O'Reilly Auto Parts 2009 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2009 O'Reilly Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

O’Reilly Automotive 2009 Annual Report

3

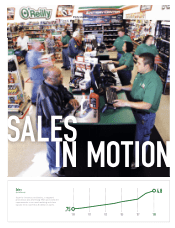

‘04 ‘05 ‘06 ‘08‘07 ‘09

O’Reilly Auto Parts

NASDAQ Retail Trade Stocks

NASDAQ US Market

Standard and Poor’s S&P 500

Comparison of Five-Year

Cumulative Return

We are pleased to deliver another year of record profits and earnings

per share to our shareholders. Our continued success was the result

of the contributions of our 45,000 team members who embrace

our culture and execute our proven business model every day. The

O’Reilly Culture of honesty, hard work, professionalism and excellent

customer service has been our foundation since the Company

began in 1957 and remains the backbone of the strong and dynamic

Company we are today. Our goal is to profitably grow our market

share in existing markets and enter new markets via new store growth

and acquisitions. We accomplish this growth by providing a higher

level of service than our competitors to both the installer and do-it-

yourself markets (our Dual Market Strategy). In 2009, we successfully

executed our strategy by growing market share in the historic O’Reilly

stores, aggressively opening new stores and continuing the successful

integration our 2008 acquisition of CSK Auto Corporation.

Growing Market Share in Existing Markets

When we purchased CSK in 2008, many were concerned that the

acquisition would cause a loss of focus in our existing markets. In

2009, the core O’Reilly stores proved this concern was misplaced

by generating a 6.7% comparable store sales increase. This strong

performance was driven by both internal and external factors. The

store and DC operational teams in historic O’Reilly markets, which

in large part have not been involved in the integration of CSK, have

continued to successfully execute our Dual Market Strategy and

represent the driving force behind the strong comparable store

sales. From an external standpoint, the aftermarket auto parts

industry benefited from the historically low new car and truck sales

and a shift in consumer behavior toward being more proactive in

repairing and maintaining their existing cars. We anticipate that

consumers will continue to retain their cars at higher mileages and

will be more willing to invest in maintaining their vehicles as they

find that the engineering improvements in cars built in the past

ten years enables cars to be reliable at much higher mileages. With

current forecasts predicting that the economy and jobs market will

recover slowly, we continue to see the macroeconomic environment

as a positive tailwind throughout 2010 and beyond.

New Store Growth

We opened 150 new stores in 2009 and continue to see great

opportunity for profitable new store growth. The fragmented

nature of the automotive aftermarket combined with the advantage

of scale of a large chain makes new store growth an attractive capital

investment for our Company. As part of our strategy to build our

store base in contiguous geographic regions, our new store openings

in 2009 were principally in the markets serviced by our newer

distribution centers (DCs). In 2010, we again plan to open 150 stores.

While new stores continue to offer an attractive return on invested

capital, our 2010 target is below our historic new store opening rate

because we believe our capital investments are best deployed on the

conversions and enhancements that will drive results in the acquired

CSK stores. Beyond 2010, we anticipate increasing our annual new

store openings to capitalize on the attractive opportunities we see

in both the markets within the distribution reach of the historic

O’Reilly footprint as well as CSK markets which will have enhanced

distribution capacity for significant growth.

Acquisition of Existing Parts Store Chains

Our 2008 acquisition of 1,342 CSK stores represented a huge

commitment to expanding our brand. The motivation behind the

LETTER TO OUR SHAREHOLDERS

169

100

102

97

84