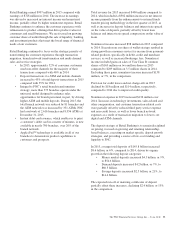

Commitments to Extend Credit

Commitments to extend credit comprise the following:

Table 13: Commitments to Extend Credit (a)

In millions

December 31

2015

December 31

2014

Total commercial lending $101,252 $ 98,742

Home equity lines of credit 17,268 17,839

Credit card 19,937 17,833

Other 4,032 4,178

Total $142,489 $138,592

(a) Commitments to extend credit, or net unfunded loan commitments, represent

arrangements to lend funds or provide liquidity subject to specified contractual

conditions.

In addition to the credit commitments set forth in the table

above, our net outstanding standby letters of credit totaled

$8.8 billion at December 31, 2015 and $10.0 billion at

December 31, 2014. Standby letters of credit commit us to

make payments on behalf of our customers if specified future

events occur.

Information regarding our commitments to extend credit and

our allowance for unfunded loan commitments and letters of

credit is included in Note 1 Accounting Policies, Note 5

Allowances for Loan and Lease Losses and Unfunded Loan

Commitments and Letters of Credit and Note 21

Commitments and Guarantees in the Notes To Consolidated

Financial Statements in Item 8 of this Report.

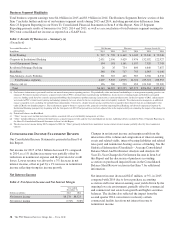

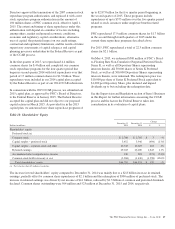

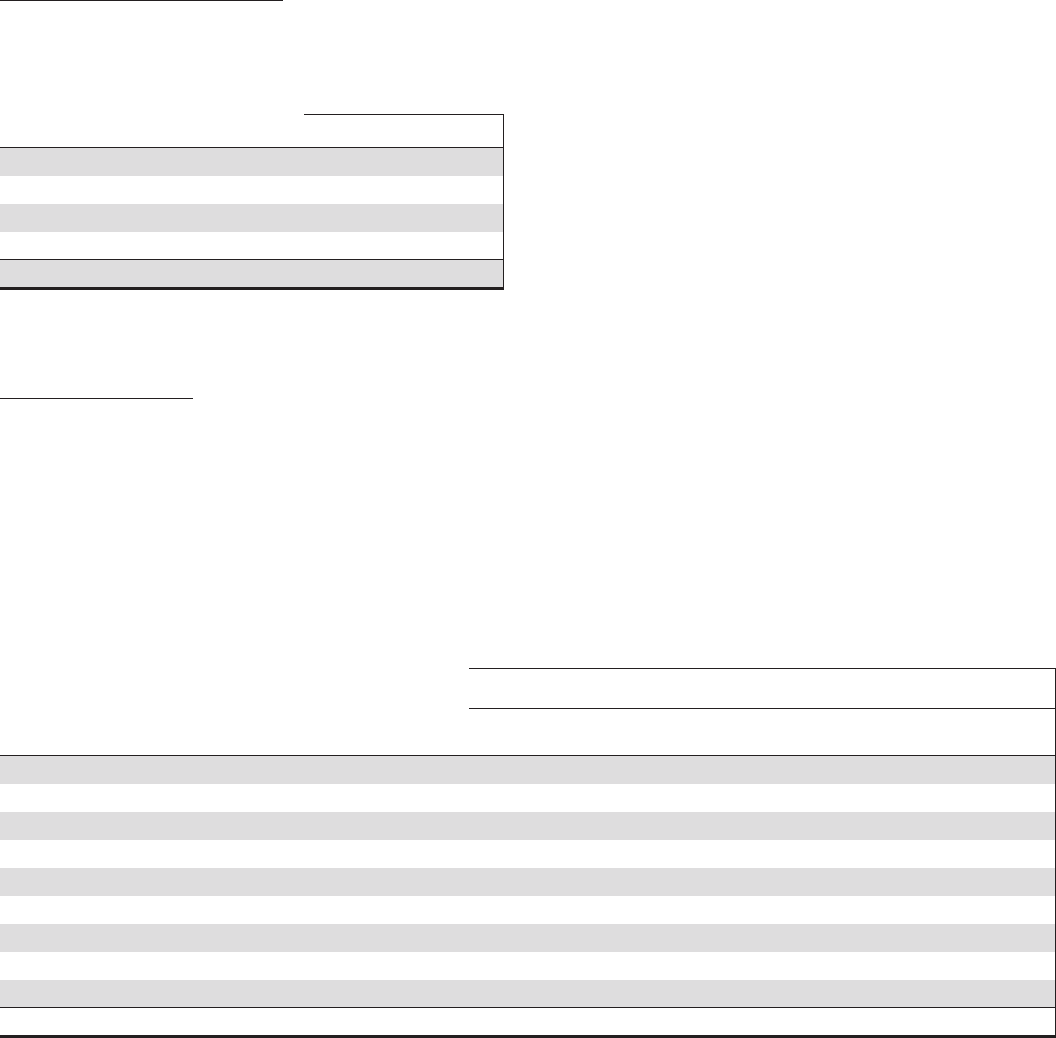

Investment Securities

The following table presents the distribution of our investment securities portfolio by credit rating. We have included credit ratings

information because we believe that the information is an indicator of the degree of credit risk to which we are exposed. Changes

in credit ratings classifications could indicate increased or decreased credit risk and could be accompanied by a reduction or

increase in the fair value of our investment securities portfolio. For those securities on our balance sheet at December 31, 2015,

where during our quarterly security-level impairment assessments we determined losses represented other-than-temporary

impairment (OTTI), we have recorded cumulative credit losses of $1.1 billion in earnings and accordingly have reduced the

amortized cost of our securities. The majority of these cumulative impairment charges related to non-agency residential mortgage-

backed and asset-backed securities rated BB or lower.

Table 14: Investment Securities

December 31, 2015 December 31, 2014

Ratings (a)

As of December 31, 2015

Dollars in millions

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

AAA/

AA A BBB

BB

and

Lower

No

Rating

U.S. Treasury and government agencies $10,022 $10,172 $ 5,485 $ 5,714 100%

Agency residential mortgage-backed 34,250 34,408 23,382 23,935 100

Non-agency residential mortgage-backed 4,225 4,392 4,993 5,225 10 1% 4% 80% 5%

Agency commercial mortgage-backed 3,045 3,086 3,378 3,440 100

Non-agency commercial mortgage-backed (b) 5,624 5,630 5,095 5,191 78 10 2 3 7

Asset-backed (c) 6,134 6,130 5,900 5,940 89 3 7 1

State and municipal 3,936 4,126 3,995 4,191 88 6 6

Other debt 2,211 2,229 2,099 2,142 56 31 13

Corporate stock and other 590 589 442 441 100

Total investment securities (d) $70,037 $70,762 $54,769 $56,219 89% 2% 1% 6% 2%

(a) Ratings percentages allocated based on amortized cost.

(b) Collateralized primarily by retail properties, office buildings, lodging properties and multi-family housing.

(c) Collateralized primarily by corporate debt, government guaranteed student loans and other consumer credit products.

(d) Includes available for sale and held to maturity securities.

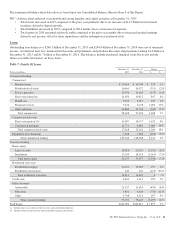

Investment securities represented 20% of total assets at

December 31, 2015 and 16% at December 31, 2014.

We evaluate our investment securities portfolio in light of

changing market conditions and other factors and, where

appropriate, take steps to improve our overall positioning. We

consider the portfolio to be well-diversified and of high

quality. At December 31, 2015, 89% of the securities in the

portfolio were rated AAA/AA, with U.S. Treasury and

government agencies, agency residential mortgage-backed and

agency commercial mortgage-backed securities collectively

representing 67% of the portfolio.

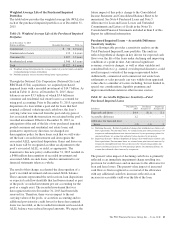

The investment securities portfolio includes both available for

sale and held to maturity securities. Securities classified as

available for sale are carried at fair value with net unrealized

gains and losses, representing the difference between

44 The PNC Financial Services Group, Inc. – Form 10-K