Nokia 2004 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2004 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

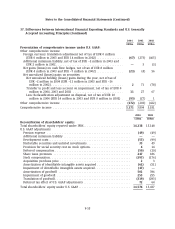

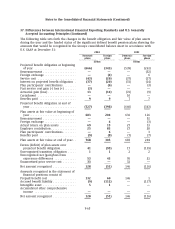

Notes to the Consolidated Financial Statements (Continued)

37. Differences between International Financial Reporting Standards and U.S. Generally

Accepted Accounting Principles (Continued)

The following table sets forth the changes in the benefit obligation and fair value of plan assets

during the year and the funded status of the significant defined benefit pension plans showing the

amounts that would be recognized in the Group’s consolidated balance sheet in accordance with

U.S. GAAP at December 31: 2004 2003

Domestic Foreign Domestic Foreign

plans plans plans plans

EURm EURm

Projected benefit obligation at beginning

of year ......................... (666) (343) (539) (261)

Remeasurement .................... ——— (52)

Foreign exchange ................... —(4)—6

Service cost ....................... (43) (20) (37) (17)

Interest on projected benefit obligation . (37) (20) (31) (14)

Plan participants’ contributions ........ —(6)— (3)

Past service cost gain (-) loss (+) ....... (3) — ——

Actuarial gain (loss) ................. 13 (14) (76) (9)

Curtailment ....................... ——10 —

Benefits paid ...................... 9977

Projected benefit obligation at end of

year ............................ (727) (398) (666) (343)

Plan assets at fair value at beginning of

year ............................ 683 204 636 126

Remeasurement .................... ———52

Foreign exchange ................... —4— (3)

Actual return on plan assets .......... 69 15 27 13

Employer contribution ............... 25 83 27 20

Plan participants’ contributions ........ —6—3

Benefits paid ...................... (9) (9) (7) (7)

Plan assets at fair value at end of year . . 768 303 683 204

Excess (deficit) of plan assets over

projected benefit obligation ......... 41 (95) 17 (139)

Unrecognized transition obligation ..... 1122

Unrecognized net (gain)/loss from

experience differences ............. 53 43 95 21

Unamortized prior service cost ........ 33 — 32 —

Net amount recognized .............. 128 (51) 146 (116)

Amounts recognized in the statement of

financial positions consist of:

Prepaid benefit cost ................. 132 60 146 1

Accrued benefit liability .............. (9) (112) — (117)

Intangible asset .................... 51——

Accumulated other comprehensive

income ......................... ————

Net amount recognized .............. 128 (51) 146 (116)

F-65