Nikon 1999 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 1999 Nikon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Operational Review and Analysis

Nikon instituted a company-wide restructuring initiative to reduce costs, raise operational efficiency and increase profits. At the

same time, the Company redoubled efforts to boost margins by developing and launching new products carefully tailored to meet

market needs. Unfortunately, the slowdown in consumer demand in Japan and other Asian markets, compounded by the

long-standing slide in chip prices that is afflicting the semiconductor industry, meant that the fruits of these efforts could not fully

offset falling sales revenues. A steep fall in sales of semiconductor-related industrial instruments caused consolidated net sales

in fiscal 1999 to fall 17.8% to ¥305.8 billion, equivalent to a drop of ¥66.4 billion. Falling revenues and lower margins in the indus-

trial instruments sector impacted the bottom line severely, and Nikon posted a net consolidated loss for the year of ¥18.2 billion.

In terms of performance by industry segment, net sales of consumer products rose 6.9% to ¥139.2 billion, producing a 23.3%

surge in operating income to ¥2.5 billion. However, consolidated net sales of industrial instruments fell 31.1% to ¥166.6 billion,

leading to an operating loss of ¥11.3 billion.

Splitting out the performance by region, sales in Japan slipped 13.5% to ¥274.5 billion, producing an operating loss of ¥11.0

billion. Overseas, results were better, though mixed. Sales in the United States dropped 20.6% to ¥80.6 billion, but produced

operating income of ¥2.7 billion. Sales in Europe plunged 27.9% to ¥36.3 billion, leading to an operating loss of ¥0.2 billion. In

Asia, principally due to an increase in the number of consolidated subsidiaries operating in the region, sales soared 57.6% to

¥11.3 billion, leading to operating income of ¥1.3 billion.

10

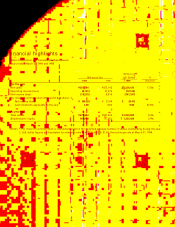

Income Analysis

For the years ended March 31, 1999, 1998 and 1997 (% of Net Sales)

1999 1998 1997

Net sales 100.0% 100.0% 100.0%

Cost of sales (67.4) (60.3) (58.0)

Gross profit 32.6 39.7 42.0

SG&A expenses (35.5) (32.3) (29.6)

Operating income (2.9) 7.4 12.4

Net interest expense and dividend income (1.4) (1.3) (1.4)

Net other income (expenses) (1.4) (1.0) (1.3)

Income (loss) before income taxes* (5.7) 5.1 9.7

Income taxes (0.3) (2.9) (4.4)

Minority interest 0.0 0.0 0.0

Net income (loss) (6.0) 2.2 5.3

* Excluding minority interest

Note: All expenses and subtractive amounts are in parentheses.

Balance Sheet Analysis

At March 31, 1999, 1998 and 1997 (% of Total Assets)

1999 1998 1997

Total assets 100.0% 100.0% 100.0%

Total current assets 65.0 69.0 67.4

Inventories 31.7 30.4 26.1

Property, plant and equipment 21.4 20.5 21.5

Investments and other assets 13.6 10.5 11.1

Total current liabilities 44.1 46.5 44.8

Short-term borrowings 22.5 20.5 15.3

Long-term debt, less current portion 21.7 19.4 18.7

Shareholders’ equity 33.9 33.7 36.0

1999 (18.2)

Net Income (Loss)

(¥Billion)

1998 8.3

1997 19.9

1996 18.6

1995 1.5

1999 (49.3)

Net Income (Loss)

per Share (¥)

1998 22.5

1997 53.9

1996 50.2

1995 4.2

1999 20.7

Capital Expenditures

(¥Billion)

1998 26.2

1997 33.8

1996 17.2

1995 8.1

QX33 .nikon second 0 0.5.12 5:35 PM ページ1 0