National Oilwell Varco 2003 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2003 National Oilwell Varco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 4

systems to maximize efficiencies for us and for our customers. We believe we have an advantage

in this effort due to our investment in technology, geographic size, knowledge of the industry and

customers, existing relationships with vendors and existing means of product delivery.

Marketing

Substantially all of our capital equipment and spare parts sales, and a large portion of our smaller

pumps and parts sales, are made through our direct sales force and distribution service centers.

Sales to foreign state-owned oil companies are typically made in conjunction with agent or

representative arrangements. Our downhole products are generally rented and sold worldwide

through our own sales force and through commissioned representatives. Distribution sales are

made through our network of distribution service centers. Customers for our products and

services include drilling and other service contractors, exploration and production companies,

supply companies and nationally owned or controlled drilling and production companies.

Competition

The oilfield services and equipment industry is highly competitive and our revenues and earnings

can be affected by price changes, introduction of new technologies and products and improved

availability and delivery. Our Products and Technology business segment competes with several

companies in North America that have drilling products that compete directly with certain of our

products. Our Distribution Services business segment competes with various smaller regional

competitors who may have strong direct ties with smaller or decentralized drilling and production

companies and other multinational distribution companies on the basis of service and price. None

of these competing companies dominate in any of the business segments or geographic areas in

which we operate.

Manufacturing and Backlog

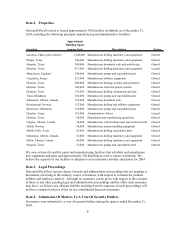

National Oilwell has manufacturing facilities located in the United States, Canada, England,

France, Norway and China. The manufacture of parts or purchase of components is sometimes

outsourced to qualified subcontractors. The manufacturing operations require a variety of

components, parts and raw materials which we purchase from multiple commercial sources. We

have not experienced and do not expect any significant delays in obtaining deliveries of materials.

Sales of products are made on the basis of written orders and oral commitments. Our backlog for

equipment at recent year-ends has been:

December 31, 2003 $339 million

December 31, 2002 364 million

December 31, 2001 385 million

Distribution Suppliers

National Oilwell obtains products sold by its Distribution Services business from a number of

suppliers, including our own Products and Technology segment. No single supplier of products is

significant to our operations. We have not experienced and do not expect a shortage of products

that we sell.