Nintendo 2016 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2016 Nintendo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.- 10 -

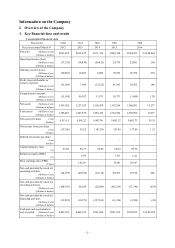

Nintendo continues to engage in the development of new products for the future.

4. Analysis of financial position, operating results and cash flow

All financial information contained below is based on the consolidated financial statements disclosed in the Annual

Securities Report (Japanese only). Any forward-looking statements contained in the following overview are made

based on information available as of the end of the fiscal year ended March 31, 2016.

(1) Important accounting policies and assumptions

Consolidated financial statements of Nintendo are prepared in accordance with accounting standards generally

accepted in Japan. In preparing such statements, assumptions that may affect the value of assets, liabilities,

revenue and expenses are made based on the accounting policies selected and adopted by management.

Management takes into account past results and the likelihood of future events to form assumptions in a

reasonable fashion, but uncertainties inherent with such assumptions may cause the actual results to be

materially different from these assumptions. Important accounting policies adopted in the consolidated financial

statements of Nintendo are detailed in the section of “V. Financial Information, Consolidated financial

statements, etc., Basis of Presenting Consolidated Financial Statements.”

(2) Factors which may have a significant impact on operating results

Nintendo operates as a business in the field of home entertainment, in which the availability of hit titles and their

sales volumes may have a significant impact on its operating results. In addition, the field of entertainment is

wide in scope, and any successful non-gaming propositions that provide consumers with more entertainment

value and surprises may also have an impact.

More than 70% of Nintendo’s total sales are generated in the overseas markets, with most transactions carried

out in local currencies. While Nintendo has attempted to increase dollar-based purchases in order to reduce the

impact of exchange rate fluctuations, it is difficult to completely eliminate their risk. As a result, exchange rate

fluctuations may have an impact on Nintendo’s financial performance.

While video game systems and their compatible software, which are Nintendo’s main products, represent a

majority of total sales, hardware and software have very different profit margins, and fluctuations of their

proportions of the total sales may have an impact on gross profit and the gross profit percentage to sales.

In addition, there may be other fluctuating factors as described in “II. Business Overview, 2. Risk factors.”

(3) Analysis of operating results for the fiscal year ended March 31, 2016

Sales and profits decreased when compared to the previous fiscal year.

(Net sales and operating income)

Net sales decreased from the previous fiscal year by ¥45.3 billion to ¥504.4 billion (U.S.$4,463 million; a

decrease of 8.2% on a year-on-year basis) due to decreased sales of Nintendo 3DS hardware and software,

despite the increase in Wii U software sales. However, due to the increase in the proportion of amiibo in sales

and the increase in download sales, gross profit increased from the previous fiscal year by ¥6.3 billion to

¥220.9 billion (U.S.$1,954 million; an increase of 3.0% on a year-on-year basis). Due to such factors as the

decrease in advertising expenses, total selling, general and administrative expenses decreased from the

previous fiscal year by ¥1.7 billion, resulting in an operating income of ¥32.8 billion (U.S.$290 million; an

increase of 32.7% on a year-on-year basis).

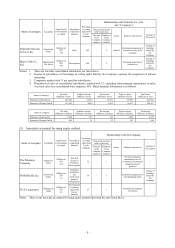

(Non-operating income and expenses, and ordinary income)

Net non-operating loss was ¥4.0 billion (U.S.$35 million), due mainly to foreign exchange losses by yen

appreciation. As a result, ordinary income was ¥28.7 billion (U.S.$253 million; a decrease of 59.2% on a

year-on-year basis).

(Profit attributable to owners of parent)

Profit attributable to owners of parent was ¥16.5 billion (U.S.$146 million; a decrease of 60.6% on a

year-on-year basis), primarily due to the decrease in ordinary income.