National Oilwell Varco 2003 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2003 National Oilwell Varco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10

Part II

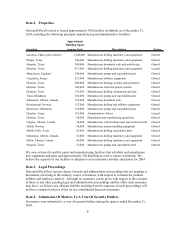

Item 5. Market for Registrant’s Common Equity and Related Stockholder Matters

Market Information

National Oilwell common stock is listed on the New York Stock Exchange (ticker symbol: NOI).

The following table sets forth the stock price range during the past three years:

2003 2002 2001

Quarter High Low High Low High Low

First 23.44$ 19.36$ 26.25$ 16.43$ 40.50$ 33.65$

Second 24.78 20.54 28.81 20.91 39.55 26.80

Third 21.80 17.86 21.29 15.19 25.74 12.91

Fourth 22.99 18.01 23.31 17.69 20.86 13.85

As of March 1, 2004, there were 531 holders of record of National Oilwell common stock. Many

stockholders choose to own shares through brokerage accounts and other intermediaries rather than

as holders of record so the actual number is unknown but significantly higher. National Oilwell has

never paid cash dividends, and none are anticipated during 2004.

Item 6. Selected Financial Data

2003 2002 2001 2000 1999 (3)

Operating Data:

Revenues 2,004,920$ 1,521,946$ 1,747,455$ 1,149,920$ 839,648$

Operating income (1) (4) 158,988 134,323 189,277 48,456 1,325

Income (loss) before taxes (4) 110,506 112,465 168,017 27,037 (14,859)

Net income (loss) (2) 76,821 73,069 104,063 13,136 (9,385)

Net income (loss) per share

Basic (2) 0.91 0.90 1.29 0.17 (0.13)

Diluted (2) 0.90 0.89 1.27 0.16 (0.13)

Other Data:

Depreciation and amortization 39,182 25,048 38,873 35,034 25,541

Capital expenditures 32,378 24,805 27,358 24,561 17,547

Balance Sheet Data:

Working capital 794,185 768,852 631,257 480,321 452,015

Total assets 2,242,736 1,977,228 1,471,696 1,278,894 1,005,715

Long-term debt, less current maturities 593,980 594,637 300,000 222,477 196,053

Stockholders' equity 1,090,429 933,364 867,540 767,206 596,375

Year Ended December 31,

(in thousands of U.S. dollars, except per share amounts)

(1) In connection with the IRI International Corporation merger in 2000, we recorded charges of $14.1 million related to

direct merger costs, personnel reductions, and facility closures and inventory write-offs of $15.7 million due to

product line rationalization.

(2) We adopted Statement of Financial Accounting Standards No. 142, “Goodwill and Other Intangible Assets” (SFAS 142),

effective January 1, 2002. The effects of not amortizing goodwill and other intangible assets in periods prior to the adoption of SFAS

142 would have resulted in net income (loss) of $115.0 million, $23.1 million, and $(4.0) million for the years ended December 31,

2001, 2000, and 1999, respectively; basic earnings per common share of $1.42, $0.29, and $(0.06) for the years ending December

31, 2001, 2000, and 1999, respectively; and diluted earnings per common share of $1.41, $0.29, and $(0.06) for the years ending

December 31, 2001, 2000, and 1999, respectively.

(3) Data for 1999 is restated to combine IRI International and Dupre′ results pursuant to pooling-of-interests accounting.