National Oilwell Varco 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 National Oilwell Varco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Mark one)

[9] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934 FOR THE YEAR ENDED DECEMBER 31, 2003

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Commission file number 1-12317

NATIONAL-OILWELL, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction

of incorporation or organization)

76-0475815

(IRS Employer

Identification No.)

10000 Richmond Avenue

Houston, Texas

77042-4200

(Address of principal executive offices)

(713) 346-7500

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, par value $.01

(Title of Class)

New York Stock Exchange

(Exchange on which registered)

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the

Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to

file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES √ NO

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and

will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by

reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ √ ]

Indicate by check mark whether the registrant is an accelerated filer (as defined in Rule 12b-2 of the Act). Yes [ √ ] No [ ]

The aggregate market value of voting and non-voting common stock held by non-affiliates of the registrant as of June 30, 2003

was $1.8 billion. As of March 1, 2004, there were 85,495,262 shares of the Company’s common stock ($0.01 par value)

outstanding.

Documents Incorporated by Reference

Portions of the Proxy Statement in connection with the 2004 Annual Meeting of Stockholders are incorporated in Part III of

this report.

Table of contents

-

Page 1

... 1934 Commission file number 1-12317 [9] NATIONAL-OILWELL, INC. (Exact name of registrant as specified in its charter) Delaware (State or other jurisdiction of incorporation or organization) 76-0475815 (IRS Employer Identification No.) 10000 Richmond Avenue Houston, Texas 77042-4200 (Address of... -

Page 2

... pumps. Our Distribution Services segment provides maintenance, repair and operating supplies and spare parts to drill site and production locations throughout North America and to offshore contractors worldwide. Increasingly, this business also is expanding to locations outside North America... -

Page 3

... strategy to enhance procurement, inventory management and logistics activities. As a result of the need to improve industry efficiency, oil and gas companies and drilling contractors are frequently seeking alliances with suppliers, manufacturers and service providers to achieve cost and capital... -

Page 4

... America, with 92 in the United States, 40 in Canada, and the remainder in various international locations. These distribution service centers stock and sell a variety of expendable items for oilfield applications and spare parts for our proprietary equipment. As oil and gas companies and drilling... -

Page 5

... on the basis of service and price. None of these competing companies dominate in any of the business segments or geographic areas in which we operate. Manufacturing and Backlog National Oilwell has manufacturing facilities located in the United States, Canada, England, France, Norway and China. The... -

Page 6

...venture operation in Lanzhou, China. Available Information Regarding our SEC Filings Our corporate offices are located at 10000 Richmond Avenue, Houston, Texas 77042-4200. Our phone number at that location is (713) 346-7500 and our Internet address is www.natoil.com. Information we make public about... -

Page 7

... and delivery. National Oilwell's Products and Technology business segment competes with several companies in North America that have drilling products that compete directly with certain of our products. National Oilwell's Distribution Services business segment faces competition from various... -

Page 8

...foreign economies and governments. Laws and regulations limiting exports to particular countries can affect our sales, and sometimes export laws and regulations of one jurisdiction contradict those of another. National-Oilwell Sells Products and Services Outside the United States. Changes in Foreign... -

Page 9

...National Oilwell...$134 million available in uncommitted facilities. Our leverage requires us to use some of our cash flow from ...could make us more vulnerable to economic downturns and competitive pressures. We do not currently have sufficient cash ...generate sufficient cash or borrow funds in the future to allow ... -

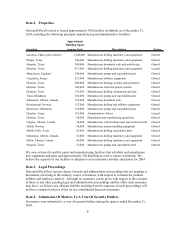

Page 10

...manufacturing and administrative facilities: Approximate Building Space Location Lanzhou, China (joint venture) Pampa, Texas Houston, Texas Houston, Texas Manchester, England Carquefou, France Houston, Texas Houston, Texas Houston, Texas Tulsa, Oklahoma Edmonton, Alberta, Canada Kristiansand, Norway... -

Page 11

... 5. Market for Registrant's Common Equity and Related Stockholder Matters Market Information National Oilwell common stock is listed on the New York Stock Exchange (ticker symbol: NOI). The following table sets forth the stock price range during the past three years: 2003 Quarter First Second Third... -

Page 12

(4) 2003 includes a $6.3 million pre-tax charge ($4.4 million after tax) related to a clearing account problem within the Distribution Group's purchasing system that had accumulated over a three-year period. We have not restated prior periods, as the impact is not considered material. 11 -

Page 13

... on the levels of worldwide drilling activity. Distribution Services Our Distribution Services segment provides maintenance, repair and operating supplies and spare parts from our network of distribution service centers to drill site and production locations throughout North America and to offshore... -

Page 14

... resulting from the addition of the Hydralift operations. Sales and rentals of downhole motors and fishing tools increased approximately $32 million, primarily due to the resurging North American drilling rig count. Spare part and service revenues accounted for the remaining incremental revenues... -

Page 15

...activity in all product areas. Revenues from backlog were down $64 million while related spare parts and expendable parts were lower than 2001 by $38 million. Sales and rentals of downhole motors and fishing tools decreased by approximately $74 million, impacted by its strong dependence on the North... -

Page 16

... and executive management costs. Year 2003 costs of $12.6 million reflect certain corporate-led marketing and product sourcing initiatives, and general overhead incurred to support a larger company. Year 2004 corporate charges are expected to approximate $13 million due to recent acquisitions... -

Page 17

... were $32.4 million during 2003, $24.8 million in 2002 and $27.4 million in 2001. The majority of these capital expenditures represent additions and enhancements to the downhole rental tool fleet and information management and inventory control systems. Capital expenditures are expected to... -

Page 18

... bonds. The senior notes contain reporting covenants and the credit facilities contain financial covenants and ratios regarding maximum debt to capital and minimum interest coverage. We were in compliance with all covenants governing these facilities at December 31, 2003. We believe cash generated... -

Page 19

... penalties and lower overall cost as compared with fixed-rate borrowings. Critical Accounting Policies and Estimates The preparation of our financial statements requires us to make certain estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes... -

Page 20

... evident. We account for our defined benefit pension plans in accordance with Statement of Financial Accounting Standards No. 87, Employers' Accounting for Pensions (FAS 87), which requires that amounts recognized in the financial statements be determined on an actuarial basis. Significant elements... -

Page 21

... of retiree healthcare benefit plans that provide a benefit that is at least actuarially equivalent to the Medicare benefit. As allowed by FASB Staff Position 106-1, Accounting and Disclosure Requirements Related to the Medicare Prescription Drug, Improvement and Modernization Act of 2003, we have... -

Page 22

... report are financial statements and supplementary data listed in Item 15. Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure None. Item 9a. Controls and Procedures (a) Evaluation of disclosure controls and procedures Our chief executive officer and chief... -

Page 23

...the definitive Proxy Statement for the 2004 Annual Meeting of Stockholders. Securities Authorized for Issuance Under Equity Compensation Plans The following table sets forth information as of our fiscal year ended December 31, 2003, with respect to compensation plans under which our common stock may... -

Page 24

... and Related Transactions Incorporated by reference to the definitive Proxy Statement for the 2004 Annual Meeting of Stockholders. Item 14. Principal Accountant Fees and Services Incorporated by reference to the definitive Proxy Statement for the 2004 Annual Meeting of Stockholders. 23 -

Page 25

..., Mark A. Reese and Robert R. Workman (Exhibit 10.2) (2). Employment Agreement dated as of June 28, 2000 between Gary W. Stratulate and IRI International, Inc., which has now merged into National Oilwell (Exhibit 10.3) (2). Amended and Restated Stock Award and Long-Term Incentive Plan (Exhibit 10... -

Page 26

.... Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. 31.2 32.1 32.2 b) Reports on Form 8-K A report on Form 8 - K was filed on February 12, 2004 regarding a press release announcing our financial results for the fourth quarter and full year ended December 31, 2003. A report... -

Page 27

...the registrant has duly caused this Annual Report on Form 10-K to be signed on its behalf by the undersigned, thereunto duly authorized. National-Oilwell, Inc. Date: March 11,2004 By: /s/ Steven W. Krablin Steven W. Krablin Sr. Vice President and Chief Financial Officer Pursuant to the requirements... -

Page 28

.... We believe that our audits provide a reasonable basis for our opinion. In our opinion, the financial statements referred to above present fairly, in all material respects, the consolidated financial position of National-Oilwell, Inc. at December 31, 2003 and 2002, and the consolidated results of... -

Page 29

...long-termdebt Accounts payable Customer prepayments Accrued compensation Billings in excess of costs Accrued income ...stock - par value $.01; 85,124,979 and 81,014,713 shares issued and outstanding at December 31, 2003 and December 31, 2002 Additional paid-in capital... part of these statements. 28 -

Page 30

NATIONAL-OILWELL, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except per share data) 2003 Revenues Cost of products and services sold Gross profit Selling, general, and administrative Operating income Interest and financial costs... notes are an integral part of these statements. 29 -

Page 31

... transaction losses, net Tax benefit from exercise of nonqualified stock options Changes in assets and liabilities, net of acquisitions: Receivables Inventories Costs in excess of billings Prepaid and other current assets Accounts payable Billings in excess of cost Other assets/liabilities, net... -

Page 32

... Currency translation adjustments Interest rate contract Minimum liability of defined benefit plans Comprehensive income Stock issued for acquisition Stock options exercised Tax benefit of options exercised Balance at December 31, 2003 $ 32 9 $ 1 $ 4 $ 805 Retained Earnings $ 205,034 104,063 Total... -

Page 33

NATIONAL-OILWELL, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS 1. Organization and Basis of Presentation Nature of Business We design, manufacture and sell comprehensive systems, components, and products used in oil and gas drilling and production, as well as distribute products and provide ... -

Page 34

... purposes. Inventories Inventories consist of oilfield products, manufactured equipment, manufactured specialized drilling products and downhole motors and spare parts for manufactured equipment and drilling products. Inventories are stated at the lower of cost or market using the first-in, first... -

Page 35

... acquired in the acquisitions of Hydralift and Mono in December 2002 and January 2003. The balance at December 31, 2003 and 2002 was $49.5 million and $40.2 million. Indefinite lived intangible assets are not amortized, but are subject to an impairment test on at least an annual basis. An impairment... -

Page 36

... of our customers' financial condition and generally do not require collateral, but may require letters of credit for certain international sales. Credit losses are provided for in the financial statements. We maintain an allowance for doubtful accounts for accounts receivables by providing... -

Page 37

... basis and are adjusted as further information develops or circumstances change. Use of Estimates The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect reported... -

Page 38

... entities in the first quarter of 2004. 2. Acquisitions Year 2003 On January 16, 2003, we acquired the Mono pumping products business from Halliburton Energy Services for approximately $91 million, consisting of $24 million in cash and 3.2 million shares of our common stock valued at $67 million... -

Page 39

... reductions arising from the acquisition of Hydralift have been excluded. During 2002 we also acquired three other businesses, primarily within our Products and Technology segment, for approximately $17 million in cash. Year 2001 In 2001, we acquired nine companies for an aggregate of $51 million... -

Page 40

... consists of (in thousands): Land and improvements Buildings and improvements Machinery and equipment Computer and office equipment Rental equipment Less accumulated depreciation Estimated Useful Lives 2-20 Years 5-31 Years 5-12 Years 3-10 Years 1-7 Years December 31, 2003 $ 23,689 99,898 154,727... -

Page 41

... participate in defined benefit health care plans of predecessor or acquired companies that provide postretirement medical and life insurance benefits. Active employees are ineligible to participate in any of these defined benefit plans. Our subsidiaries in the United Kingdom and Norway also have... -

Page 42

... States, the United Kingdom and Norway was as follows (in thousands): Pension benefits Postretirement benefits For the year 2003 2002 2001 2003 2002 2001 Service cost - benefits earned during the period Interest cost on projected benefit obligation Expected return on plan assets Net amortization and... -

Page 43

... defined benefit health care plans in the United States follow (in thousands): National Oilwell Defined Benefit Pension Plan Fiscal Period January 1 to December 31 Disclosure Assumptions For determining benefit obligations at year-end: Discount rate Salary increase For determining net periodic cost... -

Page 44

... of retiree healthcare benefit plans that provide a benefit that is at least actuarially equivalent to the Medicare benefit. As allowed by FASB Staff Position 106-1, Accounting and Disclosure Requirements Related to the Medicare Prescription Drug, Improvement and Modernization Act of 2003, we have... -

Page 45

...extent not otherwise provided for, should not materially affect our financial position, liquidity or results of operations. Our business is affected both directly and indirectly by governmental laws and regulations relating to the oilfield service industry in general, as well as by environmental and... -

Page 46

... the acquisitions of Dreco Energy Services, Ltd. in 1997, and Hitec ASA and IRI International Corporation in 2000. We converted the outstanding stock options under these plans to options to acquire our common stock and no further options are being issued under these plans. Stock option information... -

Page 47

The following summarizes information about stock options outstanding as of December 31, 2003: Weighted-Avg. Remaining Contractual Life 6.48 7.99 7.09 7.25 Options Outstanding Weighted-Avg. Shares 1,269,776 1,508,410 832,385 3,610,571 $ Exercise Price $ 16.54 21.00 40.07 23.83 Options Exercisable ... -

Page 48

... was as follows (in thousands): December 31, 2003 Federal income tax at statutory rate Foreign income tax rate differential State income tax, net of federal benefit Tax benefit of foreign sales income Nondeductible expenses Tax benefit of capital loss carryovers Foreign dividends net of FTCs Net... -

Page 49

... and $4.0 million would reduce income tax expense. Also outside the United States, the company has $3.4 million of capital loss carryforwards as of December 31, 2003, which can be carried forward indefinitely. The related potential benefit of $1.0 million has been recorded with a valuation allowance... -

Page 50

... be payable upon remittance of all previously unremitted earnings at December 31, 2003. 11. Business Segments and Geographic Areas National Oilwell's operations consist of two segments: Products and Technology and Distribution Services. The Products and Technology segment designs and manufactures... -

Page 51

Summarized financial information is as follows (in thousands): Geographic Areas: United States December 31,2003 Revenues from: Unaffiliated customers Interarea sales Total revenues Long-lived assets December 31,2002 Revenues from: Unaffiliated customers Interarea sales Total revenues Long-lived ... -

Page 52

... Goodwill Identifiable assets December 31, 2001 Unaffiliated customers Intersegment sales Total revenues Operating income (loss) Capital expenditures Depreciation and amortization Goodwill Identifiable assets Distribution Services Corporate/ Eliminations Total $ 1,215,944 98,748 1,314... -

Page 53

...73,069 0.90 0.89 (a) Reflects an income tax benefit of $2.7 million related to a revision of the annual effective tax rate to 29%. During the 4th quarter of 2003 we identified a clearing account problem within the Distribution Group's purchasing system that had accumulated over a three year period... -

Page 54

Schedule II National-Oilwell, Inc. Valuation and Qualifying Accounts Years ended December 31, 2003, 2002 and 2001 Additions (Deductions) charged to costs and expenses Balance beginning of year Allowance for doubtful accounts: 2003 2002 2001 Valuation allowance for deferred tax assets: 2003 2002 ... -

Page 55

..., Mark A. Reese and Robert R. Workman (Exhibit 10.2) (2). Employment Agreement dated as of June 28, 2000 between Gary W. Stratulate and IRI International, Inc., which has now merged into National Oilwell (Exhibit 10.3) (2). Amended and Restated Stock Award and Long-Term Incentive Plan (Exhibit 10... -

Page 56

... Norway AS National Oilwell Norge AS Hitec AS National Oilwell-Hydralift AS Hydralift-AmClyde, Inc. Hydralift France SAS Hydralift BLM SA Hydralift Holding (UK) Ltd. AmClyde (UK) Ltrd. Hydralift (UK) Ltd. Mono Group Mono Pumps Limited Mono Pumps (Australia) Pty. Limited Mono Pumps (New Zealand... -

Page 57

...-15859) National-Oilwell Retirement and Thrift Plan (No. 333-36359) Post Effective Amendment No. 3 to the Registration Statement on Form S-4 filed on Form S-8 pertaining to the Dreco Energy Services Ltd. Amended and Restated 1989 Employee Incentive Stock Option Plan, as amended, and Employment and... -

Page 58

CERTIFICATIONS Exhibit 31.1 I, Merrill A. Miller, Jr., certify that: 1. I have reviewed this annual report on Form 10-K of National-Oilwell, Inc.; 2. Based on my knowledge, this annual report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make ... -

Page 59

... affect internal controls subsequent to the date of our most recent evaluation, including any corrective actions with regard to significant deficiencies and material weaknesses. Date: March 11, 2004 By: /s/ Steven W. Krablin Steven W. Krablin Sr. Vice President and Chief Financial Officer 58 -

Page 60

...Krablin, Sr. Vice President and Chief Financial Officer of National-Oilwell, Inc., certify, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that: (1) the Annual Report on Form 10-K for the year ended December 31, 2003 (the "Periodic Report') which this statement accompanies fully complies...