National Oilwell Varco 2003 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2003 National Oilwell Varco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

We also have additional uncommitted credit facilities totaling $134 million that are used

primarily for letters of credit, bid bonds and performance bonds. At December 31, 2003, there

were no borrowings against these additional credit facilities and there were $35 million in

outstanding letters of credit and performance bonds.

The senior notes contain reporting covenants and the credit facilities contain financial covenants

and ratios regarding maximum debt to capital and minimum interest coverage. We were in

compliance with all covenants governing these facilities at December 31, 2003.

We believe cash generated from operations and amounts available under our credit facilities and

from other sources of debt will be sufficient to fund operations, working capital needs, capital

expenditure requirements and financing obligations. We also believe any significant increase in

capital expenditures caused by any need to increase manufacturing capacity can be funded from

operations or through debt financing.

We have not entered into any transactions, arrangements, or relationships with unconsolidated

entities or other persons which would materially affect liquidity, or the availability of or

requirements for capital resources.

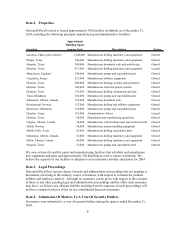

A summary of our outstanding contractual obligations and other commercial commitments at

December 31, 2003 is as follows (in thousands):

In February 2004, we reduced the line of credit commitment by $44 million to $269 million.

We intend to pursue additional acquisition candidates, but the timing, size or success of any

acquisition effort and the related potential capital commitments cannot be predicted. We expect to

fund future cash acquisitions primarily with cash flow from operations and borrowings, including

the unborrowed portion of the credit facility or new debt issuances, but may also issue additional

equity either directly or in connection with acquisitions. There can be no assurance that

acquisition funds will be available at terms acceptable to us.

Inflation has not had a significant impact on National Oilwell’s operating results or financial

condition in recent years.

Contractual Obligations Total

Less than 1

year 1-3 years 4-5 years After 5 years

Long Term Debt 608,890$ 14,910$ 243,980$ -$ 350,000$

Operating Leases 58,300 15,423 29,520 7,050 6,307

Total contractual obligations 667,190$ 30,333$ 273,500$ 7,050$ 356,307$

Commercial Commitments Total

Less than 1

year 1-3 years 4-5 years After 5 years

Line of Credit 313,570$ -$ 313,570$ -$ -$

Standby Letters of Credit 74,937 61,818 10,446 2,673 -

Total commercial commitments 388,507$ 61,818$ 324,016$ 2,673$ -$

Amount of Commitment Expiration per Period

Payments Due by Period