North Face 2013 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2013 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

At VF, we think of ourselves as

brand builders, not retailers. It may

sound like a subtle distinction. But

it makes a big difference in driving

our decisions and investments. We

work with our portfolio of brands

to optimize their growth, while we

connect with consumers in stores

and online to build relationships

based on mutual trust and loyalty.

The success of our One VF direct-

to-consumer business platform

flows from three growth strategies:

continuously driving comp-store

performance, opening new stores

that feature the right brands in the

right locations and accelerating our

e-commerce sales. It’s rooted in our

belief that building strong, direct-to-

consumer connections is as much

an art as a science. It requires focus,

discipline, data-driven decision

making and engaging brand

storytelling that fuels growth.

In the grand scheme of things,

we’re relatively young in our

direct-to-consumer journey, having

launched these businesses with

full strategic focus in 2006. Since

then, we’ve built this platform into

a high-performance mix of full-price

stores, outlet stores and e-commerce.

And the growth has been terrific.

Our 2013 direct-to-consumer revenue

reached $2.6 billion, reflecting

22 percent of the company’s revenue.

By 2017, we expect direct-to-consumer

revenue to reach $4.4 billion, or

25 percent of VF’s anticipated total

revenue a five-year compound

annual growth rate of 14 percent.

And this growth will be well-balanced

across all direct-to-consumer channels

and geographies. In fact, between

2012 and 2017 we expect a compound

annual growth rate of 12 percent in

the Americas, 21 percent in Europe

and 15 percent in Asia Pacific.

At the same time, we anticipate

combined annual growth rates for

full-price stores, outlet stores and

e-commerce of 14 percent, 9 percent

and 25 percent, respectively.

By any measure, direct-to-consumer

is a powerful, profitable growth

platform for our brands. And there’s

plenty of untapped potential ahead.

Consider this: Across our brands,

VF had 1,246 stores at the end of

2013, but only three of our brands

had more than 100 stores around

the world. Clearly, a robust growth

trajectory lies ahead of us. Our goal

is to reach 1,775 stores by the end

of 2017, with about two-thirds of

our new store openings coming

from outside the United States.

GOING DIGITAL

“E-commerce is VF’s fastest-growing consumer channel, accounting for 13 percent of our direct-

to-consumer sales in 2013. It includes consumer connections through all devices including

desktops, tablets, mobile phones and social media. VF’s Project Digital Excellence is focused on

creating operational efficiency in the digital age. It’s about building an e-commerce platform we

can leverage across all of VF’s brands and geographies. It’s about connecting with consumers …

in all the ways they connect with the world.”

Mike Gannaway

Vice President – VF Direct/Customer Teams

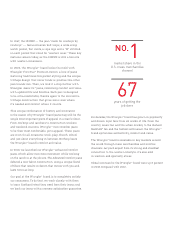

1

,246

OWNED STORES

14

BRANDS

17%

2008-2013 (5-year revenue CAGR)